Why you should invest in hybrid funds now

Market context

The equity market has been extremely bullish in this financial year (FY 2023-24) despite high-interest rates. Strong earnings growth in Q1 and cooling inflation have supported the market. The Nifty crossed the 20,000 level in September. The broader market has outperformed with midcaps (Nifty Midcap 150 TRI) and small caps (Nifty Small Cap 250 TRI), giving 26% – 27% YTD returns (as on 21st September 2023, source: NSE). The rally has pushed up valuations (PE multiple), with the broad market index Nifty 500 trading at over 23 times earnings (as on 31st August 2023, source: NSE).

As far as debt markets are concerned, long-term yields have come down in the last 6 months, but short-term yields have spiked up. The yield curve is currently inverted in the 2 to 10-year range, with a 2-year G-Sec yield at 7.25% while the 10-year G-Sec yield is 7.12% (source: Bloomberg, as on 21st September 2023). An inverted yield curve indicates that investors expect long-term yields to go down in the future; it also indicates tightening liquidity. Crude prices have surged again, raising inflationary concerns.

A hawkish statement from the US Federal Reserve indicating that interest rates will remain high longer than expected has dampened global investor sentiments. We are seeing some profit booking and volatility in equities, with the Nifty losing around 600 points in the last few days (source: NSE). In these equity and debt market conditions, investors should focus on asset allocation. In this article, we will discuss about hybrid funds, which provide asset allocation solutions for investors of different risk appetites and investment needs.

Benefits of asset allocation

Different asset classes, e.g. equity, fixed income, gold, etc. have different investment cycles. There is a low or even negative correlation in returns of two or more asset classes. The chart below shows the growth of Rs 10,000 investment in each asset class, viz. equity (represented by Nifty 50 TRI), debt (represented by Nifty 10-year benchmark G-Sec index) and Gold (MCX). You can see in the chart below that equity and gold are usually counter-cyclical to each other, i.e. Gold outperforms when Equity underperforms and vice versa. Further, there is a low correlation between debt and the other two asset classes. Diversifying your portfolio across asset classes limits downside risk when a particular asset class underperforms.

Source: National Stock Exchange, MCX, Advisorkhoj Research, 01.01.2011 to 31.03.2023. Equity: Nifty 50 TRI; Debt: Nifty 10 year benchmark G-Sec Index; Gold: INR price of Gold (MCX). Disclaimer: Past performance may or may not be sustained in the future. The chart above is purely for investor education purposes and should not construed as investment recommendation.

- Behavioural biases impact the actual returns you get from your investments. Greed and fear are the two most common behavioural biases that influence investment decisions. Irrational euphoria in bull markets and panic in bear markets cause great harm to your long-term financial interests. Asset allocation will keep you disciplined in your investments. When equities are rallying, you should be investing in debt to balance your asset allocation and vice versa. Your asset allocation should be according to your financial goals and risk appetite.

- Your asset allocation will change over time with changes to your risk profile and as you approach different life-stage goals. As you progress through life, your asset allocation should reflect a reducing risk profile.

You may also like to read 5 points to remember about asset allocation

Different types of asset allocation strategies

- Strategic asset allocation: This asset allocation strategy is also known as static asset allocation. Strategic or static asset allocation is based on target allocations for different asset classes. In strategic asset allocation, you should stick to the target asset allocation ranges irrespective of market conditions. However, periodic rebalancing is required to bring the asset allocation back to the target.

- Dynamic asset allocation: In this asset allocation strategy, you change your asset allocation depending on market conditions. For example, in some dynamic asset allocation strategies, i.e. you will decrease your equity allocations and increase your debt allocations as equity valuations increase. When equity valuation decreases, you will do the reverse i.e. increase equity and decrease debt allocations.

- Tactical asset allocation: Tactical asset allocation is a variant of strategic asset allocation strategy wherein the investor can occasionally deviate from the core strategic or dynamic asset allocation to take advantage of market opportunities e.g. take advantage of market momentum to invest in equities. Tactical asset allocation involves market timing and requires considerable investment expertise.

What are hybrid funds?

Hybrid funds are mutual fund schemes which invest in multiple asset classes e.g. equity, fixed income, gold, etc. Research has shown that asset allocation is one of the important attribution factors in portfolio performance. These schemes provide investors exposure to multiple asset classes and asset allocation benefits thereof.

Suggested reading – how conservative hybrid funds balance stability with some growth in investments and also how equity savings fund can be good options in an uncertain environment

Types of hybrid funds

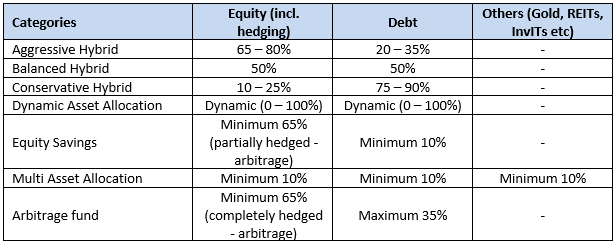

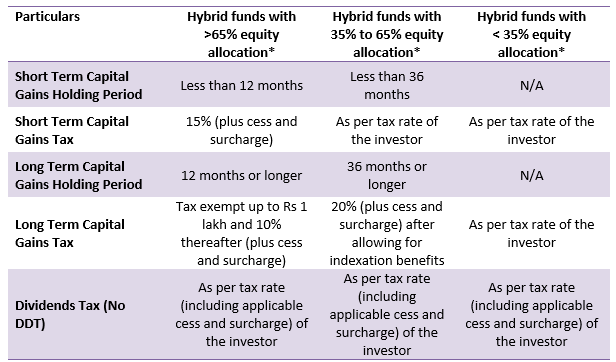

There are seven categories of hybrid funds as per SEBI’s mutual fund categorisation. The table below shows the different categories of hybrid funds along with their mandated asset allocation limits (as specified by SEBI). The taxation of hybrid funds depends on their average Equity allocation in the financial year. According to income tax regulations, mutual funds with at least 65% of their assets in equity or equity-related securities (e.g. futures, options, etc.) are treated as equity funds for taxation purposes. Investors should consult with their financial advisors to know the taxation of their hybrid mutual fund schemes and invest accordingly.

Benefits of hybrid funds

- Hybrid mutual funds offer asset allocation benefits whereby investors can balance risk and return to achieve their financial goals. The equity allocation of hybrid funds can generate higher potential returns in the long term, while the debt allocation reduces volatility and provides stability.

- Hybrid funds provide the benefit of periodic portfolio rebalancing. Rebalancing of assets ensures that the asset allocation of your investments do not deviate from the targeted asset allocation despite market movements. Portfolio rebalancing is aimed at reducing risk and help in generating relatively better risk-adjusted returns over sufficiently long investment tenures. Please note that different funds follow different rebalancing strategies. You should read the scheme information document before investing. You must also understand risk indicators in mutual funds.

- Since hybrid funds are less volatile compared to pure equity funds, they are suitable for first-time or new investors looking for the long term but who do not experience high market volatility.

- Hybrid funds which have more than 65% gross equity allocation (including hedging) enjoy equity taxation. Hybrid funds with 35% - 65% equity allocation can enjoy indexation benefits in taxation of capital gains in investments held for 36 months or longer.

Taxation of hybrid funds

*Investors should consult with their financial advisors to know the tax treatment of their hybrid funds.

What to look in Hybrid Funds before investing?

- Different hybrid funds have different asset allocations and risk profiles. You should always invest in the appropriate hybrid fund category according to your risk appetite and investment needs. Consult with your financial advisor, if you need help in understanding your risk appetite.

- Different hybrid funds have different tax consequences. You should know the tax consequence of your investment and make informed decisions. However, investment decisions should not be made purely on tax considerations. You should invest according to your risk appetite financial goals; tax consequences should be a secondary consideration.

- You should read the scheme information document (SID) of the fund carefully and consult with your financial advisor if you need any help in understanding a product and making informed investment decisions.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY