For a long period of time, most retail investors in our country associated mutual funds only with equity investments. In Advisorkhoj, we get a large number of mutual fund related queries from investors every week. We have seen that, around 70%...Read More

Of the various Tax saving options under Section 80C of Income Tax Act 1961, mutual fund Equity Linked Savings Schemes (ELSS) have the maximum wealth creation potential over a long investment horizon. Equity Linked Savings...Read More

Do you know how to select Debt Funds: Modified Duration and Volatility

Jun 23, 2017 / Dwaipayan BoseIn this debt fund series, we are discussing different characteristics of debt fund. Our aim is to explain to our readers how debt funds work and empower them with knowledge of these products so that they can make the best investment...Read More

In the last blog post – Do you know how to select Debt funds: Understanding the risk - we discussed various types of risks that may be associated with investing in debt funds. We also discussed how the debt funds are much more predictable...Read More

Over the past few months, I have come across a number of senior citizens, relatives, parents of friends, acquaintances etc., in weddings and other social occasions; their concerns were with falling interest rates of fixed deposits and...Read More

Do you know the different performance parameters of equity mutual funds: Alpha and Beta

May 5, 2017 / Dwaipayan BoseIn our post, Do you know the different performance parameters of equity mutual funds: Part 1, we discussed various risk and risk adjusted performance parameters of mutual funds. Let us do a brief recap of the various concepts...Read More

Do you know the different performance parameters of equity mutual funds: Part 1

Apr 26, 2017 / Dwaipayan BoseWhen researching funds for investment purposes many retail investors and financial advisors look at the historical returns of mutual fund schemes. If you read the fine print of a mutual fund’s disclaimer, you will often a see a line, “past returns...Read More

In this two part post, we are discussing how to read factsheets more effectively, so that you have a better understanding of the schemes that, you have invested in or plan to invest in. To help readers understand the concepts well, we are explaining...Read More

In this series of posts, we are discussing terms that are commonly used in mutual funds. Many of you may have been familiar with these terms, but a better understanding of these terms will help you become a better investor. In our post...Read More

In our post, Did you know the basics of Mutual Fund investing, we explained some commonly used terms that investors come across, when investing in mutual funds. In this blog post, we will explain some common terms associated with one of...Read More

Sundaram Towers,

46, 2nd Floor,

Chennai, Tamil Nadu - 600014

Phone 1: 044-2858 3362

Phone 2: 044-2858 3367/044-28569900

Email: customerservices@sundarammutual.com

| Location | No of Distributors |

|---|---|

| Mumbai | 1376 |

| Kolkata | 844 |

| Bangalore | 451 |

| Chennai | 450 |

| Delhi | 415 |

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

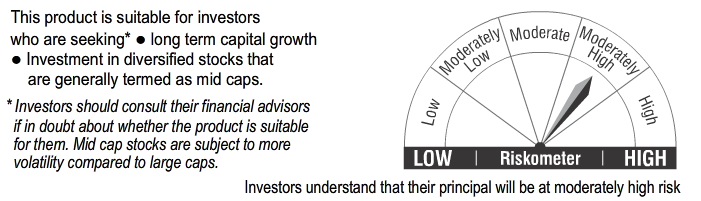

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.