How can Debt Mutual Funds be used in preserving long term wealth

Investors, who do not want to expose a portion of their wealth to vagaries of equity markets, invest in fixed income instruments like bank deposits and debt mutual funds. Debt mutual funds have become increasingly popular with retail investors and HNIs over the last 10 years. Potential of superior returns across different risk categories and tax advantage of debt funds over bank deposits has considerable appeal for many investors.

Challenges in the current environment

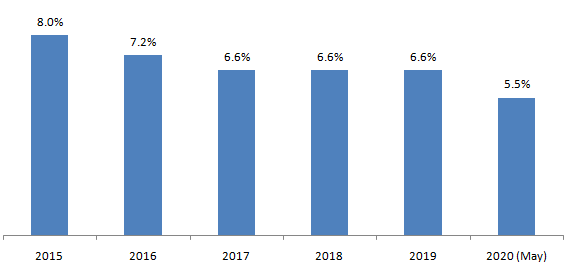

Bank interest rates have been steadily declining over the last 4 to 5 yearsas the RBI embarked on an accommodative policy to boost economic growth particularly over the last couple of years. Last week a major PSU banks cut its 1 to 3 year FD rates to 5.5%. On a post-tax basis, return on FD investment will be unacceptable to many investors since it will struggle to bear inflation. Interest rates are likely to fall further since economic growth has stalled due to lockdown in response to COVID-19 pandemic.

Source: Advisorkhoj Research

Debt mutual funds, which were good alternative fixed income investment options, have had their share of challenges over the last 18 to 24 months. These challenges were related to credit risk. A severe liquidity crisis in Non-Banking Financial Companies (NBFCs) led to series of credit rating downgrades and delay or default in payment by the issuers. This impacted the returns of the several debt funds. The onset of COVID-19 pandemic led to parts of corporate bond markets frozen up (turning illiquid) leading to unfortunate consequences for the investors of some debt funds.

Where to invest in order to preserve long term capital and earn returns?

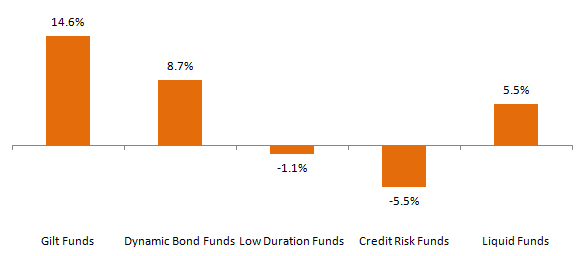

With interest rates of bank deposits declining significantly, we think that debt mutual funds continue to be good fixed income investment options if you can avoid credit risks. The chart below shows the last 1 year average returns of various debt fund categories.

You can see that negative returns were due to credit risks. On the other hand, Gilt funds which invest in Government securities gave excellent returns.

Source: Advisorkhoj Research

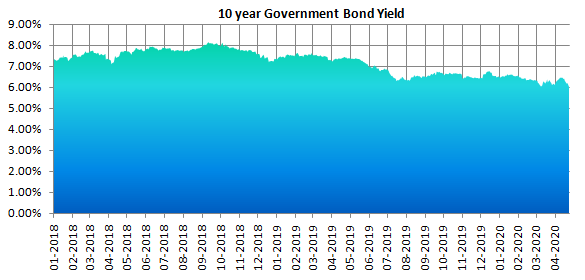

Interest rate outlook

In the current economic situation, debt funds with long duration profiles are expected to outperform as interest rates are likely to lower further. The RBI has reduced repo rate by 115 basis points since the beginning of COVID-19 outbreak, including a 40 bps rate cut in last monetary policy review in May. Even though repo rates are at historic low, the RBI Governor has hinted at further rate cuts if inflation eases. Even though bond yields have come down over the last 2 years, yields are still relatively high with a lot of scope of decline in coming months and years.

Source: Investing.com

Interest rate risk

Government Securities or Gilts have no credit risk because they have the sovereign guarantee of the Government. As such they are best fixed income investment options if you want to avoid credit risks. However, gilt funds have interest rate risks. Longer the duration of a fixed income security, higher is the interest rate risk. The average maturity of Gilt funds category is around 8.4 years. Therefore, these schemes have considerable interest rate risks. In a favourable interest rate environment, such as the current one, the long duration of these schemes will lead to higher returns / capital appreciation. However, in unfavourable interest rate environment, rising yields will hurt the returns of these schemes.

How can you avoid credit risks and also reduce interest risk over your investment tenure?

Maturity roll down

If you invest in a fixed income security and hold it till maturity, interest rate risk will reduce over time to practically zero (at the time of maturity).

How? Suppose you invest in a G-Sec which matures in 10 years. After 3 years, the residual maturity of the instrument will be 7 years. Since the duration of the instrument declines over time, the interest rate risk reduces. With maturity roll-down the risk of the investment will reduce over your investment tenure.

How is this different from usual debt fund duration strategy?

If you see a time series of duration profiles, you will see that most schemes except dynamic bond funds try to maintain duration at a constant level or within a certain range e.g. a long duration scheme may maintain duration between 7 – 8 years across all the years, a short duration scheme may maintain duration between 2 – 3 years across all the years etc. However a scheme which will rolls down maturity will bring duration down (reduce risk) over the investment tenure i.e. fresh investments will be made in similar securities so that the duration reduces over the investment tenure.

Benefits of investing in a scheme which rolls G-Secs

- No credit risk

- No interest rate risk over the long term investment tenure (though NAVs may be volatile in the interim)

- Capital appreciation because interest rates are likely to come down in the future.

Summary

In these difficult times, capital preservation is the uppermost concern for many investors. However investors also seek to get inflation beating returns on their investments. Debt funds, which were usual investment options for investors seeking superior inflation adjusted post tax returns, have come under cloud due to credit risks.

In this post, we have discussed an investment strategy which seeks to preserves your capital by investing in Government Securities (no credit risk). At the same it also protects your investment from interest rate risk over a long investment horizon, by rolling down the maturity of the underlying instruments.

Since interest rates are likely to come down, you will also get benefit of potential capital appreciation. Finally over long investment tenures (longer than 3 years) you will also be able to avail the long term capital gains tax advantage (indexation benefits) of debt funds. You should consult with your financial advisor about debt schemes which rolls down G-Secs for your preserving your long term wealth and also get superior inflation adjusted returns.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY