Why you should have debt funds in mutual fund portfolio

Most investors associate mutual funds mainly with equity investments. While equity as an asset class has an important role to play in your financial plan, fixed income or debt also has an equally important role. Traditionally fixed income investments have been associated with bank deposits, Government small savings schemes etc. However, debt mutual funds are increasingly becoming popular among investors as versatile and tax efficient investment solutions.

Why do you need fixed income in your financial plan?

- Financial goals: We have different financial goals for different stages of life. These goals can be short term, medium term or long term. While equity is mainly for long term goals, fixed income provides solutions for short, medium and long term goals.

- Lower risk: Different investors have different risk appetites, e.g. retirees will have lower risk appetite compared to a young investor. Fixed income as an asset class has much lower risks compared to equity and is suitable for investors with low to moderate risk appetites.

- Regular income: Some investors e.g. retirees may need regular income from their investments. There can be other situations in life when you need income from your investments, e.g. taking a sabbatical from work to pursue higher studies, supporting your children when they are in college etc. Fixed income is the ideal investment solution if you need regular income.

- Diversification through asset allocation: Diversification will enable you to take the optimum amount of risk as per your risk appetite. Asset allocation is essential for risk diversification and at the same time provides adequate returns to help you meet your financial goals. A mix of fixed income and equity in your investment portfolio is required for asset allocation.

- Liquidity: Emergencies can arise in any stage of life. You should have a contingency fund which can be easily converted into cash for emergencies like sudden loss of employment, unexpected large expense etc. High liquidity is also required for your short term goals as your cannot take high risks with such investments. Fixed income will be required for your liquidity needs e.g. contingency planning, short term goals etc.

Why debt funds can give higher returns than traditional fixed income investments?

As per finance theory, risk and returns are related. Let us understand this concept by comparing a bank FD with a non-convertible debenture (NCD) or corporate bond. Suppose a 5 year Bank FD is giving 5.25% interest rate per annum. A company issuing a 5 year NCD, will have to pay higher interest rate or coupon compared to Bank FD. If the company does not pay higher interest rate than bank FD, why will you invest in the NCD? The issuer is paying you higher interest rate because you are taking the risk. Not all NCDs will have the same interest rate or yield. An issuer with a lower credit rating will pay you even higher interest rate, compared to an issuer with higher credit rating. Why will you invest in a lower rated bond unless it gives higher returns? Higher the risk, the higher will your returns be. You should understand the risk return trade-off and make informed decisions, based on your risk appetite. In general, the interest rate of a risk free investment will be only slightly higher than the inflation rate. A market linked investment will usually give higher returns than a fixed interest investment. We will discuss a few examples in the following sections. Let us now compare returns of fixed interest and market linked products of similar tenures.

You may also like to read should you invest in debt funds when interest rates are rising?

Debt funds are highly liquid

Open ended debt mutual funds are highly liquid. You can redeem units of your debt mutual fund schemes at any time. Redemptions in liquid and overnight funds are processed on a T+1 basis, while that in other debt funds are processed on T+3. Unlike some traditional fixed income schemes, there are no penalties for pre-mature withdrawals for redemptions made after the exit load period. Please note that some schemes may charge exit load for partial or full redemptions within the exit load period. Please read the scheme information document carefully before investing.

Suggested reading: why liquid funds are good to park your idle funds?

Wide variety of solutions for different investment needs

As per SEBI’s mutual fund categories, there are 16 categories of debt mutual funds. Debt funds offer investment solutions for wide variety of investment tenures and risk appetites. There are debt fund products where you may invest for just a few days, weeks or months. There are also medium term and long term debt products, where you can invest for 3 to 5 years or even longer. There are different debt products for different risk appetites ranging from conservative to moderately conservative to moderate.

Suggested reading: should you invest in corporate bond funds?

Debt funds are more tax efficient over longer investment tenures

Interest income from several traditional products e.g. bank FDs are taxed as per the income tax rate of the investor. While capital gains from debt funds held for less than 3 years are taxed as per the income tax rate of the investor, capital gains from investments held for more than 3 years are taxed at 20% after allowing for indexation benefits.

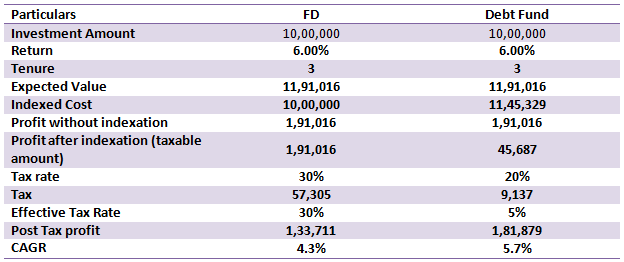

For investment tenures of 3 years or more, debt funds are much more tax efficient than most traditional fixed income investment options e.g. bank FDs. The table below demonstrates how conservative hybrid funds are much more tax efficient than traditional fixed income schemes like Bank FDs for investors in the higher tax brackets. In this example, we have assumed that Cost Inflation Index (CII) in the year of purchase was 289 and CII in the year of redemption is 331.

Disclaimer: The above illustration is purely for investor education purposes. You should discuss the tax consequences of your investment with your tax advisor.

Conclusion

In this blog post, we have discussed why you need to have fixed income investments for your comprehensive financial plan. Debt funds provide a whole spectrum of solution for different investment needs. With interest rates of traditional fixed income products on the decline, investors should consider debt funds as versatile and tax efficient investment options. Investors should discuss with their financial advisors about how debt funds can be suitable for their different investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY