Having a well-thought-out strategy is crucial when managing investments and building long-term wealth. Systematic Transfer Plans (STPs) give investors a disciplined approach to shift funds from one investment option to another gradually. This article will explore STPs, why investors should consider using them, their benefits...Read More

Avoid these 10 mutual fund investing mistakes

Apr 30, 2023 / Dwaipayan BoseSome investors wait to time the market in order to buy at low price. As per the Random Walk Hypothesis of movement of stock prices is random, in other words, it is not possible to predict short term price movement based on trend. Bear markets in the past have shown a sudden trend reversal. Even if...Read More

How SWP and STP Taxation works

Mar 28, 2023 / Dwaipayan BoseSystematic Withdrawal Plan (SWP) and Systematic Transfer Plan (STP) are mutual fund facilities which offer solutions to different investment needs. SWP provides fixed cash-flows to investors. STP enables investors to transfer fixed amounts at regular intervals (e.g. weekly, monthly, etc.) from one scheme (usually low...Read More

What is YTM and why is it important for debt funds

Feb 28, 2023 / Dwaipayan BoseMost investors select mutual fund schemes based on past returns, often recent returns e.g. last 1 year returns. However, looking at last 1 or 2 years returns can be misleading for debt funds. In this article, we will discuss why past returns can be misleading for debt investors. We will also discuss about a debt fund...Read More

Most investors associate mutual funds mainly with equity investments. While equity as an asset class has an important role to play in your financial plan, fixed income or debt also has an equally important role. Traditionally fixed income investments have been associated with bank deposits, Government small savings...Read More

Many investors have substantial amounts lying idle in their savings bank accounts. Interest on savings bank balance is currently around 2.7 – 3%. Savings bank interest is taxable under the head “Income from other sources”. You can avail deduction of up to Rs 10,000 under Section 80TTA. Thereafter, the interest will be...Read More

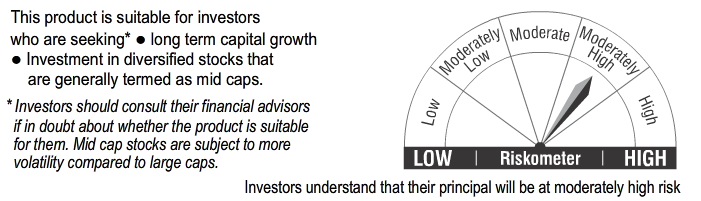

Risk Indicators in Mutual Funds

Dec 7, 2022 / Dwaipayan BoseMutual funds are market linked investments. The prices of the underlying securities e.g. stocks, bonds etc of a mutual fund scheme can go up or down depending on market movement. The Net Asset Value (NAV) of a scheme reflects the market value of the underlying securities. Accordingly, the NAV of a scheme can go up or down...Read More

Understanding mutual fund NAVs

Oct 31, 2022 / Dwaipayan BoseNet Asset Value or NAV is a very important term in the lexicon of mutual funds. NAV is the market value or price of one unit of a mutual fund scheme. It is the per unit price you pay or get when you are buying or selling (redeeming) mutual funds. You should know the correct NAVs of your mutual fund schemes when you are filing...Read More

Should you invest in corporate bond funds

Oct 10, 2022 / Dwaipayan BoseCorporate bonds are debt instruments issued by companies to the public. Corporate bonds have a fixed tenure i.e. they mature on a fixed date and they pay regular interest (also known as coupons) at regular intervals e.g. monthly, quarterly or yearly. Corporate bonds can either be secured i.e. backed by the company’s assets...Read More

Flexicap fund is the one of the most popular categories of mutual funds in India. As per AMFI data, total assets under management (AUM) in flexicap funds, as on 29th July 2022, was more than Rs 2.3 lakh crores, almost the same as the AUM in large cap funds. Though the term flexicap as a category name is relatively...Read More

Sundaram Towers,

46, 2nd Floor,

Chennai, Tamil Nadu - 600014

Phone 1: 044-2858 3362

Phone 2: 044-2858 3367/044-28569900

Email: customerservices@sundarammutual.com

| Location | No of Distributors |

|---|---|

| Mumbai | 1376 |

| Kolkata | 844 |

| Bangalore | 451 |

| Chennai | 450 |

| Delhi | 415 |

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.