The Finance Minister announced some important taxation changes for both financial and non-financial assets in the Union Budget 2024. In her Budget speech, the Finance Minister said that the purpose of making these tax changes is "simplification and rationalisation of capital gains". In this article, we will discuss the...Read More

Vacations and Mutual Fund SIPs

Jun 21, 2024 / Anamika PareekIce creams, lime juice, afternoon siestas, munching on refreshing slices of watermelon and fragrant mangoes— all conjure up the hot summer months and the beginning of the vacations, when the only thought that can cross the mind is an escape into the mountains. However, have you planned for it? And this is the question...Read More

It is now common knowledge that regular investment is required to relieve one's money worries. However, many people feel that, in the face of rising costs and mounting responsibilities, whatever they earn is not sufficient for both immediate needs and their long/short-term investment goals. A struggle to make ends meet even...Read More

How to achieve financial freedom through planning

Jan 31, 2024 / Anamika PareekFreedom could be of many different types. For example, we could be speaking of mental, physical or social freedom; but here we will focus on financial freedom, which often gets pushed to the back burner until we hit our retirement years, and we realize we are still prisoners of expenses that hit us in the face of almost dwindling...Read More

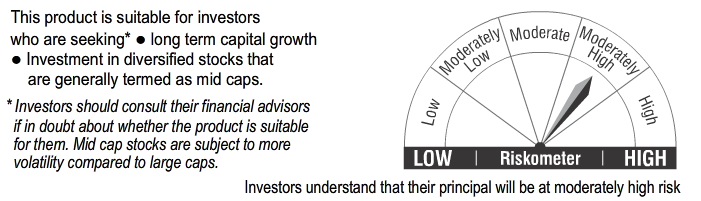

Mutual Funds offer diversification as each fund invests across multiple stocks or /and debt instruments. It is however important to assess all factors carefully before creating a portfolio of investments that can align to the investor’s financial goals. Equity has the potential to beat inflation and help them achieve their...Read More

Did you know that creating wealth is faster with the SIP Top Up facility

Nov 6, 2023 / Anamika PareekMutual fund investments have been a favourite of investors in India. The sheer convenience of investing in mutual funds has drawn investors to this instrument for over 3 decades now. The data published by AMFI reports that mutual fund accounts in September 2023, stood at 7.13 crores. The amount collected through SIP during the month...Read More

Why you should invest in hybrid funds now

Sep 29, 2023 / Dwaipayan BoseThe equity market has been extremely bullish in this financial year (FY 2023-24) despite high-interest rates. Strong earnings growth in Q1 and cooling inflation have supported the market. The Nifty crossed the 20,000 level in September. The broader market has outperformed with midcaps (Nifty Midcap 150 TRI) and small caps (Nifty Small...Read More

One of the most important areas to look at white saving for your future is to plan for a stress free and economically independent retirement. An SIP is a tool to systematically invest in mutual funds with the amount of your choice, helping you to build a corpus in the initial years of your career. Post retirement, the need is for...Read More

Small cap equity mutual funds have been a rage with retail investors over the past 3 months. The Nifty Small Cap 250 Index is at its record high. The small cap index has outperformed Nifty 50 by a big margin over the last 3 years (see the chart below) and has continued to outperform if we see recent returns e.g. last 1 month...Read More

How Conservative Hybrid Funds balance stability with some growth in investments

Jul 17, 2023 / Shoaib ZamanConservative Hybrid Funds are an investment category that aim to focus on stability with prospects of growth as well. These funds offer investors a diversified portfolio comprising predominantly of debt instruments while allocating a small portion to equities. Conservative Hybrid Funds are a category of mutual funds that...Read More

Sundaram Towers,

46, 2nd Floor,

Chennai, Tamil Nadu - 600014

Phone 1: 044-2858 3362

Phone 2: 044-2858 3367/044-28569900

Email: customerservices@sundarammutual.com

| Location | No of Distributors |

|---|---|

| Mumbai | 1378 |

| Kolkata | 844 |

| Bangalore | 451 |

| Chennai | 450 |

| Delhi | 416 |

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.