How can you maximize your Mutual Fund SIP returns

Advisorkhoj has always been a big advocate of mutual fund Systematic Investment Plans (SIPs) for financial planning. Thanks largely to the efforts of financial advisors and investment awareness programs of asset management companies (AMCs), retail investor participation in mutual funds through the SIP route has increased manifold in the last few years.

As per AMFI data, monthly mutual fund AUM mobilization through SIPs on March 2019 was more than र8,000 Crores compared to just around र3,000 Crores in March 2016. In FY 2018-19, 9.13 lakh SIP accounts were added each month. Based on comments and queries received by us at Advisorkhoj, we know that many of our readers are investing through SIPs. In this blog post, we will discuss how existing and also new SIP investors can maximize their SIP returns.

Start early and invest for long periods

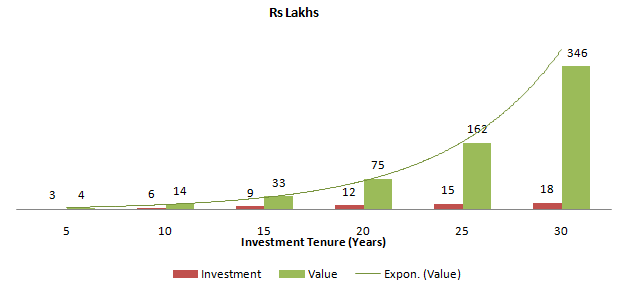

We have stated a number of times in our blog that the most important ingredient in the wealth creation recipe is not money but time. Money when invested is put to work and the longer it works, the more profits it can generate. Profits invested generate more profits and over the long investment horizon you can create substantial wealth. This is known as the power of compounding. The chart below shows how much wealth investors can create over different investment tenures with a monthly SIP of just र5,000 (assuming 15% rate of return)

You can see that your wealth creation is exponential over longer tenures. By starting early you give yourself more time, for your money to grow through the power of compounding.

Suggested reading: Why you should start investing early in mutual funds for your retirement

Remain disciplined even during volatile markets

Stock markets are volatile – ups and downs are part of equity investments. Sometimes markets can be extremely volatile correcting 20% or even more. We understand that volatility can be stressful because no one likes to see losses. However, you must resist the urge of canceling or stopping your mutual fund SIP in market corrections. In fact, corrections are the best time to invest systematically because your acquisition cost is lowered through Rupee Cost Averaging (you buy units of mutual fund schemes at lower and lower costs during market corrections) and your long-term returns are enhanced significantly. We have looked at the last 3 major corrections in the stock market (Nifty) and calculated the returns you would have given up in just the next 3 years, if you stopped your SIP. Let us assume you were investing in Nifty 50 TRI.

You can see that, if you had stopped your SIPs during the correction, you would have lost out on a considerable profits (12 – 18% CAGR). Remain disciplined with your SIPs, even in the face of volatility and you will be rewarded in the long term.

Increase your SIP periodically to boost your wealth

Over time your income increases, as do your expenses. With a rise in income your lifestyle also improves substantially. Logically, your savings and investments should also increase over time. By increasing your SIP instalments every year with an increase in your salary, you can accumulate a much larger corpus. Remember extra rupee you invest, will multiply many times over long investment tenures.

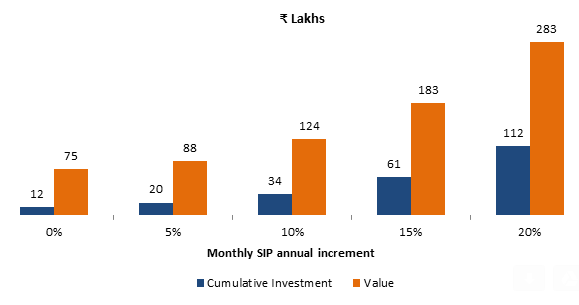

Let us assume you start a monthly SIP of र5,000. Over 20 years, assuming 15% ROI, you will accumulate of र75 lakhs (with a cumulative investment of र12 lakhs). If you increase your monthly SIP by just 5% every year, then your corpus will grow to Rs रlakhs (with cumulative investment of र20 lakhs). So the additional र8 lakhs investment, spread over 20 years, will create additional wealth of र13 lakhs for you. The chart below shows, how much you will be able to accumulate by increasing your monthly SIP by certain percentages every year.

You can see that by increasing your mutual fund SIPs by 10% every year; you will be able to accumulate a corpus which is almost र50 lakhs (65%) more. Higher your SIP increment, larger is your profit both on an absolute and a relative basis. There is no hard and fast rule regarding how much you should increase your SIP every year. Ideally you should increase your SIP in line with your salary increment percentage, but you can increase it by an amount you’re comfortable with and you will be able to accumulate a much bigger corpus. Increasing your SIP every year is not a complicated process. Most mutual funds offer SIP Top Up or Step Up facilities, whereby you can increase your SIP by a fixed amount or fixed percentage every year. We urge investors to avail these facilities to boost their long term wealth.

You can check this SIP with annual increase tool to find what would have been the enhanced growth of your SIPs had you opted for annual increase.

Tactically take advantage of market corrections to invest in lump sum

While SIPs over long investment horizons have created substantial wealth for investors, there is no denying that, the market from time to time provides opportunities to investors to buy at very low prices and get potentially high returns. If you are investing through a SIP in a good mutual fund scheme and have funds available to invest a lump sum, take advantage of market corrections tactically, by investing a lump sum in the same scheme. Past data shows that 15 – 20% corrections provide excellent investment opportunities. Based on our experience of investor behaviour, they are often unable to take advantage of corrections because they wait to catch the market bottom. It is very difficult, even for the most experienced investor to perfectly time the market.

In our view, 15 – 20% correction provides good investment opportunities, but if you are worried that the market may fall even further then you can invest your lump sum funds in a liquid fund and use Systematic Transfer Plans (STPs) to invest from the liquid fund to the equity fund over 3 – 6 months. Historical data shows that bear markets or corrections do not last very long before market rebounds – about 12 months at most. Therefore, once market has corrected 15% or more, 3 – 6 months STP will enable you catch lower prices and even the bottom.

Conclusion

Summarizing key points of this post:-

- In order to get the maximum returns from your SIP, you should start early and invest systematically over very long periods, at least 10 years or even longer to get the best results

- Remain disciplined in your investments and do not get perturbed by volatility. SIPs help you take advantage of market volatility by Rupee Cost Averaging of purchase price

- Increase your SIPs every year with a rise in your income. This will boost your wealth substantially in the long term

- Take advantage of corrections to tactically invest in lump sum. You are likely to get excellent returns in the medium to long term

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY