Passive Investing: Should you invest in ETFs or Index Funds

Passive investing i.e. investing through ETFs or index funds is very popular in the developed economies. Passive mutual fundswere launched in the 1970s, but their popularity soared globally after the Global Financial Crisis of 2008. As on March 2020, global assets under management (AUM) in passive mutual funds crossed $5 trillion (source: S&P Dow Jones Indices). In the US, which accounts for 68% of global passive funds AUM (as on March 2020), passive AUM topped actively managed AUM in August 2019 (source: Bloomberg).

Passive investing in India

In India actively managed mutual funds still rule the roost, but there seems to be growing interest in passive investing in recent years. 10 years total passive AUM in India was less than $1 billon. 5 years back it was $2 billion and now it is $24 billion (as on December 2019) – growing at CAGR of nearly 65% over the past 5 years (source: etfgi.com). Though AUM of passive funds (ETFs, index funds) have clocked dramatic growth rates in recent years, in terms of share of overall assets, passive funds account for only 7.5% of the mutual fund industry AUM as on December 2019 (source: etfgi.com), which is substantially lower compared to developed markets.

In our view, there seems to be a lack of awareness and clarity about passive funds in India. In this article, we will discuss about passive funds and how to invest in these funds.

What are passive funds?

Passive mutual fundsto invest in a basket of stocks which replicate a market index e.g. Sensex, Nifty, etc. Weights of stocks in a passive fund mirror the weights of the constituents in a market index. Unlike actively managed mutual funds, the fund manager of a passive mutual fund does not aim to beat the market. The fund manager simply aims to give index returns to investors and reduce tracking error. Tracking error is deviation of fund returns from the index returns.

Benefits of passive funds

- Low cost: Expense ratios (TER) of passive funds are much lower than actively managed funds. For the similar underlying fund portfolio performance, passive mutual fundswill provide higher returns to investors compared to active funds. Let us try to understand the impact of cost on returns with the help of an example. Let us assume that TER of an active fund is 2.25%, while that of a passive fund with the same benchmark index is 1.1%. This means the manager of the active fund has to beat the benchmark index by 1.15% (alpha) just to match the performance of the passive funds.

- No unsystematic risk: In order to beat the index (create alpha), the fund manager will have to be overweight or underweight on certain stocks in the index. This will result in unsystematic i.e. stock or sector specific risks in addition to market risk. Sometimes the fund manager’s strategy may pay off and the fund will beat the benchmark, but sometimes, it may not pay off and the fund will underperform the benchmark.There is no unsystematic risk in passive mutual funds. Passive mutual fundsonly have market risks and you will get market returns subject to tracking error.

- Underperformers have lower weights: Market benchmark index constituents are usually weighted based on their market cap. Higher the market cap of a stock, higher will be its weight in the index. This method of index construction automatically gives higher weights to outperformers and lower weights to underperformers. By extension, passive funds which track the index will also have weights for outperformers and lower weights for underperformers.

- Simpler investment: In passive funds you do not have to check the performance track record of the fund manager across different market conditions, how long has he / she been managing the fund, understand his / her stock selection strategyetc. You simply have to decide which market index you want to invest in and then select a fund which has low cost and tracking error. Often higher cost is the source of higher tracking error. So if the cost of a passive fund is low, then the tracking error is likely to be low.

Types of passive funds

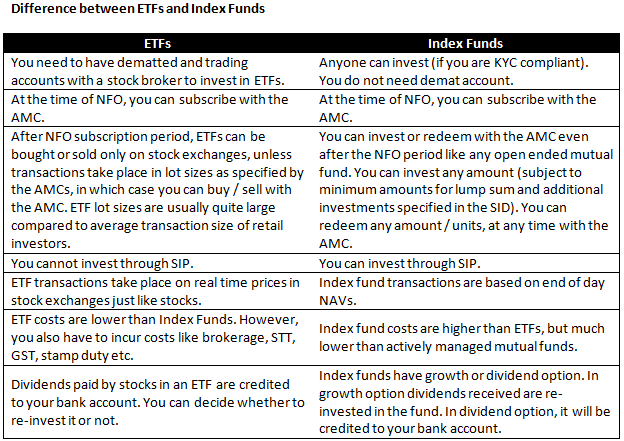

There are two types of passive funds – Exchange Traded Funds (ETFs) and Index Funds. In terms of investment objectives ETFs and index funds are exactly the same. Both aim to track / replicate a specific market index. Often investors and financial advisors use the terms ETFs and index funds interchangeably. However, there are important differences between the two which investors must understand.

How to decide between ETFs and Index Funds?

We have discussed key differences between ETFs and Index Funds in the previous section. Many online blogs on this topic suggest that if you have a demat account or are willing to open a demat account then you should invest in ETFs. Otherwise, go for Index Funds. In our view, the differences run deeper than simply having dematted accounts. Here are some factors you should consider when deciding between the two.

- Cost: Cost of ETFs including the transaction costs like brokerage, STT, GST, stamp duty etc. are lower than Index Funds. Purely from a cost viewpoint, ETFs have an advantage over Index Funds.

- Liquidity: This is a very important consideration because unless you are redeeming in lot sizes, you can sell ETF units only in the stock exchange. In other words, you need to find a buyer, if you want to sell your ETFs. Some ETFs are quite liquid, while others may not be liquid. You have to look at average daily trading volumes of your ETF to get a sense of its liquidity. Liquidity also depends on market conditions. This may require some investment experience. Liquidity is not an issue with index funds because you can redeem with the AMC.

- Experience: If you have investment experience in the stock market buying and selling stocks, then investing in ETFs will be easier for you because ETFs are very similar to stocks. You should know what price to buy, sell, look at trading volumes and know what to do with dividends. Index funds, on the other hand, are mutual funds. As such, they have all the advantages that are associated with mutual funds e.g. convenience, flexibility, investing through SIP / STP etc.

Conclusion

Passive investments are becoming popular all over the world, including India. In the coming years, you will hear more and more about passive investments. In this blog post, we discussed about passive funds, their benefits and different types of passive funds. We also discussed about key differences between ETFs and Index Funds, and how you can go about deciding between the two. While cost is always an important factor, you should also give some thought to liquidity and your own investment experience when deciding what to select between ETFs and Index Funds. As always, if required, you should consult with your financial advisor and make informed investment decisions.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY