All you wanted to know about Multi Cap and Flexi Cap Funds

Mutual Funds offer diversification as each fund invests across multiple stocks or /and debt instruments. It is however important to assess all factors carefully before creating a portfolio of investments that can align to the investor’s financial goals. Equity has the potential to beat inflation and help them achieve their long-term financial goals. Equity mutual Funds also offer diversification benefits to investors with a high risk appetite.

Investors have long been attracted to multicap mutual funds which invest across Large Cap, Mid Cap and Small Cap stocks. In November 2020, SEBI introduced a new type of fund category called the Flexi Cap Fund and at the same time made some changes to the scheme mandates of the Multi Cap Funds.

In this article we will look at the salient features of the Flexi Cap funds and the Multi Cap Funds.

What are Multi Cap Funds?

Prior to November 2020, Multi Cap mutual Funds used to invest in the different market cap segments, without any restrictions on the percentages they could invest in each segment.

As per the new SEBI guidelines, Multi Cap Funds have to essentially invest 25% of their assets in each market cap segment viz, large, mid and small cap. The remaining 25% (after allocating 25% each to Large, Mid and Small Cap) can be allocated to any market cap segment or asset class as per the discretion of the fund manager.

What are Flexi Cap Funds?

SEBI also introduced a new type of fund called the Flexi cap fund. These funds have the liberty to invest across market cap segments without any restrictions. The only mandate is that these funds should invest 65% of their total investments in equity. In fact, the new Flexi Caps resemble the Multi Cap funds prior to November 2020.

Suggested reading – Why you should have Flexi Cap Funds in your portfolio?

Why did SEBI make these regulations?

Before SEBI’s mandate, the Multi Cap Funds were not essentially true to their label. AMCs were wary of investing in mid and small caps. So if a fund was investing 80% of its funds in Large Cap, it could hardly be called a Multi Cap Fund. The second reason for the guideline was to induce liquidity in the small cap sector.

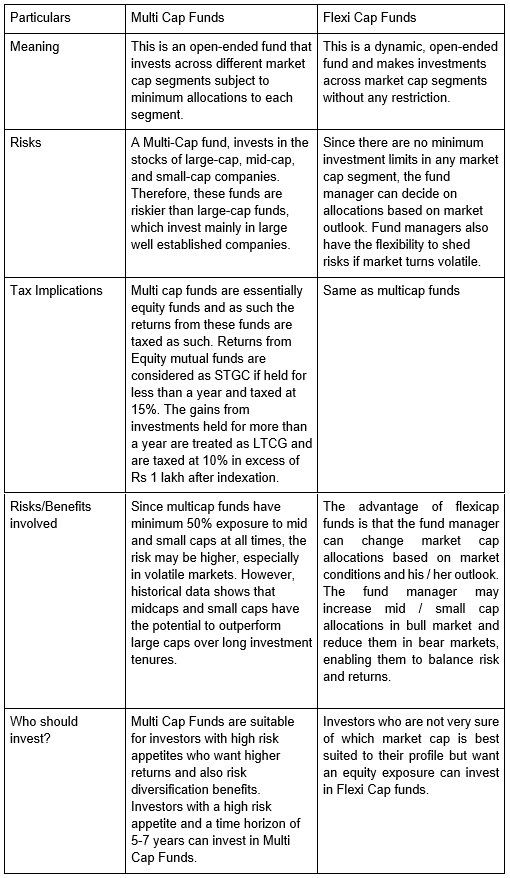

Multi Cap Fund Vs the Flexi Cap Fund

Both the Multi Cap and Flexi Cap Funds invest across market caps, but there are some fundamental differences between the two. Let us look at them in detail now.

The last word

Even though the Multi Cap and Flexi Cap funds look similar, there are fundamental differences between them as is evident from the discussion above. The categorization of these funds by SEBI is a step towards offering greater clarity to the investors to choose funds as per their risk appetite and financial goal identification. Different investors have different investment needs, risk appetites, experience, and preferences. Both the Multi Cap and Flexi Cap funds are suitable for different types of investors. The investors should make informed investment decisions based on their specific needs.

Consult with your financial advisor or mutual fund distributor to have a better understanding of different mutual fund products and invest according to your needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY