How rollover in tax saver mutual funds provide substantial benefit

The pursuit of perpetual motion machines obsessed many scientists and engineers in Europe for centuries since the middle ages. Some readers may think why we are taking about perpetual motion machines in a finance blog; we will come to it very shortly. Let us first discuss what a perpetual motion machine is. A perpetual motion machine is a device which can work without any input of energy. Think about it, the economic potential of a perpetual motion machine can be vast - automobiles could run without petrol or diesel, electricity could be generated without coal or gas, nations and its people can become prosperous.

But can such a machine ever be created? A lot of scientists came up with theoretical designs of the perpetual motion machine, but it did not work in practice because a perpetual motion machine violates one of the most fundamental laws of physics which states that, energy can neither be created nor destroyed – it only changes from one form to another.

However, a few months back, a friend forwarded me a US blog whose basic idea was that, tax saving investment rollovers worked like a perpetual machine for tax planning. However, just like perpetual motion machines are not possible in the real world, you will have to make initial investments and the wealth creation potential will depend on how much risk you are willing to take. However, the concept of tax saving investment rollovers is very simple to understand and easy to execute which can make it appealing to many investors reading this post. Before we get into tax saving investment rollovers, let us quickly recap the tax savings options under Section 80C of Income Tax Act 1961.

Tax Savings under Section 80C

Section 80C allows tax payers to claim tax deductions of up to Rs 1.5 lakhs from their taxable income by investing in certain eligible investment schemes; if you are in the highest tax bracket, you can get up to Rs 46,350 tax by investing in 80C investment schemes. The eligible investment schemes in Section 80C are Employee Provident Fund (EPF), Public Provident Fund (PPF), National Savings Certificates (NSC), 5 year tax saver bank fixed deposits, 5 year tax saver Post Office time deposits, Senior Citizens Savings Schemes (SCSS), Sukanya Samriddhi Yojana (SSY), life insurance premiums and tax saver mutual funds also known as ELSS or Equity Linked Savings Schemes (ELSS) etc. SCSS and SSY are relevant only specific to demographic profiles viz. senior citizens and girl children; the other 80C investments are available for wide sections of the taxpayer population.

We have discussed several times in our blog that, as per historical data, equity is the best performing asset class in the long term and why tax saver mutual fund or ELSS is the best tax saving option for wealth creation. Tax saver mutual fund is also the most tax friendly investment option. Maturity proceeds of many tax saving investments NSC, tax saver fixed deposits, SCSS etc are taxable as per the investor’s tax bracket, but capital gains (profits) and dividends paid by ELSS are totally tax free. ELSS is also the most liquid tax saving investment option. ELSS investments have a lock in period of only three years; other 80C investments have much longer lock in or maturity periods. In this blog we will discuss how ELSS rollovers can be used effectively for tax planning.

What is Rollover?

Rollover in investment parlance is re-investing the maturity proceeds of an instrument in the same instrument or similar instrument. Rollovers often have a specific purpose like tax saving, trading, locking interest rates etc. Some of our readers may not be familiar with the term “rollover”, but many readers will be familiar with the concept. Many readers will be familiar with the auto renewal feature of FDs;auto renewal is nothing but rollover.

Let us now discuss if tax saver mutual fund or ELSS rollovers can be beneficial for you.

Tax planning with tax saver mutual fund rollovers

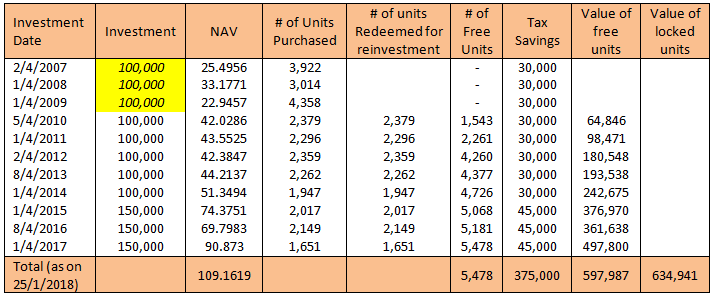

To understand tax saver mutual fund or ELSS rollovers let us walk through an example. Purely for the purpose of illustration we have selected Sundaram Diversified Equity fund - Growth, an ELSS Fund. Let us suppose you began your tax saving on April 1, 2007 by investing Rs 1 lakh in the said ELSS fund. Next year, you again invest Rs 1 lakh in the ELSS for FY 2009 / AY 2010 tax saving. Similarly in 2009, you invest Rs 1 lakh in the ELSS for FY 2010 / AY 2011 tax saving. Remember each investment will be locked in for 3 years from the respective investment dates. For purpose of this analysis, let us assume that you are in the highest (30%) tax bracket.

Now, suppose you are in 2010 – let the fun begin. Your 2007 investment is no longer locked now or in other words, it is free. The NAV of Sundaram Diversified Equity fund – Growth on April 2, 2007 was Rs 25.49, while that in April 5, 2010 was Rs 42.03. This means you can fund your tax saving investment for 2010, from your 2007 ELSS investment. All you need to do is redeem the required number of units (at prevailing NAV) and reinvest it again for tax savings benefits. In 2011, your 2008 ELSS investment is free. You also have the free un-redeemed units from your 2007 investment. You redeem the required number of units (at prevailing) and re-invest for tax savings. This can go on and on, unless you have a severe bear market which wipes out 3 – 4 years of gains (this rollover worked despite the severe correction in 2008). The table below shows how this rollover worked.

Source: NAV data from Advisorkhoj Research

There are several interesting observations in this example. Firstly, the actual cash-outflow for you was only Rs 3 lakhs (marked in yellow). Using this rollover strategy you would have made tax savings of Rs 3.75 Lakhs. You can observe that, from 2015 onwards you were making investments of Rs 1.5 lakhs every year because the 80C limit was increased from Rs 1 lakh to Rs 1.5 lakhs in 2014 NDA Budget, but you did not need to bring extra money from your bank to avail increment tax savings. Capital gains from your tax saver mutual fund were able to fund the additional tax savings.

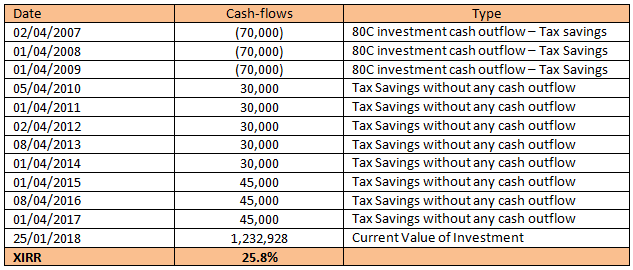

Let us now discuss how much wealth you created. The current value of your investments is Rs 12.32 lakhs. The test of any good investment strategy is how much internal rate of return (XIRR) it is able to generate. The XIRR of this investment including the tax savings is 25.8%. Please see the table below for XIRR calculations.

Rs 5.97 lakhs of your investment value is highly liquid; you can redeem it any time. Rs 6.34 lakhs is locked in, but a portion of it will be free in April. You can see that, the initial investment (over the first three years) and the ELSS returns thereof funded your tax savings over the next 7 years. You can also see that, you had fairly good liquidity using this strategy from around 2011 onwards, should you have needed it for any purpose. Finally, you were able to create substantial wealth using this strategy.

Why is tax saver mutual fund ideal for rollover?

This strategy can theoretically work for any 80C investment but tax saver mutual fund or ELSS is ideal because of several reasons.

- Initial investment required for this rollover is lowest with ELSS. ELSS has shortest lock-in / maturity period among all 80C investment options. For other 80C investment options you had to invest for at least 5 years, but with ELSS you had to invest for only 3 years.

- Tax free status of ELSS returns ensures that, there is no incidence of taxation when you redeem units for re-investment. Interest paid by NSC, tax saver FDs etc is taxable.

- Tax saver mutual fund or ELSS has the potential to give higher returns. In the long term, the wealth creation through ELSS rollovers is likely to be substantially higher because of superior asset returns and the power of compounding

Conclusion

In this blog post, we discussed how you can use tax saver mutual fund or ELSS roll-overs for tax planning and its several benefits. Investors depending on their personal financial situation and individual preferences may find rollovers useful for tax saving. This strategy is simple and very easy to execute. Investors may want to discuss whether to use rollovers for their tax planning with their financial advisors.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY