How to choose the right mutual funds according to your need

Many investors still think of mutual funds as a way of investing in equities. As per AMFI, nearly 70% of retail and HNI assets were invested in equity funds in August 2020. However, mutual funds offer investment solution for a variety of investment needs for investors in all age groups.

You can invest in mutual funds to park money for a few months to few years to earn potentially higher return than bank deposits and other traditional investments. Mutual funds are ideal for planning your life-stage goals like retirement, children’s higher education etc. Mutual funds can also help you create an income stream for you in your retirement, plan your estate, so on so forth.

Different mutual funds have different risk return profiles. Selecting a mutual fund which is suitable for your risk appetite is must in order to meet your financial goals.

Financial goals

You need to define different financial goals so that you can build an investment plan to meet these goals. Goal planning involves articulating the purpose of your financial goals in different stages of life, e.g. purchasing a property, paying off loans, children’s higher education, children’s marriage, retirement planning, leaving an estate for your loved ones etc. One of the most important aspects of goal planning is quantifying these goals so that you have an actionable plan i.e. how much to invest and for how long, where to investment and picking the right mutual fund. You should remember that purchasing power of money reduces over time and therefore, you should always factor in inflation when setting goal targets.

You may like to read: Why should you start investing early in mutual funds for your retirement

Risk Appetite

Risk refers to an adverse financial outcome against your expectations. Some people have higher capacity to take risks than others. Your risk appetite depends on your age, stage of life, personal and financial situation. For example, a young person will have higher risk appetite than someone close to retirement. A person with no financial liabilities will have higher risk appetite than a person with debts. You should always invest according to your risk appetite.

Risk appetite can be different from your attitude towards risk. For example, a young, first time investor is likely to have different emotional reaction to a deep market correction compared to an experienced investor who has seen multiple bear markets. Investors’ actions are often influenced by their attitude towards risk e.g. redeeming your mutual fund when market falls and this can harm your financial interest. Mutual funds offer products of different risk profiles within the same asset class e.g. risk profile of large cap funds is lower than midcap or small cap funds. Therefore, picking the right mutual fund is of utmost importance. A new investor may start by investing in large cap funds and then gradually add midcap or small cap to his / her portfolio as he / she gains experience.

Asset allocation

Different asset classes have different risk profiles e.g. debt mutual funds have lower risk profiles than equity funds. The risk profile of hybrid funds (which invest in both, debt and equity) is intermediate between debt and equity funds. You should understand that risk and return are directly related.

Asset allocation aims to balance risk and return in achieving your financial goals. If your risk appetite is higher, you can have higher allocation to equity and vice versa. You should invest in the right asset class depending on your financial goal and risk appetite.

Asset allocation is one of the most important aspects of financial planning because it will determine whether your portfolio is able to generate sufficient returns to meet your financial goals. At the same time, asset allocation will also reduce downside risks in the event of adverse market movements. You should always have a portfolio perspective when managing your asset allocation. Successful investors have target asset allocations depending on their risk appetite and goals for different stages of life.

Mutual fund selection if done properly can be excellent instruments for managing your asset allocation because they offer different schemes for different asset classes and sub-classes. You switch between schemes, get fixed cash-flows through SWP or invest through STP subject to exit load and taxation considerations.

How to pick the right mutual fund?

- Investment horizon: How long will you remain invested? It will depend on how much time you have to reach your financial goal. Equity funds are suitable for long investment horizon because historical data shows that equity is the best performing asset class in the long term. For short investment tenures, debt funds are suitable. For very short investment tenures (less than 1 year), certain types of debt funds like overnight funds, liquid funds, ultra-short duration funds etc. are suitable. Therefore, select mutual funds based on your investment needs.

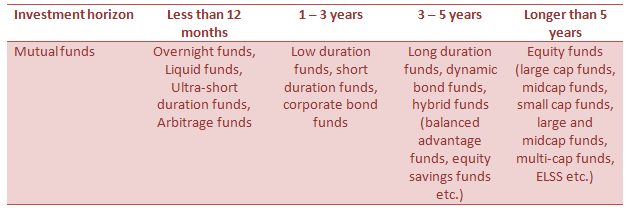

- The table below shows different types of mutual fund schemes that may be suitable for different investment tenures. You should select mutual funds based on these time horizons.

![Different types of mutual fund schemes that may be suitable for different investment tenures Different types of mutual fund schemes that may be suitable for different investment tenures]()

Disclaimer: The above fund category suggestion is purely illustrative for general guidance. Mutual funds are subject to market risks. You should always invest according to your financial goals and risk appetite. You should consult with your financial advisor before investing..

- Investment objective: Do you want capital gains or regular income? Equity funds are best suited for capital appreciation over long investment horizon. You should invest in debt funds if you want regular income e.g. income during retirement years, accruing income for short to medium term with low capital risks. Your cash-flow needs will determine whether you invest in growth or dividend option. If you need regular cash-flows then you can invest in dividend option. If you do not need regular cash-flows you should invest in growth option. You should take your tax situation into consideration when investing in dividend option and consult with your financial advisor in helping you make the right decision.

- Risk profile: Does the risk profile of the scheme match your risk appetite? Mutual funds offer products covering a large spectrum of risk profiles to suit different risk appetites. You should know the risk profile of a scheme to ensure that you are taking the right amount of risk. Equity funds are suitable for investors with moderately high to high risk appetites. Debt funds are suitable for investors with low to moderate risk appetites. Hybrid funds (excluding arbitrage funds) are suitable for investors who have moderately high risk appetite. Selecting a mutual fund, therefore, based on your risk appetite is the most important thing.

Even within a broad asset class different fund categories have different risk profiles. Within the broad equity fund category, large cap funds have lower risks compared to midcap funds. Midcap funds have lower risk compared to small cap funds.

Similarly in debt funds, overnight funds have practically no risks. Liquid and ultra-short duration funds have much lower risks compared to low duration, short duration and corporate bond funds. Longer duration funds, dynamic bond funds and Gilt funds can be more volatile in the short term than the shorter duration funds. You should understand the risk profile of your fund before investing. - Taxation: You should know the tax consequences of your investment. Short term capital gains (held for less than 12 months) in equity funds are taxed at 15%. Long term capital gains (held for more than 12 months) in equity funds are tax exempt up to Rs 1 lakh and taxed at 10% thereafter (in excess of Rs 1 lakh of capital gains).

Short term capital gains (held for less than 36 months) in non-equity funds are taxed at as per your income tax rate. Long term capital gains (held for more than 36 months) in non-equity funds are taxed at 20% after allowing for indexation benefits. Mutual fund dividends are added to the investor’s income and taxed as such. You should take your tax situation into consideration when making investment decisions. For example, if you are in a high tax bracket then SWP may be a more tax efficient cash-flow solution than dividend option. You should consult with your financial advisor before investing.

Suggested reading: Know your mutual fund taxation for FY 2019-20 - Expense Ratio: Expense ratio is important for certain types of investments like index funds. In actively managed funds, the fund manager’s ability to generate high alphas may compensate for higher expense ratios. Index funds on the other hand, do not aim to create alphas and merely track the index. So expense ratio is important in index funds. Expense ratio is also important in overnight funds and liquid funds, where the fund manager’s ability to generate alpha is limited. Choose a good mutual fund which not only can create alpha but also has lower expense ratio.

- Liquidity: Liquidity is an important factor depending your financial goal and situation. You should check the exit load and also see if there is any lock-in period, so that you can make informed decisions according to your needs.

Summary

In this article, you have discussed factors you should consider when investing in a mutual fund scheme so that you can select the best mutual fund. You should also check the long term track record of the mutual fund scheme, its fund manager and also the fund house before picking the right mutual fund. Select Mutual Funds whose managers have strong performance track records. You may also like to read do you know the most important parameters in selecting mutual funds

You should always take the help of a financial advisor if you have difficulties in understanding the investment characteristics of mutual funds.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY