Why should you invest in equity mutual funds now

The last one month has been very difficult for stock market due to the spread of Coronavirus pandemic around the world. The Nifty fell from 11,700 levels to around 7,600 (on 23rd March) – a 35% fall. Since then Nifty has recovered some 1,000 points over the next 3 daysafter the US Government announced $2 trillion stimulus. On 26th March, the Indian Government also announced a Rs 1.7 lakh crore relief package to deal with the impact of the disease. Despite the relief rally over the last 3 days, the market is down nearly 30% since the beginning of this year. This is the deepest correction we have seen since the global financial crisis.

What you should do?

The usual reaction which investors have in these market conditions is to redeem their equity investments and / or sit on cash waiting for the opportune time to invest. We have discussed previously in our blog that bear markets are the worst time to redeem because you will be selling at very low prices. It is prudent to remain invested because markets eventually recover. For investors who are waiting for the market to bottom out, you should understand that it is very difficult to time the market.

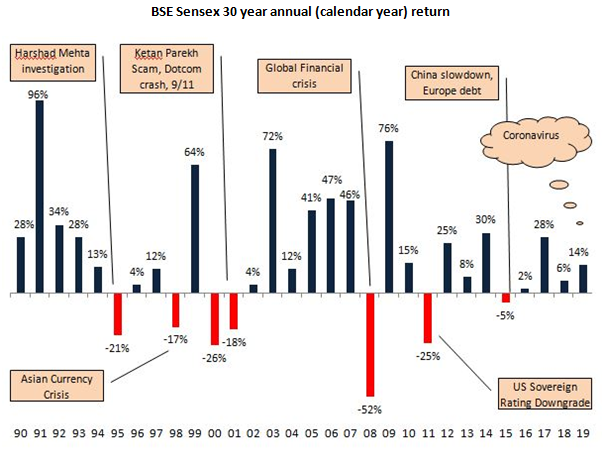

The chart below shows the annual returns of the Sensex over the last 30 years. You can see each correction was different.

Source: BSE, Advisorkhoj Research

What is good level to buy?

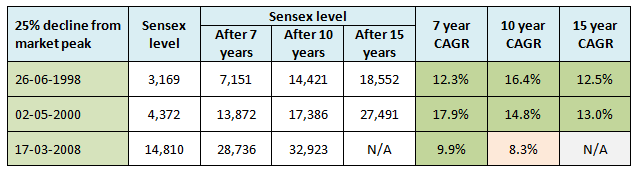

We analysed what amount of market correction in the past led to good returns over the next 5 years or so. The table below shows how much Sensex recovered from a 25% correction from the market peak over the next 7 to 15 years. The CAGR return of the Sensex over the last 20 years (ending 25th March 2020) is 9.2% - we can assume that this is the historical long term average return that one can expect from the Sensex.

The green boxes tell you that, you can get significantly higher long term (over 7 to 15 years) returns from the long term average if you invest at a level where the Sensex has corrected 25% from the peak.

Source: BSE, Advisorkhoj Research

The question in the mind of several investors is, whether the current market level is attractive. The analysis above tells that the market gave better than average returns over 7 to 15 years from 25% correction. Since the Sensex has fallen 30%, based on anecdotal evidence, we think that this presents an attractive investment level.

Valuation perspective

Let us now analyze from a fundamental perspective, whether the current market levels are attractive. The chart below shows the historical P/E ratios of the Nifty from 2010 to 2020. The average P/E ratio of Nifty was 22.15, while median P/E ratio was 21.95. Nifty P/E ratio was more than 20 in 70% of the trading sessions in the last 10 years. The current P/E ratio of the NIFTY is around 18. Purely from historical valuation standpoint, this is a good buying opportunity.

Source: NSE

Risk factors

The biggest risk factor is the spread of Coronavirus pandemic in India and across the world. The Government has acted promptly by enacting a nationwide lockdown. The nation hopes to see disease transmission broken and eventual flattening of the Coronavirus infection curve in the coming weeks. The economic fallout of the lockdown will be seen in the Q1 corporate earnings. Based on data coming out of China, the lockdown will have a severe impact on corporate earnings since we were going through an economic downturn even before the lockdown. Therefore, investors should be prepared to face volatility and have long investment horizons.

Summary

Past data tells us that bad times are the best buying opportunities. You should not panic and instead try to make the best of these opportunities either by investing in lump sum or by buying at dips (through systematic transfer plan) depending on your financial needs.

You should have a long investment horizon to get the best results because the market may be volatile in the near term. Consult with your financial advisor before investing.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY