Which return to use for selecting mutual funds: Part 1

Mutual funds are increasingly becoming popular among Indian retail investors. As per AMFI data assets under management in the mutual fund industry grew by more than 30% from September 2016 to September 2017. What is also very encouraging is that investors are taking a lot of interest in learning more about mutual funds. The traffic statistics on our website (advisorkhoj.com) shows that a lot of our visitors go to our Mutual Fund Research section every day; we get on an average around 12,000 visitors daily to our website, of which a large percentage use our different research tools every day. This is a very encouraging development because this shows the growing maturity of Indian investors. In Advisorkhoj, we believe that good research is the foundation of successful investment decisions.

The one metric which almost all mutual fund investors and financial advisors look at before selecting mutual funds is returns. However, if you go to a mutual fund research website, whether advisorkhoj.com or any other, you are likely to find different types of returns, e.g. last 1 year returns, 3 year returns, 5 years, returns since inception, annual returns, point to point returns, SIP returns, rolling returns etc; some investors may find these returns a little confusing.

In this blog post, we will discuss different types of mutual fund returns, so that investors have a clear idea of what these different returns are and which ones should they use for their investment decisions. Purely the purpose of illustration, we will use returns of Sundaram Select Midcap Fund, to explain different concepts.

Absolute Returns

Absolute return is the most important return measure from an investor’s perspective, but you will not find absolute return on any mutual fund website. Absolute return is the profit made by you over the tenure of your investment. Suppose you invested Rs 1 lakh in a mutual fund scheme on April 1, 2007. The value of your investment is now Rs 5 lakh. Your absolute return is therefore Rs 4 lakh. This is the most important return for any investor because ultimately an investor cares only about the money he or she has accumulated or will accumulate in his or her mutual fund investment. However, absolute return is something that you will know only after you have invested and some time has elapsed.

Annualized Returns

Annualized return is the compounded annual growth rate (CAGR) of your investment. It is a very useful metric because it can be used to compare with other investments. Sometime back during a friends gathering, one of my college friends told us that his relative bought an apartment for Rs 60 lakhs and sold it 10 years later at Rs 1.6 Crores (making a profit of Rs 1 Crore). Initially it seemed to us that this relative made a great investment. But one of my friends who quickly did some calculations on his phone calculator whispered in my ear that this friend’s relative got only around 10% annualized returns.

Top performing diversified equity mutual funds over the last 10 years gave more than 15% annualized returns; midcap funds gave even higher returns. You can see that, absolute returns can be misleading for comparison purposes. Annualized return is the more relevant measure.

Trailing Returns

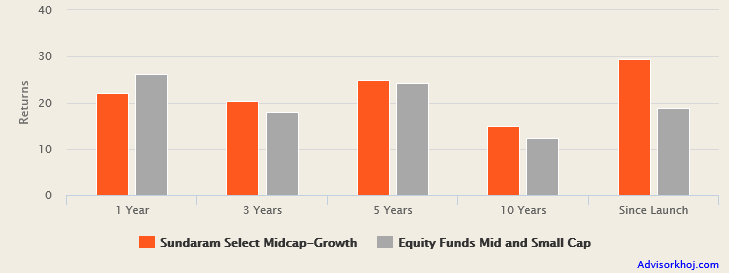

This is the most popular return metric used in the mutual fund industry. The returns that you are likely to find on most research websites (e.g. 1 year returns, 3 year returns, 5 year returns, 10 year returns etc) and mutual fund factsheets are trailing returns. Trailing returns are annualized returns over the trailing period ending today or the last Net Asset Value (NAV) date. For example, 1 year trailing return as on today (November 8, 2017) is the return of the mutual scheme from November 8, 2016 to November 8, 2017. The 3 year trailing return as on today (November 8, 2017) is the return of the mutual scheme from November 8, 2014 to November 8, 2017. The 5 year trailing return as on today (November 8, 2017) is the return of the mutual scheme from November 8, 2012 to November 8 2017, so on so forth. The chart below shows the trailing returns of Sundaram Select Midcap Fund from our Advisorkhoj.com website.

Source: Advisorkhoj Fund Research

Trailing returns by itself can be a useful metric, but it is more useful as a relative metric. Some research websites show trailing returns versus benchmark, while others show trailing returns versus the product category. In Advisorkhoj.com, we like to show trailing returns versus category because a mutual fund scheme portfolio can diverge significantly from the benchmark and more importantly, the investor has the choice of selecting from a large number of schemes offered by different AMCs. A category based on scheme portfolio is often more reflective of the risk / return characteristics compared to the scheme benchmark. In the above chart, you can see that, Sundaram Select Midcap Fund outperformed the Midcap funds category over most time-scales.

The biggest advantage of trailing returns is that it is easy to understand. You can see the performance of a scheme over different time-scales in one chart or table. Many investors and financial advisors use 1 year trailing returns in their investment decisions because it tells them, how the fund is performing now. However, 1 year trailing return may not be truly reflective of a scheme’s performance potential because it is a very short time period to evaluate a fund manager’s ability to deliver superior risk adjusted returns.

A 3 year or 5 year trailing returns time-scale is more suitable to evaluate a fund manager’s performance relative to peer funds. Many mutual fund blogs talk about 10 years, 15 years and 20 years returns of a scheme from a wealth creation perspective. Returns over a long time horizon (like 10 or 20 years) can make for a great wealth creation story to encourage investors to invest in equity mutual funds, but 10 years or 20 years returns are not very relevant because many things change over such a long time period. For example, a fund manager of a scheme could change in 10 years, the investment strategy could have evolved over such a long period and the Indian stock market itself would have evolved in terms of maturity and efficiency over a 10 or 20 years period.

In Advisorkhoj’s view 3 to 5 years annualized trailing returns relative to other schemes is probably the most important among all trailing returns measures. But even 3 to 5 year trailing returns are not without their drawbacks.

Trailing returns have a recency bias; in other words, trailing returns are heavily influenced by current market conditions. If the stock market is rallying, trailing returns are likely to be good (for good funds), while in bear markets the trailing returns are likely to be depressed. Therefore, in our view, trailing returns should not be taken as an indicator for future returns. Trailing returns should be used as relative measure to see outperformance versus peer funds or the category over the same time period.

Different fund managers have different investment styles. Some fund managers adopt the growth style of investing. In this style, fund managers look for stocks which can deliver high EPS (earnings per share growth) over the next 12 to 24 months or may be slightly longer. These funds can deliver good returns in a shorter timeframe, but may be more volatile than others in bear markets. Some fund managers prefer value style of investing, where they focus on stocks which are trading at considerable discounts to their fair value. These stocks can remain depressed for long periods, but they can give superlative returns in the long term, when the value of these stocks is recognized by the market. Another category of fund managers may follow the Growth at a Reasonable Price (GARP) style of investing, which is somewhere between growth and value investing.

All three investment styles have created wealth for investors and we, in Advisorkhoj, do not want to cast our vote in favour of any particular style, but it is important for investors to note that the trailing returns of a scheme will also depend on the investment style of the fund manager relative to prevailing market conditions. It is therefore, important for investors to get a sense of style of the fund manager. You can get a sense of the investment style of a scheme’s fund manager from the product literature of the scheme on the Asset Management Company’s website.

Point to Point Returns

Point to point return is the profit generated by a mutual fund scheme between two specific dates. Point to point return is an important metric because it lets you analyze a mutual scheme’s performance in different market conditions. For example, let us look at Sundaram Select Midcap Fund’s performance from April 1, 2011 to April 1, 2017. We will use Advisorkhoj Point to Point Returns Calculator.

The point to point dates are important because it can tell you how a scheme performs in different market conditions. For instance the point to point dates chosen by us in this example, covers a long period and includes two bear market period. You can see that the scheme gave 20% annualized returns over this period despite two bear markets. You can also select a period from the beginning of one bear market to the end of another bear market, for example Mar 1, 2011 to Mar 1, 2016. Let us see the results using Advisorkhoj Point to Point Returns Calculator.

Point to point returns is useful to analyze scheme performances in different market conditions.

Conclusion

When you are investing in mutual funds, you are essentially investing in the mandate of a scheme and the fund manager’s ability to deliver superior risk adjusted returns. As an investor, you will be concerned with absolute returns, but you will have to select mutual fund schemes based on other returns parameters because absolute return is post facto. In this post, we discussed about trailing returns, the most popular measure of mutual fund performance, but not necessarily, the most effective one. In the next part of our blog post, we will discuss some other returns metrics which may be more useful than trailing returns. Please stay tuned.....

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY