Dividend paying mutual funds hold allure for many investors, especially those who want regular cash-flows from their investments. Though many mutual fund schemes have excellent dividend pay-out track records, it is important for investors to understand that mutual fund dividends are not guaranteed. Mutual fund dividends are...Read More

Passive investing i.e. investing through ETFs or index funds is very popular in the developed economies. Passive mutual fundswere launched in the 1970s, but their popularity soared globally after the Global Financial Crisis of 2008. As on March 2020, global assets under management (AUM) in passive mutual funds crossed...Read More

How to choose the right mutual funds according to your need

Sep 29, 2020 / Advisorkhoj Research TeamMany investors still think of mutual funds as a way of investing in equities. As per AMFI, nearly 70% of retail and HNI assets were invested in equity funds in August 2020. However, mutual funds offer investment solution for a variety of investment needs for investors in all age groups. You can invest in mutual funds to park money for...Read More

Why should you invest in equity mutual funds now

Mar 30, 2020 / Dwaipayan BoseThe last one month has been very difficult for stock market due to the spread of Coronavirus pandemic around the world. The Nifty fell from 11,700 levels to around 7,600 (on 23rd March) – a 35% fall. Since then Nifty has recovered some 1,000 points over the next 3 daysafter the US Government announced $2 trillion stimulus. On 26th...Read More

Implications of 2020 Budget: Growth versus Dividend Option of mutual funds

Mar 11, 2020 / Dwaipayan BoseFor the last 20 years (except for a brief period in FY 2003) dividends were tax free in the hands of the investors, but the company paying dividends had to pay dividend distribution tax (DDT) before giving dividends to investors. In the 2020 Budget, the Finance Minister abolished DDT and moved back to the classical system of taxing...Read More

Avoid 6 common tax planning mistakes

Feb 3, 2020 / Dwaipayan BoseTax planning is an important financial objective any person has. Tax planning starts when a person starts working and continues almost throughout one’s life, even after retirement. We have observed that, people often fail to look at tax planning objectively and start making investments related to tax saving in a very mechanical way. Tax...Read More

Debt mutual funds are great investment options for getting stable returns with lower downside risks. Debt funds offer a large variety of solutions for wide range of investment needs e.g. liquidity, investment tenures and risk appetites. However, based on comments and queries received by us at Advisorkhoj, we think that many retail...Read More

It is our endeavour at Advisorkhoj to increase awareness and knowledge about mutual funds among common retail investors. Debt mutual fund is a product category where we perceive a sense of a lack of clarity and understanding based on comments / queries received by us from you. Debt fund investments are not difficult if you understand...Read More

Mid career investment planning

Sep 27, 2019 / Dwaipayan BoseFinancial planning for long term goals is not high priority for most individuals when they are young. At a younger age, fulfilling lifestyle desires, getting married and starting a family, purchasing assets for the family like a car and a house, are given more importance than savings and accumulation. But...Read More

5 benefits of investing in Multi cap mutual funds

Aug 20, 2019 / Dwaipayan BoseMulti-cap mutual funds are equity mutual fund schemes which invest in stocks across different market capitalization segments. Market capitalization of a stock is the share price of the stock multiplied by the number of shares...Read More

Sundaram Towers,

46, 2nd Floor,

Chennai, Tamil Nadu - 600014

Phone 1: 044-2858 3362

Phone 2: 044-2858 3367/044-28569900

Email: customerservices@sundarammutual.com

| Location | No of Distributors |

|---|---|

| Mumbai | 1376 |

| Kolkata | 844 |

| Bangalore | 451 |

| Chennai | 450 |

| Delhi | 415 |

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY

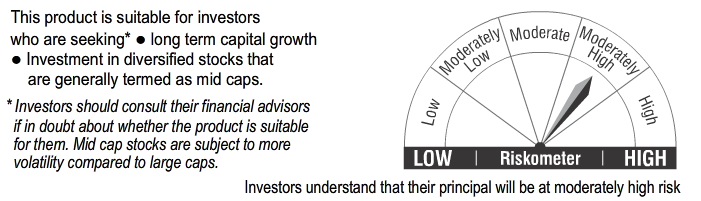

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.