The pursuit of perpetual motion machines obsessed many scientists and engineers in Europe for centuries since the middle ages. Some readers may think why we are taking about perpetual motion machines in a finance...Read More

In the first part of our two part blog post, How you should invest in debt mutual funds: Short term versus long term, we discussed the basic difference between short term and long term debt funds. We also discussed how these two types...Read More

How you should invest in debt mutual funds: Short term versus long term

Jan 12, 2018 / Dwaipayan Bose2017 was a great year for the stock market and mutual funds. As per December 2017 AMFI data, industry wide assets under management in equity and balanced funds rose 77% year on year. Even after factoring in value...Read More

All investors want to buy best performing mutual funds. It is not possible to predict the future and so investors go with past performance when selecting mutual funds in the hope that a fund which performed well in the past, will...Read More

We get many queries on www.advisorkhoj.com from investors asking us, which is the best mutual fund to invest or which is the best investment solution for their requirements? The quest for the best or perfect is understandable but...Read More

I remember a few scenes from an American romantic comedy series, where the actress is getting ready to go to a New Year’s party. She opens her cupboard; it is lined up with hundreds of shoes and she is totally confused which one...Read More

Mutual funds are increasingly becoming popular among Indian retail investors. As per AMFI data assets under management in the mutual fund industry grew by more than 30% from September 2016 to September 2017. What is also...Read More

Take control of your financial journey: Part 2

Oct 17, 2017 / Dwaipayan BoseIn the first part of our blog post, Take control of your financial journey, we discussed why is it important to plan your financial journey just like you plan your travel. Without proper planning, you are likely to put your and your...Read More

Take control of your financial journey

Oct 11, 2017 / Dwaipayan BoseMy wife and I love to travel. In the last 15 years, we have travelled to many destinations in different continents and here in India. Let me share some learning from the experience we had and try to relate to today’s blog topic...Read More

Equity Mutual funds invest primarily in equity shares of listed companies across sectors and market capitalization segments. Equity mutual funds in India are one of the best long term investment products and ideal for meeting your long term...Read More

Sundaram Towers,

46, 2nd Floor,

Chennai, Tamil Nadu - 600014

Phone 1: 044-2858 3362

Phone 2: 044-2858 3367/044-28569900

Email: customerservices@sundarammutual.com

| Location | No of Distributors |

|---|---|

| Mumbai | 1376 |

| Kolkata | 844 |

| Bangalore | 451 |

| Chennai | 450 |

| Delhi | 415 |

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY

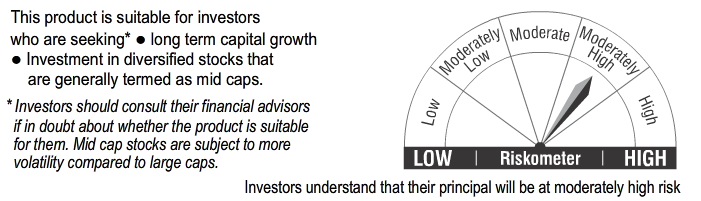

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.