Understanding the tax implications of your investments: Budget 2024

The Finance Minister announced some important taxation changes for both financial and non-financial assets in the Union Budget 2024. In her Budget speech, the Finance Minister said that the purpose of making these tax changes is “simplification and rationalisation of capital gains”.

In this article, we will discuss the changes in mutual fund capital gains taxation and tax implications of your mutual fund investments.

Mutual Fund Taxation

In mutual funds or any other financial asset, incidence of taxation arises when you receive some income (either in the form of dividends or interest) from your asset or when you make a profit (capital gains) by selling your asset. In Union Budget 2020, the Government abolished Dividend Distribution Tax (DDT) and made dividends taxable in the hands of the investor. In other words, dividends (IDCW) from mutual funds will be added to your income and taxed as per your income tax rate.

Capital Gains Taxation

You should know that capital gains are taxed, only when they are realized i.e. if you have sold your asset (e.g. units of mutual funds) at price higher than the purchase price. There is no taxation on unrealized capital gains.

Nature of capital gains

There are two types of capital gains for taxation purposes – short term capital gains and long-term capital gains. If you sell your mutual funds units within a specified period of time (holding period) then short-term capital gains (STCG) tax will apply. If your holding period is longer than the specified period, then long term capital gains (LTCG) tax will apply. The specified holding periods for short- and long-term capital gains differs for different fund categories.

Types of mutual funds for taxation purposes

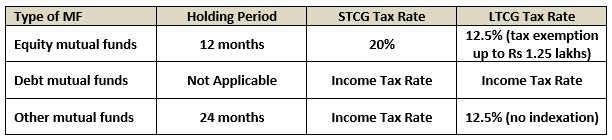

Union Budget 2024 has three clear types of mutual funds for taxation purposes: -

- Equity mutual funds – In these funds minimum equity holdings should be 65%. Example – equity funds (including ELSS), hybrid funds with more than 65% equity allocation (e.g. aggressive hybrid funds, equity savings funds, arbitrage funds etc), equity ETFs, equity index funds, FOF with minimum 90% allocation to equity ETFs, solutions-oriented funds (e.g. children’s fund, retirement funds with minimum 65% equity allocations) etc.

- Debt mutual funds – In these fund’s minimum debt or fixed income holdings should be 65%. Example – debt funds, hybrid funds with more than 65% debt allocation (e.g. conservative hybrid fund), target maturity funds etc.

- Other mutual funds – All mutual funds which do not fall in either of the two types of mutual funds mentioned above, will be in this category. Example – hybrid funds whose equity allocation is 35 – 65%, gold ETFs / FOFs, silver ETFs / FOFs, equity FOFs (with less than 90% allocation to equity ETFs), hybrid ETFs, international funds / ETFs etc.

There is no other type of mutual funds, as far as taxation is concerned. You should know the taxation category (e.g. equity, debt or other) for each scheme in your mutual fund portfolio. You should consult with your financial advisor or mutual fund distributor if you have any doubt about the taxation of your mutual fund investments and make informed investment decisions

What changes have been announced in Budget 2024?

- Certain types of mutual funds used to enjoy indexation benefits in long term capital gains taxation. Indexation benefits have been removed in Budget 2024, not only for mutual funds but for all asset classes except real estate.

- Short term capital gains tax rate for equity funds has been increased from 15% to 20%.

- Long term capital gains taxation exemption limit for equity funds increased from Rs 1 lakh to 1.25 lakhs. In other words, if your long-term capital gains in a financial year in an equity fund do not exceed Rs 1.25 lakhs, you will not have to pay long term capital gains tax.

- Long term capital gains tax rate for equity funds has been increased from 10% to 12.5%. The long-term capital gains tax will apply only on gains exceeding Rs 1.25 lakhs in a financial year.

- Specified long term capital holding period for “Other mutual funds” (refer to the section above) has been reduced from 3 years to 2 years.

- Long term capital gains tax rate for “Other mutual funds” (refer to the section above) will be flat 12.5% with no indexation benefits.

Summary – Capital Gains Taxation of Mutual Funds

Please note that this taxation will apply only on mutual fund units bought or sold after 22nd July 2024.

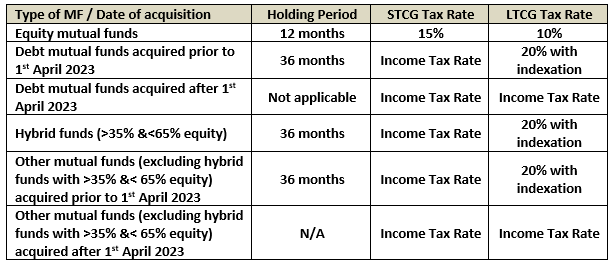

What tax rates would apply if you redeemed your mutual fund units between 1st April and 22nd July 2024?

You should consult your financial advisoror mutual fund distributor if you have any doubts on taxation of mutual fund units redeemed between 1st April 2024 and 22nd July 2024.

Grandfathering provisions will continue

Please note that the grandfathering provisions introduced in the budget of 2018 will continue. The grandfathering provisions provide that in case the listed shares or units of equity oriented schemes were acquired prior to 1st February 2018, the closing price in case of shares and Net Asset Value in case of units of equity oriented schemes on 31st January 2018 could be taken as your cost of acquisition for computation of capital gains.

Our take

Overall, the Budget has been positive for long term investors. The hike is LTCG tax rate for equities / equity mutual funds is obviously a disappointment, but the simplification and rationalization of taxation for different types of mutual funds is a welcome change. Even with the increased LTCG taxation for equities, it has the potential of generating higher post tax returns compared to traditional fixed income investments.

The impact of removal of indexation benefits will depend on your investment horizon. For shorter investment tenures, you will benefit from the lower rate of taxation (12.5% versus 20%), but over long-term indexation reduced the tax burden for investors.

Taxes are a reality of life, whether we like it or not. You should be aware of the tax implications of your investments and make informed decisions which will reduce your tax obligation in the long term. Always consult with your financial advisor or mutual fund distributoror the tax consultant if you need any help in understanding the tax implications of your investments and how to make tax efficient investments.

One-time KYC (Know Your Customer) is mandatory to invest in mutual funds. You can complete your eKYC here: https://invest.sundarammutual.com/. Investors must deal with/invest in only SEBI Registered Mutual Funds. Details are available at www.sebi.gov.in. Complaint Redressal: Investors can reach us on 1860 425 7237 or write to us at customerservices@sundarammutual.com. For escalation, write to grievanceredressal@sundarammutual.com or lodge your grievance with SEBI through their SCORES (SEBI Complaint Redressal System) Portal at https://scores.sebi.gov.in. If you are still not satisfied with the redressal from SEBI SCORES, you can further initiate dispute resolution through the ODR Portal at https://smartodr.in/login.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY