What is YTM and why is it important for debt funds?

Most investors select mutual fund schemes based on past returns, often recent returns e.g. last 1 year returns. However, looking at last 1 or 2 years returns can be misleading for debt funds.

In this article, we will discuss why past returns can be misleading for debt investors. We will also discuss about a debt fund measure known as Yield to Maturity (YTM). We think YTM provides more useful information in selecting debt funds according to your investment need and risk appetite.

Suggested reading why you should have debt funds in mutual fund portfolio

What does debt fund returns depend on?

Debt funds invest in debt and / or money market instruments, which pay interest to investors and principal on maturity of the instrument. Some fixed income instruments, especially money market instruments do not pay periodic interest; instead, the price at which the instrument is issued by discounted by the interest payable from the principal and they pay the principal on maturity.

Let us now understand, what debt fund returns depend on? Debt fund returns depend on two things – the interest paid by the underlying debt and money market instruments and change in prices of the underlying debt and money market instruments over your investment tenure. How does the price of debt / money market instruments change? Prices of debt and money market instruments have an inverse relationship with interest rates. If interest rates rise, then prices will fall and vice versa. This is known as interest rate risk.

It is important for investors to know that if your investment tenure matches with the maturities of the debt / money market instruments, then interest rate changes will have no impact on your returns because on maturity of a debt / money market instrument, the issuer will pay you the face value, essentially the principal, irrespective of what the interest rates are. You should keep this in mind, so that you can make informed investment decisions.

You may also like to read should you invest in debt funds when interest rates are rising

Why recent returns of a debt fund can be misleading?

Recent returns of debt funds can be misleading because interest rates change depending on the interest rate trajectory. For example, 6 months back the interest paid by (yield) the 91-day Treasury Bill was 5.42%, and now the yield of the 91 day Treasury Bill is 6.42% (source: RBI, as on 31st January 2023). The short term yield / interest rate has gone up by 100 bps or 1% in the last 6 months. So the last 12 months returns will not give you the true picture.

For the longer duration funds, the returns may have been low because interest rates had been rising for the last one or two years. As mentioned before, rising interest rates have a negative impact on prices of debt / money market instruments and debt fund returns. You should ask yourself the question, will interest rates rise at the same rate, at which it has been rising for the last one year?

For example, the yield of the 10-year Government Bond on 31st January 2022 was 6.8% and on 31st January 2023 was 7.3% (source: investing.com). Will the yield (interest rate) rise by another 50 bps in the next 1 year? If the answer is no, then past returns are misleading. If past returns are not a good indicator for debt funds in changing interest rate scenarios, then what is a good measure?

Yield to Maturity (YTM)

Yield to Maturity (YTM) is the expected annualized return from your debtinvestment if you hold the debt / money market instrument till its maturity. Debt fund (YTM) is one of the most important concepts of debt investments because it does not depend on how the instrument performed in the past; it simply tells you how much return you can get, if you hold the instrument till maturity.

How is YTM calculated?

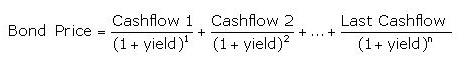

The equation for calculating yield to maturity (YTM) is as follows:-

The cash-flows are the coupon payments made by the bond. The last cash-flow will have both coupon and the maturity amount (face value). If you know, how much you paid for the bond, then you can calculate the yield (YTM) based on the above equation. However, this is purely for your theoretical interest; you do not need to calculate YTM yourself, since AMCs disclose the YTM of their debt funds in the monthly fund factsheets. You can also find YTMs of debt funds on our website.

YTM is directly related to maturity / duration of the fund

Debt or money market instruments of longer maturities pay higher interest rates (yields) than instruments of shorter maturities. So, longer maturity debt / money market instruments or debt funds will have higher YTMs than shorter maturity debt / money market instruments or debt funds. However, you should also know that maturity or duration of a debt funds has a direct correlation with higher interest rate risk – longer the maturity / duration, higher is the interest rate risk. In order to avoid interest rate risk your investment tenure should be equal or longer than the duration of the fund. You should select debt funds based on YTM and maturity that matches with your investment tenure.

Read why liquid funds are a good option to park your idle funds

YTM and credit quality

Debt and money market instruments of lower credit quality (low credit ratings) will have to pay higher interest rates compared to debt and money market instruments of high credit quality. So, YTM of lower credit quality papers or funds will be higher than YTM of higher credit quality papers. You should bear in mind that lower credit quality funds will have higher credit risks.

Credit risk of fixed income instruments refers to the issuers’ failure of meeting their interest and / or principal payment obligations, exposing the investor to potential loss of income and / or capital. If the issuer defaults on interest and principal payments, then the price of the instrument will be written down permanently and the investor may have to suffer a loss.

You should not base your investment decision simply based on high YTMs; you should consider credit risks and make informed investment decisions based on your risk appetite. In times of economic slowdown / downturn, it is usually advisable to avoid credit risks.

Suggested reading should you invest in corporate bond funds

Why and how to use YTM for fund selection?

Yield to maturity (YTM) is one of the most important concepts in fixed income investing. It is a much better indicator of expected returns compared to past returns, if your investment tenure matches with the maturity profile of the fund. Higher the yield to maturity, higher will be your returns. However, you should be mindful of interest rate risk and credit risk when you are making debt fund investment decisions. You should invest according to investment needs, tenure and risk appetite.

You should consult with your financial advisor or mutual fund distributor if you need help in understanding the risk characteristics of your debt fund.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY