Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

Current Market Context

Equity market had a rough start in Calendar Year (CY 2025). The Nifty 50 has plunged more than 15% (as on 28th February 2025) from its all-time high due to heavy Foreign Institutional Investors (FIIs) selling. The market was correcting in the last 2 months of CY 2024 on concerns about INR Depreciation versus the USD and corporate earnings growth outlook. Selling has intensified in January and February 2025 due to the concerns about the impact of trade policies of the Trump Administration on India’s economy. Due to the selling pressure from FIIs, large caps saw sharper declines compared to mid and small caps in November and December CY 2024. However, in the last January and February (CY 2025), the midcaps (14.4% correction) and small caps (20.7% correction) experienced deeper cuts than large caps (6.5% correction).

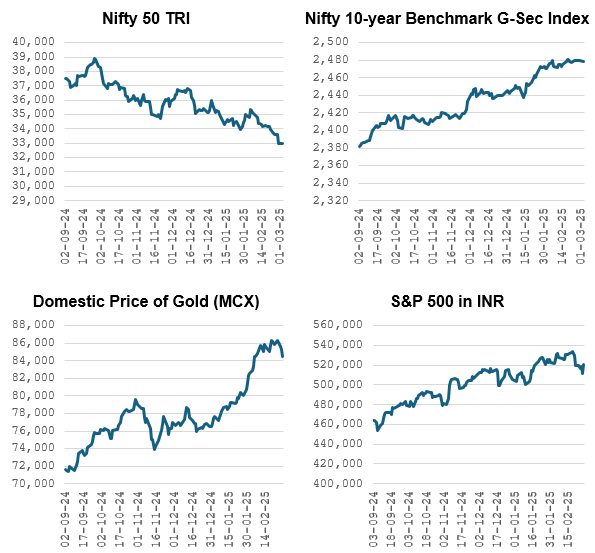

How have different asset classes behaved in this correction?

Source: NSE, MCX, Bloomberg, Advisorkhoj Research. Period: 01-09-2024 to 28-02-2025. Disclaimer: Past performance may or may not be sustained above. The graphic above is purely for investment education purposes and does not constitute investment recommendations.

You can see that, even though domestic equity as an asset class is going through a deep correction, other asset classes like debt, gold, international equity etc, gave positive returns. This shows the importance of asset allocation in your investment portfolio.

What is asset allocation?

Asset allocation refers to diversification of your investments in more than one asset class. Asset classes are types of investments which share same basic characteristics. Equity and debt (fixed income) are two popular asset classes. However, there are other important classes that you should be aware of e.g., commodities (gold, silver), international equity, real estate etc. While traditional asset allocation refers to mix of equity and debt in your portfolio, multi asset allocation is becoming increasingly popular with investors.

How asset allocation diversifies risk?

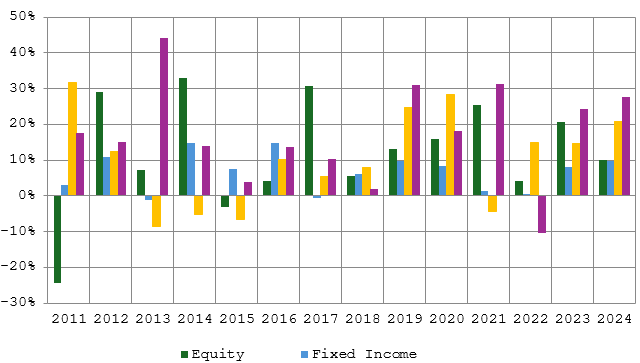

Asset classes like equity, commodities, fixed income, etc. have different investment cycles. There is a low or even negative correlation in returns of two or more asset classes. The chart below shows the annual returns from each asset class viz. equity (represented by Nifty 50 TRI), debt (represented by Nifty 10-year benchmark G-Sec index), domestic prices of Gold (based on MCX spot prices) and international equity (represented by S&P 500 in INR). You can see in the chart below that equity and gold are usually counter cyclical to each other, i.e., gold outperforms when equity underperforms and vice versa. Further, there is a low correlation between debt and the other asset classes. Diversifying your portfolio across asset classes limits downside risk when a particular asset class underperforms.

Source: National Stock Exchange, MCX, Advisorkhoj Research, 01.01.2011 to 31.12.2024. Equity: Nifty 50 TRI; Fixed: Nifty 10-year benchmark G-Sec Index; Gold: INR price of Gold (MCX), S&P 500 in INR: S&P 500 converted to INR. Disclaimer: Past performance may or may not be sustained in the future. The chart above is purely for investor education purposes and should not construed as investment recommendation.

Different asset classes have different risk profiles

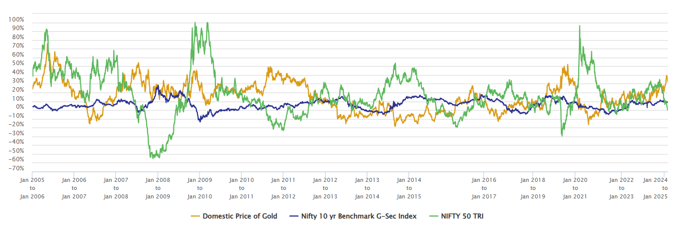

The chart below shows 1 year rolling returns of Nifty 50 TRI (equity), Nifty 10-year Benchmark G-Sec Index (debt) and Domestic Price of Gold over the last 20 years.

Source: National Stock Exchange, MCX, Advisorkhoj Research, 01.01.2005 to 28.02.2025. Disclaimer: Past performance may or may not be sustained above. The graphic above is purely for investment education purposes and does not constitute investment recommendations.

You can see in the chart above that the equity as an asset class is more volatile than gold and fixed income. Fixed income has the lowest volatility, while gold is seen as a safe haven asset in long term (in the short term even gold can be volatile) since gold is a hedge against inflation.

Asset allocation helps you remain disciplined

Behavioural biases impact the actual returns you get from your investments. Greed and fear are the two most common behavioural biases and influence investment decisions. Irrational euphoria in bull markets and panic in bear markets causes great harm to your long-term financial interest. Asset allocation reduces portfolio volatility and provides relative stability, which will keep you disciplined in your investments. When equities are rallying, you should be investing in debt to balance your asset allocation and vice versa. Your asset allocation should be according to your financial goals and risk appetite.

Hybrid funds for asset allocation

Hybrid funds are mutual fund schemes which invest in two or more asset classes e.g., equity, fixed income, gold etc. Different hybrid funds have different asset allocation profiles i.e., percentage allocations to different asset classes.

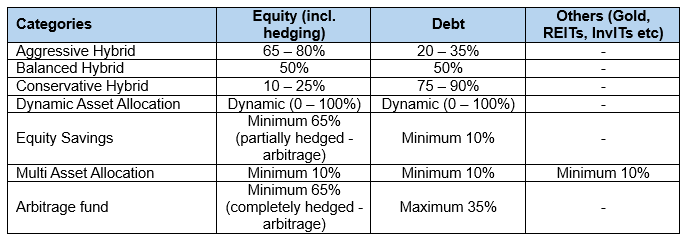

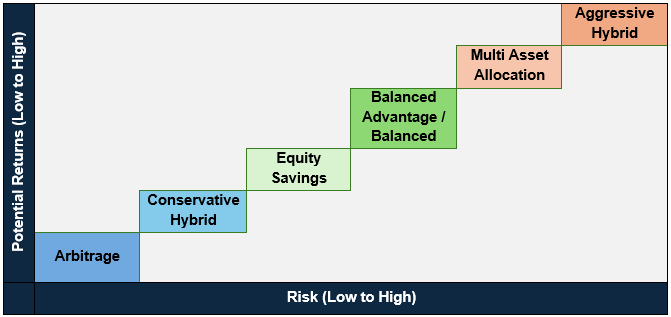

Types of hybrid funds

There are seven categories of hybrid funds as per SEBI’s mutual fund categorization. The table below shows the various categories of hybrid funds along with their mandated asset allocation limits (as specified by SEBI).

Benefits of hybrid funds

- Hybrid mutual funds offer asset allocation benefits whereby investors can balance risk and return to achieve their financial goals.

- Hybrid funds provide asset allocation solutions for investors with different risk appetites. Hybrid funds with higher allocations to equity can be suitable for investors with higher (aggressive) risk appetites, while hybrid funds investing primarily in debt will be suitable for more conservative investors.

Disclaimer: The graphic above is purely for investment education purposes and does not constitute investment recommendations. Consult your financial advisor before investing

- Hybrid funds provide the benefit of periodic portfolio rebalancing. Rebalancing of assets ensures that the asset allocation of your investments do not deviate from the targeted asset allocation despite market movements.

- Since hybrid funds are less volatile compared to pure equity funds, they are suitable for first time or new investors who do not have experience of high market volatility.

- Since hybrid funds are less volatile, they can also be suitable for Systematic Withdrawal Plans for investors who need cash flows from their investments. SWP can be much more tax efficient than income from traditional fixed income products (e.g., Bank FDs, Post Office Small Savings Schemes) or dividends.

- Hybrid funds provide tax efficient investment solutions. Long term capital gains (investment holding period of more than 1 year) from funds which have more than 65% gross equity allocation (including hedging) are tax exempt up to Rs 1 lakh and taxed at 12.5% thereafter. Long term capital gains (investment holding period of more than 2 year) from funds which have 35% - 65% equity allocations are taxed at 12.5%.

Investors should consult with their financial advisors or mutual fund distributors if hybrid funds are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Should you invest in momentum funds: Why momentum works in investing

- Nippon India Active Momentum Fund: Invest in winners

- Importance of Passives Funds in Core and Satellite Portfolio Strategy

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY