SWP: A Helpful Investment Solution for Retirement Planning

One of the most important areas to look at white saving for your future is to plan for a stress free and economically independent retirement. An SIP is a tool to systematically invest in mutual funds with the amount of your choice, helping you to build a corpus in the initial years of your career.

Post retirement, the need is for a regular and steady cash-flows to meet your regular expenses. SWP or a systematic withdrawal plan is the answer if you want to withdraw the amount you have invested in mutual funds in a regular and planned manner. You can allocate a portion of your retirement corpus to a suitable mutual fund scheme to opt for regular withdrawal of the amount needed to meet your regular expenses. Let us look at how an SWP works to plan your retirement. Suggested reading how to plan your retirement?

How does a SWP work?

A systematic withdrawal plan (SWP) helps you withdraw fixed amounts from your mutual fund investments in a planned and regular manner monthly or as per any frequency you prefer. You may even choose to withdraw your fund quarterly, half yearly or annually. After setting up an SWP, as per your choice, the fund house redeems the required units from your mutual fund holdings and credits the amount to your savings bank account providing you with steady cash-flows.

Let us take the help of an example to understand how a systematic withdrawal plan works. Say you have a mutual fund with a corpus of Rs 1 crore, and after retirement your requirement to meet your monthly expenses is Rs 50,000. You will then have to set up an SWP with an instruction to the fund house to credit Rs 50,000, into your bank every month and debit the unit balance. Your fund house will then withdraw Rs 50,000 from your mutual fund corpus every month by redeeming units of your mutual fund scheme and transferring it to your registered bank account. The remaining balance units in your fund continue to earn returns. Over time, the balance units in your corpus decrease as a result of your SWP withdrawal, but the value of the units can go up as per the performance of the assets underlying the funds.

You may also like to read how to plan for your retirement with mutual funds?

Understanding SWP with an example

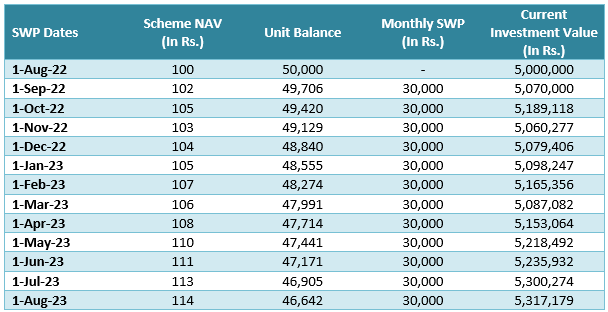

Suppose you invested Rs 50 Lakhs in a mutual fund scheme at a NAV of Rs 100 per unit on 1st August 2022. You started a SWP of Rs 30,000 per month (SWP payment to be made on 1st day of the month) starting 1st September 2022. The table below shows the cash-flows for the purely illustrative NAV movement and the change in value of your investment. You can see that your unit balance will diminish over time because your SWP cash-flows are being generated by redeeming units of your scheme. However, if the scheme return over the SWP period is higher than the withdrawal rate, the value of your investment can grow over time.

Disclaimer: The table above is purely illustrative and meant for investor education purpose only. It is not indicative of the returns you will get from your investments. Mutual fund NAVs are subject to market movements. You should consult with your financial advisor before planning your SWP

What are the benefits of a SWP?

There are a number of benefits that you can consider while choosing an SWP for your retirement planning.

- Regular income: An SWP helps you to withdraw your money regularly and plan for your retirement. Since the amount that is credited to your bank account is planned by you, this can be a reliable source of cash-flows to meet your expenses. Many retirees still depend on dividends (IDCW) to meet their cash-flow needs. You should understand mutual fund dividends (IDCW) are paid entirely at the discretion of the fund manager subject to availability of accumulated profits / distributable surplus. The fund may change its IDCW payout rate or in highly volatile markets even stop making IDCW payments. You may like to read what is IDCW in mutual funds?

- Flexibility: You can choose the frequency and the withdrawal amount that suits your needs. For example, you can set up an SWP to withdraw monthly, quarterly, or even annually.

- Avoid the risk of market timing: Since you will not be redeeming your entire corpus in one go, the risks associated with withdrawing funds when the markets are volatile is avoided as the redemption price gets averaged out.

- Tax efficiency: SWP in equity and equity-oriented funds are much more tax efficient than income from traditional fixed income investments. We will discuss SWP taxation later in this article.

How SWP can provide cash-flows in retirement and create wealth?

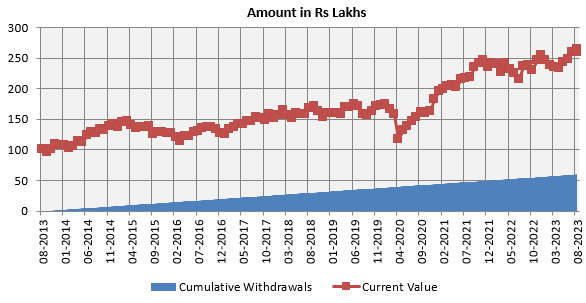

The chart below shows Rs 50,000 monthly SWP over the last 10 years from an investment of Rs 1 crore in Nifty 50 TRI (as on 31st August 2023). You can see that over the last 10 years, you would have withdrawn Rs 60 lakhs from your investment and yet your capital grew 2.6 times. The XIRR of this SWP is 14.6%. This chart shows that with reasonable rates of SWP withdrawals, you can not only draw cash-flows for your regular need, you can also create wealth over long investment horizon.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st August 2023. Disclaimer: Past returns may or may be sustained in the future. This chart is purely for investor education. It should not be construed as investment recommendation. You should invest according to your risk appetite and investment needs

Things to keep in mind while planning your retirement with a SWP

- What are the Tax Implications of SWP? Capital gains tax is levied on mutual funds upon redemption. The taxes are subject to the holding period and the type of funds viz. equity or a non equity fund. An equity fund is one in which 65% is invested in domestic equities. The rest of the funds are called non-equity funds. The gains from redeemed equity funds that are held for a period of more than 12 months are called long-term capital gains and are taxed at 10% in excess of Rs 1 lakh p.a. The gains from redeemed equity funds held for less than 12 months are called short term capital gains and are taxed at 15%. For all investments made in debt funds after 1st April 2023, the tax levied on the redeemed amount depends on the investor’s slab rate. Please note that SWP follows the same tax implications as if funds are redeemed i.e. treated as capital gains or loss.

- How much should you withdraw from your SWP? You must plan your SWP withdrawal amount in such a way that your investment capital does not get depleted. As a thumb rule, you should not withdraw more than what could be the expected rate of return on the investments. Many financial advisors and mutual fund distributors recommend that annual SWP withdrawal should not exceed 6-8% of your initial investment corpus. So, if your corpus is Rs. 50 Lakhs, your total withdrawals for the year should be well within Rs. 3.50 Lakhs or so. Please note that this is a very general guidance; you should consult with your financial advisor or mutual fund distributor to plan your SWP. In conclusion, we can summarize that an SWP is a powerful tool for generating cash-flows from your accumulated savings, during the golden years of your life when you can no longer depend on regular cash flows from your earnings. Please consult your financial planner or mutual fund distributor to get the best guidance based on your exact requirements.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY