Rolling down SDLs are good long term fixed income investment solutions

Mar 29, 2021 / Dwaipayan BoseDebt mutual funds offer investors a variety of solutions for different types of risk profiles and investment needs. Investors usually have three considerations when investing in debt funds viz. low risk, higher returns compared to traditional investments and visibility of returns. In this blog post, we will discuss "rolling down SDL", a good investment...Read More

We have discussed a number of times in our blog that Systematic Investment Plans is the ideal way of investing for your long term goals. An important factor in wealth creation is investment tenure due to power of compoundingover time. Longer your investment tenure, greater is the effect of compounding. Mutual fund SIPs enable you to...Read More

After crashing to 7,500 levels during March meltdown due to COVID-19, Nifty recovered to its previous high earlier this month and now is trading at its all-time high near 12,800 levels. Investors who did not panic and sell in March / April must now be sitting pretty and investors who used the March correction to tactically invest in equity would have...Read More

Want to invest in SmallCap Mutual Funds: Consider Nifty Small Cap 250 Index

Oct 1, 2020 / Dwaipayan BoseAccording to SEBI, stocks whose market Capitalizations are smaller than the 250th company by market Cap are classified as SmallCap stocks. SmallCap companies tend to be newer companies or emerging companies which have not yet reached the scale of operations associated with Mid Cap companies. These companies can be in sectors...Read More

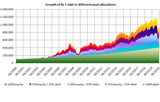

Importance of portfolio diversification

Jun 30, 2020 / Dwaipayan BoseRisk diversification in investment parlance is essentially an application of the age old idiom, “Do not put all your eggs in one basket”. Prices of different assets rise or fall depending upon market and economic conditions. If you spread your investment over different assets, your risk of making a loss reduces compared to investing in a single...Read More

Investors, who do not want to expose a portion of their wealth to vagaries of equity markets, invest in fixed income instruments like bank deposits and debt mutual funds. Debt mutual funds have become increasingly popular with retail investors and HNIs over the last 10 years. Potential of superior returns across different risk...Read More

Spread of Coronavirus pandemic across the world has sent stock markets around the world in a free fall. From its all time high of nearly 42,000 in mid January, the Sensex broke below 26,000 levels towards the end of March 2020. Over the last 2 – 3 weeks we saw a good recovery in the market and the Sensex is now trading above the...Read More

The outbreak of Coronavirus pandemic over the last 2 months or so has sent shockwaves through financial markets across the world. The pandemic has rapidly spread outside China over the last one month and infections have multiplied in many countries including India. Stock markets in major economies have cracked with Dow...Read More

How to get the most from your mutual fund SIPs

Feb 25, 2020 / Dwaipayan BoseOne of the most encouraging trends of investor maturity in India is the increasing popularity of SIPs in India. As per AMFI data, there are more than 3 Crore SIP accounts as on January 2020. More than 1 crore SIP accounts were added in FY 2018-19 and a higher number is expected to be added in this financial year. Rs 8,532 Crores were...Read More

Nippon India Nivesh Lakshya Fund: A good investment for your long term goals

Feb 24, 2020 / Dwaipayan BoseBank Fixed Deposits have been the traditional long term investment choice of average Indian households. As per Reserve Bank of India’s annual statistical publication on financial assets and liabilities of Indian households, bank FDs account for nearly 50% of average household savings with life insurance policies a distant second...Read More

7th floor South wing & 5th floor North wing, Near Prabhat Colony,

Prabhat Colony Rd, Sen Nagar, Santacruz East,

Mumbai, Maharashtra, India 400055

Toll Free Number : 1860 266 0111

Email: customer_care@reliancemutual.com

| Location | No of Distributors |

|---|---|

| Mumbai | 1417 |

| Kolkata | 876 |

| Bangalore | 489 |

| Chennai | 463 |

| Delhi | 441 |

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.