Know your mutual fund taxation for FY 2019 20

There is a common saying that taxes and death are unavoidable and therefore, you should always assess your tax correctly and pay it at the right time. Mutual funds do not deduct tax at source for redemption proceeds but investors are required to declare capital gains made on their mutual fund investments in their income tax returns and pay the required taxes. If your tax liability exceeds Rs 10,000 then you should pay advance tax in each quarter based on the accrued estimated tax liability for the entire year; failure to pay advance tax will result in interest being levied on the tax amount.

Tax treatments are different for different types of mutual fund schemes. Knowing the tax consequences of your investmentsis an important part of financial planning because it will help you make tax efficient investment decisions.

In this blog post, we will discuss the tax implications of mutual fund investments, so that you are able to assess the tax obligation arising out of your mutual fund transactions correctly and also make informed investment decisions.

Purely from a tax perspective, there are broadly two types of mutual fund schemes:-

Equity funds:

A fund in which at least 65% of the portfolio is allocated to equities (stocks) is an equity fund. Please note that as far as mutual fund taxation is concerned, derivatives whose underlying assets are stocks (or stock indices) are also considered to be equity. Apart from funds which are categorized as equity funds as per SEBI’s definitions, certain types of hybrid funds where average gross equity allocation is more than 65%, like aggressive hybrid funds, arbitrage funds, equity savings funds etc. are also treated as equity funds from a tax perspective. If you are unsure about the tax treatment of a mutual fund scheme in your portfolio, you should consult your financial advisor.Non-equity funds:

Non-equity funds from a tax standpoint are mutual fund schemes which have less than 65% allocation to equity in their portfolio. Non-equity funds include schemes which are classified as debt funds as per SEBI’s definitions and certain types of hybrid funds where equity allocation is less than 65%, like conservative hybrid funds, multi asset allocation funds etc. Investors should note than Gold funds, fund of funds and international funds are also non-equity funds (irrespective of their equity allocations). As discussed earlier, you should discuss with your financial advisor if you have doubts about the tax treatment of your scheme.

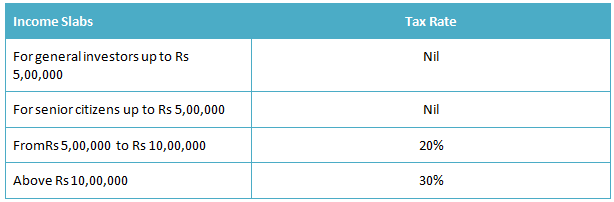

Income Tax Slabs

Before we discuss taxation of different types of mutual fund schemes, let us first recap the exemption limits and key income tax slabs for Resident Indians and Hindu Undivided Families (HUF).

Please note that, 4% education and health cess will be levied on your income tax amount.

Capital Gains

Capital gain is the appreciation in the value (redemption value – purchase value) of the units of a mutual fund at the time of the sale. Investors should know that capital gains are taxed only at the time of redemption or sale. If your mutual fund units have appreciated in value and you are still holding them, then there is no taxation on the unrealized gains. From a tax standpoint, there are two types of capital gains.

Short term capital gain:

For equity funds, if the units are sold within 12 months from the date of purchase then short term capital gains tax applies. For non-equity funds, if the units are sold within 36 months from the date of purchase then it will attract short term capital gains tax.Long term capital gain:

For equity fund, if the units are sold after 12 months from the date of purchase then it attracts long term capital gains tax. For non-equity funds, LTCG applies if the units are sold after 36 months from the date of purchase.

Capital gains taxation for Equity Funds

Short term capital gains (if the units are sold before one year) in equity funds are taxed at the rate of 15% plus 4% cess.Long term capital gains of up to Rs 1 Lakh are tax exempt. Long Term Capital gains in excess of Rs 1 Lakh are taxed at 10% plus cess.

Capital gains taxation for Non Equity Funds

Short term capital gains (if the units are sold before three years) in debt funds are taxed as per applicable tax rate of the investor. So if your taxable income is above Rs 10 lakhs then short term capital gains tax of your debt fund sale is 30%. Long term capital gains of debt fund are taxed at 20% with indexation. To calculate capital gains with indexation, you should index your purchase cost by multiplying the purchase cost with the ratio of the cost of inflation index of the year of sale and cost of inflation index of the year of purchase, and then subtract the indexed purchase cost from sales value.

Related reading: How mutual fund capital loss tax credits work

Dividend Taxation

Dividends are profits by a mutual fund scheme which are paid to investors at regular intervals while holding the units of the scheme. Investors should note that dividends are tax free in the hands of the investors but the Asset Management Company (AMC) has to pay dividend distribution tax (DDT) before paying dividend to investors. AMCs have to pay 10% dividend distribution tax (DDT) on dividends distributed by equity funds. For non equity funds, DDT = 25% + 12% surcharge + 4% cess = 28.84%. You should understand the tax implications when selecting growth versus dividend options and make informed decisions.

Recap of Equity and Non-Equity Fund Taxation

The table below summarizes the taxation of equity and non-equity funds.

Conclusion

In this post, we have discussed the effect of taxes on your mutual fund investment. When filing Income Tax Returns, you should carefully go through all the mutual fund redemptions made during financial year and calculate the capital gains. You can get your capital gains statements online from mutual fund registrars. You should mention your capital gains in your income tax returns and pay taxes accordingly. If you are in any doubt you should consult your tax advisor.

Suggested reading: how rollover in tax saver mutual funds provide substantial benefits AND What are equity linked saving schemes and their benefits

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY