Importance of portfolio diversification

Risk diversification in investment parlance is essentially an application of the age old idiom, “Do not put all your eggs in one basket”. Prices of different assets rise or fall depending upon market and economic conditions. If you spread your investment over different assets, your risk of making a loss reduces compared to investing in a single asset.

You must read: Importance of diversification in financial planning

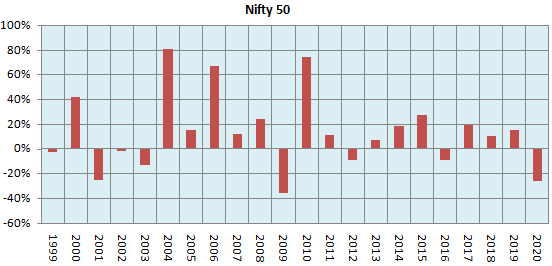

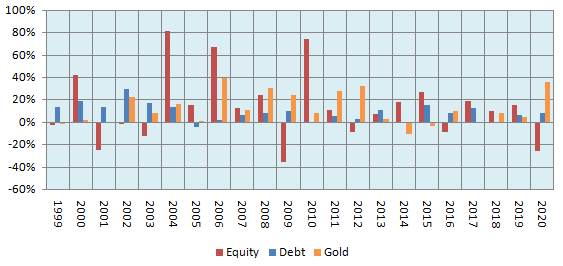

The chart below shows the returns of Nifty 50 in each fiscal year over the last 20 years. You can see that Nifty returns have been quite volatile. If you redeemed your investment in the years Nifty fell sharply, you would have seen considerable reduction in your investment value.

Source: National Stock Exchange, years are fiscal years (Apr – Mar)

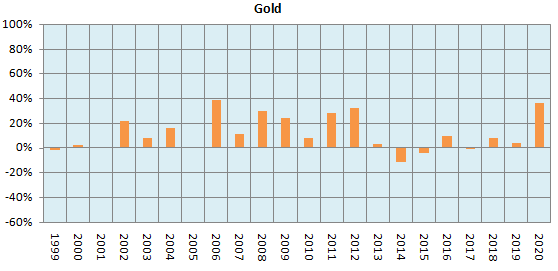

Many investors think gold is a safe asset class. Gold is much less volatile than equity but gold can underperform for long periods (please see the chart below). You can see that gold gave lower returns than even fixed income in the period from 1999 to 2001 and again in the period of 2013 to 2018.

Source: Advisorkhoj Research, years are fiscal years (Apr – Mar)

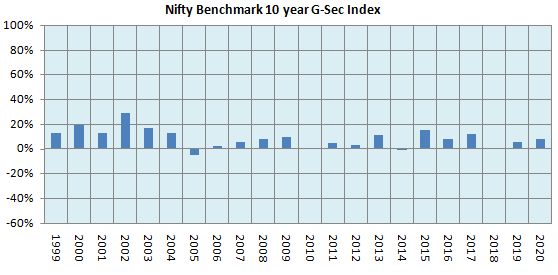

Finally let us come to fixed income. Fixed income is certainly less volatile than equity and gold, but fixed income returns also fluctuates depending on prevailing interest rate and economic scenarios. The chart below shows the returns of Nifty Benchmark 10 year G-Sec Index. You can see that the probability of making a loss is lowest in the fixed income. At the same time you can see that over most periods fixed income underperformed equity and gold.

Source: National Stock Exchange, years are fiscal years (Apr – Mar)

Diversifying across asset classes

Asset classes have low or negative correlation in their price movements. This means that when price of one asset class is falling, price of another asset class may be rising and vice versa. For example, equity outperformed gold from 2000 to 2008, but gold outperformed equity from 2008 to 2012. Equity is once again outperformed gold over the next 5 - 6 years or so, but has underperformed in the last 2 years or so.

Source: Advisorkhoj Research

Since different asset classes outperformed or underperformed each in different periods, you can reduce your portfolio volatility considerably by spreading your investments over different asset classes.

Asset Allocation and volatility

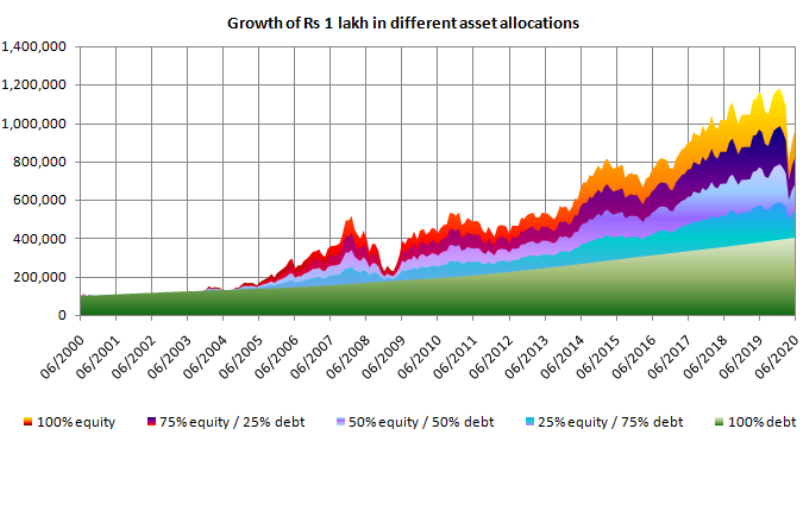

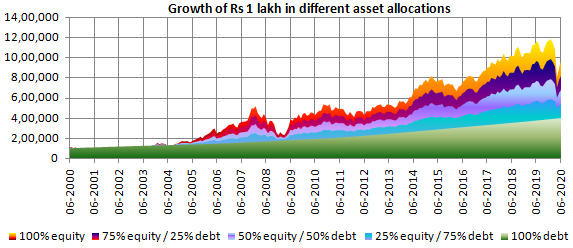

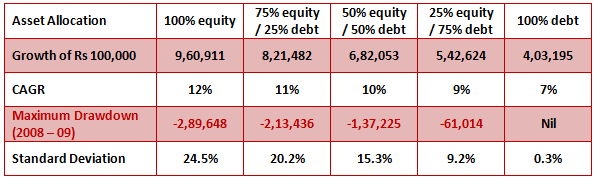

Asset allocation balances risk and returns to reduce portfolio while generating sufficient returns to meet your financial goals. In the chart below we have shown the growth of Rs 1 lakh investment in different asset allocation in the last 20 years (ending 1st June 2020). Here we have used Nifty 50 TRI as the proxy for equity and 1 year bank Fixed Deposit (renewed yearly) as proxy for debt.

Source: Advisorkhoj Research

Risk and return are directly related. You can see that the higher asset allocation to equity gave highest returns in the last 20 years, but also suffered larger drawdowns. While higher risks need to be taken to get higher returns, the appropriate asset allocation balances risk and return to meet your financial objectives.

Source: Advisorkhoj Research

Invest according to your risk appetite

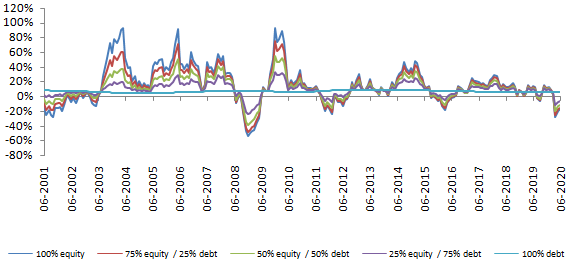

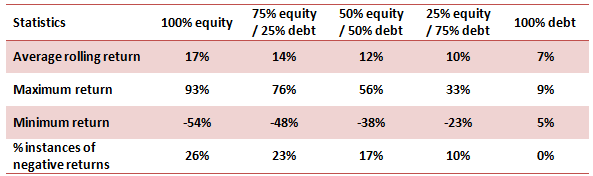

We calculated the 1 year rolling returns (rolled monthly) of portfolio with different equity and debt asset allocations. Please see the chart below.

Source: Advisorkhoj Research

The table below shows the different rolling return statistics of the five different asset allocations. You can see that asset allocation reduces your risk of making a loss considerably. You can also see that through the right asset allocation you can reduce risk considerably and still have the potential of getting good inflation adjusted returns compared to traditional fixed income investments. You should invest according to your risk appetite.

Source: Advisorkhoj Research

Mutual funds for diversification

Hybrid mutual funds can also help you diversify across different asset classes. Some hybrid funds have a higher exposure to equity, while some have higher exposure to fixed income and arbitrage strategies. You should select the appropriate fund based on your risk appetite. Apart from diversifying across asset classes, mutual funds also provides diversification of unsystematic risk. Unsystematic risk refers to the risk related to a single stock. By investing in a portfolio of stocks across different industry sectors, mutual funds reduce unsystematic risk considerably. Similarly debt mutual funds reduce credit risk related to single issuers by investing in bonds of a sufficiently large number of issuers.

Suggested reading: How to get better returns from your mutual fund portfolio

Conclusion

We have long term, medium term and short term goals in life. Different asset types are suitable for different investment tenures and objectives.

- Equity and gold are suitable for long term goals.

- A mix of hybrid and debt funds may be suitable for medium term goals.

- For short term goals, you should invest only in fixed income. You may like to read how can debt funds be used in preserving long term wealth

- You should create a diversified portfolio comprising of different asset classes and sub-classes to your different financial goals without compromising any goal.

- Most importantly, you should always invest according to your risk appetite and stick to your financial plan irrespective of market conditions.

You should consult a financial advisor if need help in understanding your risk appetite and asset allocation.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY