Should you invest in small cap funds when they are at a record high?

Current market context

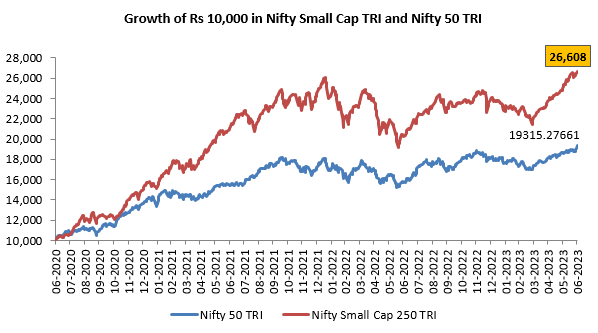

Small cap equity mutual funds have been a rage with retail investors over the past 3 months. The Nifty Small Cap 250 Index is at its record high. The small cap index has outperformed Nifty 50 by a big margin over the last 3 years (see the chart below) and has continued to outperform if we see recent returns e.g. last 1 month or last three months.

In each of the months of the first quarter of this financial (FY 2023-24), small cap funds attracted the largest net inflows among all actively managed equity mutual fund categories. In April, May and June 2023, small cap funds got net inflows of Rs 2,182 crores, Rs 3,282 crores and Rs 5,471 crores respectively. Small cap inflows constituted nearly 60% of net inflows of actively managed equity fund categories (source: AMFI monthly data, April, May and June 2023). In wake of these large inflows some small cap funds are declining fresh lump sum investments.

In this article, we will discuss whether you should continue to invest in small cap funds.

Source: National Stock Exchange, Advisorkhoj Research, as on 30th June 2023. Disclaimer: Past performance may or may not be sustained in the future

What are small cap funds?

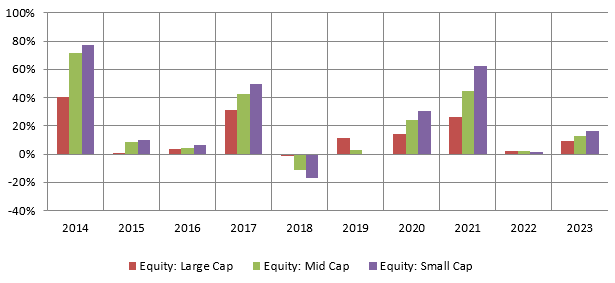

Stocks below the top 250 stocks by market capitalization are classified as small cap stocks. As per SEBI’s mandate, small cap funds must invest at least 65% of their assets in small cap stocks. Small cap stocks usually have high promoter ownership and relatively less ownership by institutional investors compared to large cap and midcap funds. The earnings growth potential of small cap stocks is higher than large and midcap funds. Furthermore, the price discovery of small caps is not as efficient as large caps. Also, the small cap universe with 250+ stocks is bigger than the universe of large caps and midcaps. Due to the above reasons, fund managers of small cap schemes have greater potential of generating higher returns compared to large and midcap funds (see the chart below). If we look at category returns over the past 10 years (see the chart below), you can see that small cap funds outperformed large cap and midcap funds in 7 out of 10 years.

Source: Advisorkhoj Research as on 30th June 2023. Disclaimer: Past performance may or may not be sustained in the future

Why are some small cap funds declining lump sum investments?

You should understand that in equity investments, price and earnings growth are not the only factors; liquidity is a very important factor. Before we discuss liquidity of small cap stocks, let us understand a concept known as free float shares and market cap. Free float shares of a company are the shares owned by the public. Public includes retail, HNI and institutional investors. Free float shares do not include shares owned by promoter, promoter’s family and related parties, management of the company and the Government. Free float market cap is the share price multiplied by the number of free float shares outstanding. In small cap stocks, the free float market cap is a small percentage of total market cap compared to large cap or even midcap stocks. A free float market cap indicates the liquidity of a stock.

What does this mean for small cap funds? If a fund wants to deploy a large amount in a small cap stock with low free float shares, it may drive the price of shares up because the supply of shares is limited. The fund may be forced to buy the shares at a much higher price than what it intended to pay for the shares, especially when share prices are already high. There can also be the problem of over-supply in a volatile market. Suppose there are large scale redemptions, the fund manager may not find enough buyers because the free float market cap is low. Then the fund manager will be faced with the undesirable consequence of having to sell some stocks at very low prices or forced to sell stocks which he / she may not want to sell. In both cases, the interests of investors who remain with the fund are harmed. That is why some small cap funds decline lump sum investments from time to time in certain market conditions.

However, you should not extrapolate this to all small cap funds. Some funds may decline lump sum investments because the fund manager may be sitting on large cash balances and does not see attractive investment opportunities at current levels / valuations without increasing concentration in a few stocks. On the other hand, fund managers of other small cap schemes may find attractive investments even at current levels for new investors and at the same time ensure diversification. You should consult with your mutual distributor to know which small cap funds are declining lump sum investments and which small cap funds are continuing to take lump sum investments.

Is this a good time to invest in small cap funds?

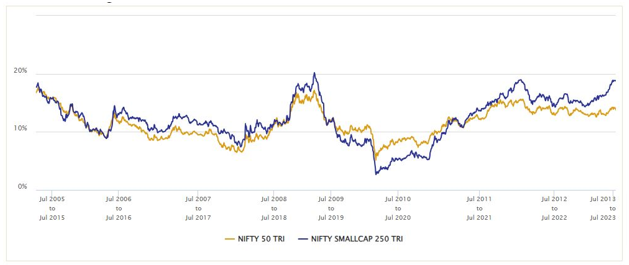

- The chart below shows the 10 year rolling returns of Nifty Small Cap 250 TRI versus Nifty 50 TRI since the inception of the small cap index. You can see that Nifty Small Cap 250 TRI was able to outperform Nifty 50 TRI over 10 years most of the time, irrespective of the market levels when the investment was made.

The chart below shows that if you have long investment tenures, you will have the potential of getting higher returns from your small cap funds, irrespective of the market level at which the investment is made. We have said several times in our blog that your investment tenure matters much more than market timing for your investment returns or wealth creation.

Source: Advisorkhoj Rolling Returns. Period: 01/04/2005 to 01/07/2023. Disclaimer: Past performance may or may not be sustained in the future

- Indian economy is in a structural up cycle which will come to the fore as global macroeconomic challenges recede over next few quarters. Corporate and bank balance sheets are now in the best possible shape to drive capex and credit respectively. The earnings growth / valuation expectation context is turning more and more favorable.

- Small caps are integral to the India growth story. Large cap stocks are concentrated in only a few industry sectors. Large cap stocks do not have a presence in many sectors. Sectors like chemicals, packaging, sugar and tea, ceramics and sanitary ware, hotels, logistics, construction, textiles, apparels, luxury goods, healthcare, application software are primarily in the small cap market cap segment. These sectors are likely beneficiaries of a number of policy reforms enacted by the Government and have a great potential in the consumption driven India growth story.

How to invest in small cap funds in these times?

- We have said several times in our blog that Systematic Investment Plan (SIP) is one of the best ways to invest in small cap funds. One advantage of SIPs in a volatile category like small cap is the benefit of Rupee Cost Averaging.

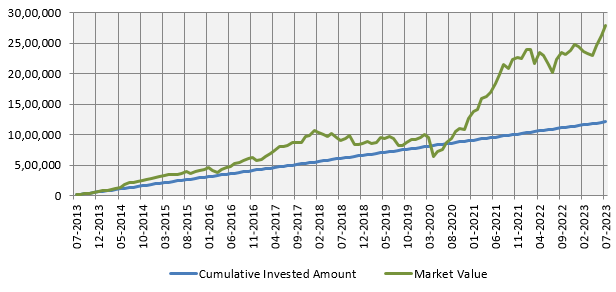

The chart below shows the growth of Rs 10,000 monthly SIP in Nifty Small Cap 250 TRI over the last 10 years. The SIP XIRR over this period was nearly 16%.

Source: National Stock Exchange, Advisorkhoj Research, as on 1st July 2023. Disclaimer: Past performance may or may not be sustained in the future

- Even though some small cap funds have declined new lump sum investments, you continue to invest in these funds or in other small cap funds through SIP.

- The market does not go up every day even in bull market. From time to time there are pullbacks, profit booking, etc. If you want to invest in lump sum, then you can take advantage of market dips to invest tactically at lower prices.

- If you want to invest a lump sum but do not have the time to follow the market on a daily basis, then you can invest using the Systematic Transfer Plan (STP) facility. In STP, you can invest in a low-risk fund e.g. liquid fund and transfer fixed amounts every week, month, etc. to your small cap funds.

- Whether you are investing a lump sum, doing an SIP or STP, you should always have long investment tenures (minimum 5+ years) for small cap funds.

- You should have a very high risk appetite for small cap funds. You should always invest according to your risk appetite.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY