Banking and PSU Debt Funds: Good fixed income investment options in current environment

Jul 24, 2019 / Dwaipayan BoseOver the past few years, we have seen growing interest in debt mutual funds among retail investors visiting our website. AMFI data shows that retail and HNI investors now have 46% share of debt mutual fund (excluding liquid and...Read More

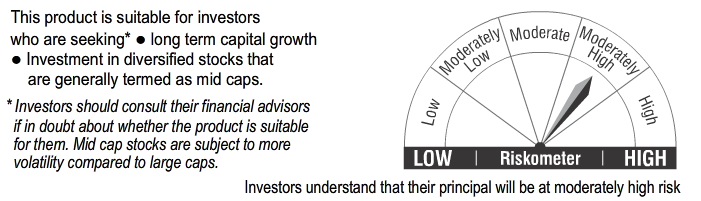

Should you invest in midcap mutual funds now

Jun 7, 2019 / Dwaipayan BoseMany retail investors who pulled out of midcap and small cap mutual funds during the correction last year have been waiting on the sidelines for the past few months for the election results. The Indian electorate has given a clear...Read More

How can you maximize your Mutual Fund SIP returns

May 13, 2019 / Dwaipayan BoseAdvisorkhoj has always been a big advocate of mutual fund Systematic Investment Plans (SIPs) for financial planning. Thanks largely to the efforts of financial advisors and investment awareness programs of asset management...Read More

The difference between a focused fund and more diversified equity funds is that focused funds have a concentrated portfolio strategy as opposed to a diversified mix of stocks / sectors in diversified equity funds. We have had a number...Read More

How to be prepared for uncertain times

Mar 25, 2019 / Dwaipayan BoseThe stock market has surged in the last few days with the Nifty near its 52-week high. Nifty has gained nearly 6% in the last month but it has given negative returns over the last 6 months. The Nifty Midcap 100 Index has gained more...Read More

Know your mutual fund taxation for FY 2019 20

Feb 25, 2019 / Dwaipayan BoseThere is a common saying that taxes and death are unavoidable and therefore, you should always assess your tax correctly and pay it at the right time. Mutual funds do not deduct tax at source for redemption proceeds but investors...Read More

If you like to research different mutual funds before investing or are generally interested in mutual fund research, you may have come across a new equity fund category, Large and Midcap Equity Funds. This new category came...Read More

Growth Fund versus Value Fund: Which mutual fund scheme should you have in your portfolio

Jan 24, 2019 / Dwaipayan BoseMutual fund investing is all about mapping your goals to suitable schemes that can help you achieve those goals. Your risk appetite and investment tenure are the two most important factors you’ll consider before you invest, as they...Read More

In the first part of this post, “Why you should get serious about retirement planning and start investing in mutual funds”, we had discussed that without serious thought and planning from an early stage of your career, retirement...Read More

Why should you get serious about retirement planning and start investing in mutual funds

Dec 21, 2018 / Dwaipayan BoseRetirement planning is one of the most important life goals for any family. Unfortunately, in our country, most people do not take retirement planning very seriously until it is too late. In the absence of a sufficiently large retirement...Read More

Sundaram Towers,

46, 2nd Floor,

Chennai, Tamil Nadu - 600014

Phone 1: 044-2858 3362

Phone 2: 044-2858 3367/044-28569900

Email: customerservices@sundarammutual.com

| Location | No of Distributors |

|---|---|

| Mumbai | 1370 |

| Kolkata | 843 |

| Bangalore | 451 |

| Chennai | 447 |

| Delhi | 411 |

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.