Investing in short term versus long term debt fund: Part 2

In the first part of our two part blog post, How you should invest in debt mutual funds: Short term versus long term, we discussed the basic difference between short term and long term debt funds. We also discussed how these two types debt funds performed in 2017. We also clarified some misconceptions regarding short term and long term debt funds. In this part, we will discuss the difference between short term and long term debt funds in greater details. We will discuss how investors should choose short term and long term debt funds based on their investment needs.

In part 1, fixed income or debt investors get returns from two sources:-

- Interest paid by the bond (or NCD). Higher interest rate results in higher income for the investors. Please note that, though interest rate is quoted on face value, the yield (return) to the investor can be different because the investor may buy the bond at a price which is either higher or lower than the face value.

- Price appreciation of the bond. Price of a bond is inversely related to interest rates. Rise in interest rates will cause prices to decline (debt fund returns will be lower) and fall in interest rates will cause prices to appreciate (debt fund returns will be higher)

Bond yield and maturity

Let us now understand which bonds will give higher yields by understanding the concept of term structure of interest rates. Term structure of interest rates is the relationship of interest rates with bond maturity (term). The term structure of interest rates is usually upward sloping, which implies that long maturity bonds pay higher interest rates than short maturity bonds. This is because the value of money diminishes over time due to inflation. Bonds pay interest (usually twice a year) through the bond tenure and the face value on maturity. The time value of money of the face value payment will be lower for longer maturity bonds compared to shorter maturity bonds. Therefore, investors will want longer maturity bonds to pay higher interest rate to compensate for the lower time value of maturity payment.

India Yield Curve

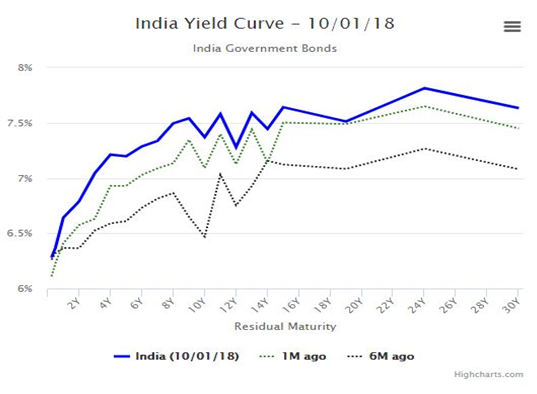

Term structure of interest rate is commonly known as yield curve. As discussed in the previous paragraph the yield curve is usually upward sloping (yield curves can also be inverted but it is a rare occurrence and outside the scope of this post). However, the shape or level of the yield curve can change depending on macro-economic and debt market developments. Let us now discuss the actual yield curve of India Government bonds as on January 10, 2018.

Source: worldgovernmentbonds.com

The horizontal axis of the chart represents bond maturities while the vertical axis represents yields. If investors understand yield curve well, they can make better investment decisions. You can see in the chart above that the yield curve is upward sloping – long term bonds give higher yields compared to short term yields.

You can see that, the yield of the 10 year bond is almost 70 – 80 bps higher than yield of 2 year bond. So, over two year investment tenure, the 10 year bond will give 0.7 to 0.8% higher returns, provided the yield curve does not change. In reality the yield curve changes over time due to macro-economic and debt market developments. If yield curve sees a parallel shift upwards, then the price of both the 2 year bond and 10 year bond will fall, but the price decline of the 10 year bond will be much more than that of the 2 year bond (due the higher interest rate sensitivity of the longer maturity bond). On the other hand, if the yield curve sees a parallel shift downwards, then price appreciation of the 10 year bond will be much higher than that of the 2 year.

Risk Return trade-offs in the yield curve

It is difficult to predict whether the yields will be higher or lower. Therefore, investors should look at the risk return trade-off. What is risk return trade off? Risk return trade-off is the profit of the investor when price rises (yields fall) versus loss of the investor when price falls (yield rises). If the profit of the investor when yield rises is significantly higher than loss of the investor when yields fall, then risk return trade-off is favorable.

In the case of short maturity versus long maturity bonds, the difference in yields between the long and short maturity bonds will result in the risk return trade-off; if the difference in yields is high then risk return trade-off is good and vice versa.

The dotted lines on the chart show the yield curves of 6 months and 1 month back. You can see that, six months back the difference between the 2 year and 10 year bond yields was not too much; on the other hand the price risk of the 10 year bond was much higher. Purely based on the yield curve 6 months back, it would have made sense to invest in short term debt funds (which invest in the nearer parts of the yield curve) versus long term debt funds (which invest in the farther parts of the yield curve). It should therefore not have been a surprise that in 2017, short term debt funds would give significantly better returns than long term debt funds (short term debt funds gave 5.8% returns versus 3.9% given by long term debt funds).

You can further observe that, the risk return trade-off is different in different parts of the yield curve. Observe that the yield of the 8 year maturity bond is higher or same than the yield of the bonds with 10 to 20 year maturities, while the risk of the 10 to 20 year maturity bonds are much higher than 8 year maturity. So if you decide to invest in long maturity bonds, it is better to invest in bonds which have maturity of 7 – 8 years.

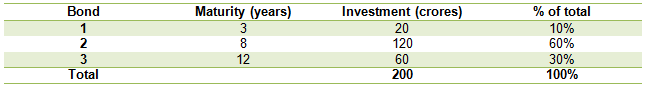

So far we have discussed maturity of a bond, but what is the maturity of a debt fund? Let us take a hypothetical example. Suppose a fund has following investments in 3 bonds.

The average maturity of the debt fund = 3 X 10% + 8 X 60% +12 X 30% = 8.94 years

You can find the average maturity of a debt fund in the factsheet. The fund manager usually will invest in the yield curve where expected returns are the best. However, as an informed investor, you should also know the maturity of the debt fund before investing to understand the risk return characteristics.

Tenure of investment

So far, we have discussed how you can use the yield curve to make debt fund investment decisions. However, the tenure of your investment should be a very important factor in decision. If you have short investment tenure, say 1 to 2 years, then you should invest only in short term debt funds because the duration (price sensitivity with respect to interest rates) of a long term debt fund can make it very risky. If you have 3 year plus investment horizon, then you can invest in long term debt funds but you cannot be assured that long term debt funds will give better returns than short term debt funds even over a three year period.

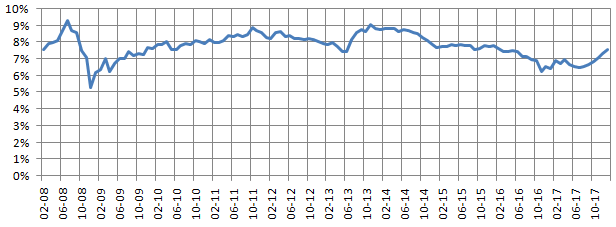

Many investment bloggers argue that, over a three year period we have periods of both rising and falling interest rates –therefore, long term debt funds give good returns over 3 year investment tenure. While this logic sounds good in theory, historical data suggests that, bond yields can keep rising for a long period of time. The chart below shows the 10 year Government Bond yield over the last 10 years.

Source: in.investing.com

You can see that bond yields were rising from 2009 to 2012. During that period long term debt mutual funds gave average annualized category returns of only 3 to 4%. At the same time, over certain 3 year periods long term debt mutual funds gave double digit returns also. Therefore, along with long investment tenures, investors also need high risk appetites for long term debt mutual funds.

If you do not have sufficiently high risk appetite, then you are better off investing in short term debt mutual funds for both short and long investment tenures. If you want both income and capital appreciation from debt mutual funds over a long investment horizon, then you can invest in a mix of short term debt mutual funds and long term debt mutual funds – short term debt mutual funds can provide stable returns, while long term debt mutual funds can provide a kicker in favorable rate scenarios.

Conclusion

The objective of this two part post was to discuss how short term and long term debt mutual funds work in relation to yield curve. We hope that this post helped you to improve your understanding of the risk return characteristics of these two types of debt mutual funds and make better investment decisions in accordance to your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY