How to use different ways of investing systematically in mutual funds?

It is now common knowledge that regular investment is required to relieve one's money worries. However, many people feel that, in the face of rising costs and mounting responsibilities, whatever they earn is not sufficient for both immediate needs and their long/short-term investment goals.

A struggle to make ends meet even when the yearly increments happen seems to take the juice out of investment intentions. Well, this is the exact reason why mutual funds with all the various ways of systematic investment options are such a versatile investment option.

In this article, we will look at the different ways in which you can invest systematically in a mutual fund which may minimize your money stress and help you plan your finances in an efficient way.

Ways of investing systematically using mutual funds

1. Systematic Investment Plan

A Systematic Investment Plan or SIP is a way of investing in mutual funds. Through SIPs, a fixed amount of your choice can be invested at a pre-defined interval of your choice. The fixed amount that you invest can be as less as Rs. 100/- which means that there is no excuse for lack of funds for investment.

How does an SIP work?

You can choose to invest the amount of your SIP at daily, weekly, monthly, quarterly, or even yearly intervals through a mandate to your registered bank that allows automatic transfer of your investment amount to the mutual fund on specified SIP dates.

The amount of your SIP is used to buy the units of the mutual fund at the prevailing NAV of the SIP date or the next working day if the SIP date happens to be a holiday. The fluctuating NAV (per unit price of the scheme) offers rupee cost averaging that lowers the average cost/unit in the long run. The power of compounding from SIP has the potential to grow your meagre investment of even Rs. 500 a month to a large sum of Rs. 19 lakhs over 30 years, assuming 12.38% annual rate of return*.

*The above illustration uses a 12.38% rate of return (Mean of 3-year Sensex Rolling Returns from FY14 to FY23, i.e., 10 years). Values have been rounded off to nearest whole numbers. The above illustration is provided as per AMFI Best Practice Guidelines Circular No. 109 dated November 1, 2023, to illustrate the concept of power of compounding. Disclaimer: Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations.

2. SIP Top Up Plan

You can increase your SIP amount with a SIP Top up Plan where your investment amount is increased by a certain percentage or a fixed amount at every interval of your choice to coincide with the increments in your earnings.

How does an SIP Top up Plan work?

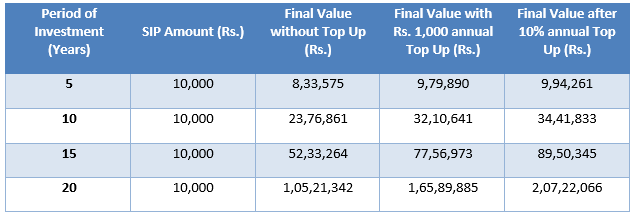

You can opt for an SIP Top up plan by simply ticking the relevant option when you are starting your SIP. Observe the table below that tells you how the SIP Top up facility can help you grow your corpus exponentially.

The chart above shows that at an assumed 12.38%* average annual return, your Rs. 10,000 SIP can grow close to Rs. 1.05 crores in 20 years, but if you increase it by just Rs. 1000/- per annum, you will be able to create a corpus of Rs. 1.65 crores. A 10% increase in your SIP amount will allow you to accumulate Rs. 2.07 crores.

*The above illustration uses a 12.38% rate of return (Mean of 3-year Sensex Rolling Returns from FY14 to FY23, i.e., 10 years). Values have been rounded off to nearest whole numbers. The above illustration is provided as per AMFI Best Practice Guidelines Circular No. 109 dated November 1, 2023, to illustrate the concept of power of compounding. Disclaimer: Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations.

Suggested reading did you know that creating wealth is faster with the SIP top up facility

3. Goal Based SIP

Another way to save up for your goals through SIP is to assign a monetary value to your goals. When you start investing in SIP with a target in mind to reach a specific corpus, we call it a goal-based SIP.

How does a Goal Based SIP work?

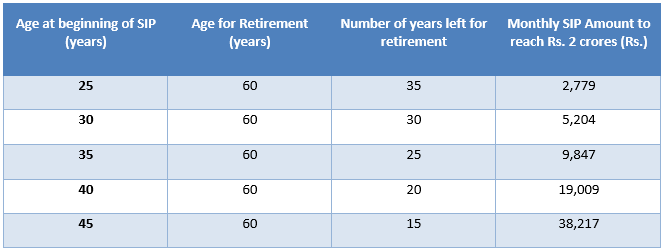

For example, you have a goal to save up Rs. 2 crores for your retirement. Look at the table below that gives you an overview of the SIP you need to reach your goal.

Source: Advisorkhoj Research

As you can see from the above chart, the longer you save, the lesser you need to invest through your SIP to reach that target. To reach your target of Rs. 2 crores, you would need to save only Rs. 2,779/- if you start when you are 25 years of age. Compare this to the Rs. 38K monthly that you would need to save when you reach 45 years of age to achieve the same Rs. 2 crores target by an age of 60. The assumed rate of return here is 12.38%*.

*The above illustration uses a 12.38% rate of return (Mean of 3-year Sensex Rolling Returns from FY14 to FY23, i.e., 10 years). Values have been rounded off to nearest whole numbers. The above illustration is provided as per AMFI Best Practice Guidelines Circular No. 109 dated November 1, 2023, to illustrate the concept of power of compounding. Disclaimer: Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations.

4. Systematic Transfer Plan

At times you may have some money as a lumpsum in one fund ‘A’, that you want to reinvest in some other fund ‘B’. The reasons for this could be many. For instance,

- You might have received a yearly bonus that you want to invest as an SIP into a mutual fund scheme, but instead of leaving it in your bank account you have invested it in a liquid fund.

- It may be that there is a fund you had wanted to invest in but due to lack of fund / or market volatility you could not invest in it.

- You want to transfer your funds from a poorly performing fund to a better performing fund.

To meet all such investment needs, you have the Systematic Transfer Plan.

A Systematic Transfer Plan or STP is an investment plan where funds are transferred from one scheme to another. The difference here is that the source of the fund is not your bank account but another scheme of the same fund house in which you have accumulated the funds to be transferred.

How does an STP work?

To start an STP, you would need to choose a fund (say Fund ‘B’) where you would want your accumulated corpus/ or investments in liquid fund to be transferred. The funds from the Scheme (Say Fund ‘A’) are then transferred systematically over time at the predetermined interval of your choice and the amount.

This amount is invested in the new scheme ‘B’ at the prevailing NAV of the scheme on the STP date. The funds remaining in the source scheme ‘A’ continue to earn returns as well.

The benefit of STP is that you do not need to transfer the entire amount that you have in Fund ‘A’ to Fund ‘B’. Since the transfers are done systematically, you also benefit from rupee cost averaging.

Suggested reading STP – A comprehensive guide for investors.

5. Systematic Withdrawal Plan

A Systematic Withdrawal Plan or a SWP is the exact opposite of a SIP. In SIP you can invest small amounts at regular intervals, whereas in an SWP you withdraw a fixed amount at regular intervals. So, instead of withdrawing the entire amount accumulated in your mutual fund scheme, you can align it to the time of your need. For example:

- You may need a fixed income for your regular expenses from the retirement corpus.

- You may want to pay off the EMI of your home loan using the funds from your accumulated corpus.

- You may want to pay for the tuition fees for your children's college education from the funds accumulated in the scheme aligned to their higher education.

You may also like to read how SWP is a helpful investment solution for retirement planning?

How does an SWP work?

To start an SWP, you need to specify the amount you require to withdraw and the periods at which you want to make these withdrawals. The amount of your SWP is made available to you by redeeming the required number of units at the prevailing NAV of the scheme. The remaining amount in the scheme continues to earn returns.

For example, let us say Rajani invested an amount of Rs, 80,000/- in a mutual fund. If the NAV of the fund is Rs. 10 per unit, she holds 8,000 units. Rajani now wishes to withdraw Rs. 5,000 per month. This means that in the first month at the prevailing NAV, say Rs. 14,357.14 units are redeemed, and the amount (Rs. 5,000) is transferred to your bank account (Since, Required Amount/ NAV= Rs. 5000/ Rs. 14 = 357.14 units).

Now, in the next month, say the NAV becomes Rs. 20/-, in this case Rs. 5,000/Rs. 20 = 250 units are redeemed from the mutual fund to transfer Rs. 5,000/- to Rajni’s bank account. At the end of the second month, the scheme will be left with 7,392.86 units. This will continue till the time Rajani has chosen to receive the amount as SWP or till the units last in the mutual fund scheme account, whichever is earlier.

The value of the remaining units in the scheme at the prevailing NAV of Rs. 20 in the second month is Rs. 1,47,857.20 (Rs. 20 x 7,392.86 units) against an initial investment of Rs 80,000/-. This way, the remaining amount in the SWP account keeps appreciating or depreciating as per the scheme’s NAV.

The SWP benefits also include rupee cost averaging, as funds are redeemed at various NAVs instead at once, and the remaining funds also have a chance to earn the returns.

We have discussed various ways of investing in a mutual fund – SIP, SIP Top Up, Goal based SIP, STP and SWP - both for building a corpus to meet various needs and to withdraw funds when you need regular income. Depending upon your investment requirements, you can choose the plan that suits you the most. You can also consult a mutual fund distributor or a financial advisor to assist you with your investments.

Suggested reading how SWP and STP taxation works?

Disclaimers

One-time KYC (Know Your Customer) is mandatory to invest in mutual funds. You can complete your eKYC here: https://invest.sundarammutual.com/. Investors must deal with/invest in only SEBI Registered Mutual Funds. Details are available at www.sebi.gov.in. Complaint Redressal: Investors can reach us on 1860 425 7237 or write to us at customerservices@sundarammutual.com. For escalation, write to grievanceredressal@sundarammutual.com or lodge your grievance with SEBI through their SCORES (SEBI Complaint Redressal System) Portal at https://scores.sebi.gov.in/. If you are still not satisfied with the redressal from SEBI SCORES, you can further initiate dispute resolution through the ODR Portal at https://smartodr.in/login.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY