Should you invest in momentum funds: Why momentum works in investing

Factor based investing is popular in developed markets and is becoming increasingly popular in India also. Since 1st January 2024, 19 factor based index funds or smart beta funds were launched. Momentum is one of the most dominant factors in the smart beta funds and has been in the news for the past 6 months. In this article we will discuss why factor-based investing is gaining importance with emphasis on momentum-based investing and funds.

What are smart beta funds?

Smart beta funds are funds which combines passive and active methods of investing. Smart beta funds track factor indices. Factor indices are constructed based on quantitative, rule-based investment strategies based on factors which historically driven portfolio returns and risk. These factors can be Momentum, Low Volatility, Beta, Alpha, Value, Quality, Dividend Yield etc. Factor indices can be of two types: -

- Single factor indices – Single factor indices select stocks from a certain investment universe (e.g. Nifty 50, Nifty 100, Nifty 500 etc) based on a single factor. For example, Nifty 500 Momentum 50 Index selects 50 companies with highest Momentum score based on 6 & 12-month price return adjusted for volatility from the Nifty 500 universe.

- Multi factor indices - These indices select stocks from a certain investment universe (e.g. Nifty 50, Nifty 200, Nifty 500 etc) based on multiple factors. For example, the Nifty Alpha Low Volatility 30 index tracks the performance of 30 stocks selected based on the top combination of Alpha and Low Volatility (both high alpha and low volatility) from the Nifty 100 and Nifty Midcap 50 indices.

Smart beta funds combine passive and active methods of investing i.e. you can get alpha generation at much lower costs compared to actively managed funds.

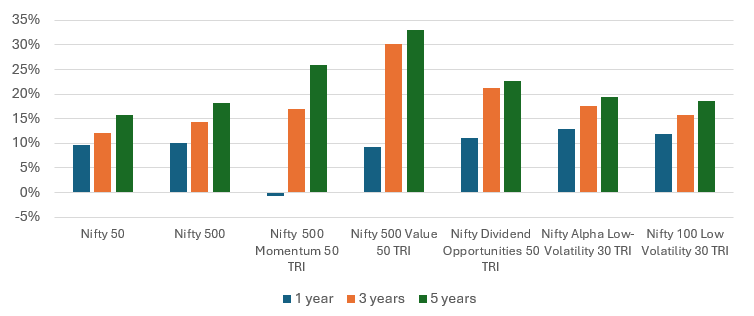

Factor based indices outperformed broad market indices

Source: National Stock Exchange, Advisorkhoj Research, as on 31st January 2025

What is momentum?

Momentum refers to the tendency of stock price trends to persist. It works on the premise that the stock market will continue to reward recent winners, and they will continue to remain winners in the near term. Similarly, losers will remain losers. Momentum factor investing refers to taking advantage of this market behaviour to generate alphas by being overweight on winners. Instead of the conventional, "buy low, sell high" approach, momentum strategy is essentially, "buying high and sell higher".

How momentum investing works?

- The momentum strategy is overweight on stocks that are outperforming and avoids / is underweight on stocks that are underperforming.

- The strategy picks a stock after it has moved upwards and proven its strength.

- The strategy exits a stock on a down trend once it identifies that the trend is continuing downward.

- Instead of predicting peaks or bottoms, the focus is on identifying and capitalizing on the market’s trend.

- There is a perception that while momentum strategy is high risk strategy with increased downside risks during market corrections. But trend following strategy can aid in lowering risks in down markets by dispassionately exiting past winners in down-cycles.

- In essence, momentum aims to participate in winners and stick with them till they start declining.

Why momentum has the potential of creating alphas in your portfolio?

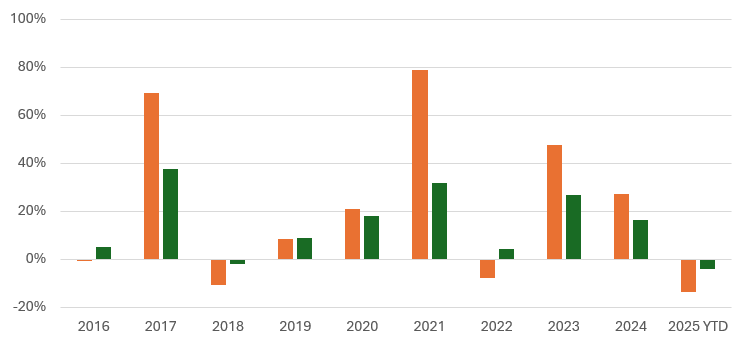

The chart below shows the calendar year returns of momentum factor index versus the broad market index (Nifty 500). While momentum underperformed in the years when the market was volatile, the margins of outperformance in the years when market was in uptrend were significantly higher than the margin of underperformance versus the broad market index (see the chart below). Over long investment tenures momentum has the potential of creating alphas in your investment portfolio.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st January 2025

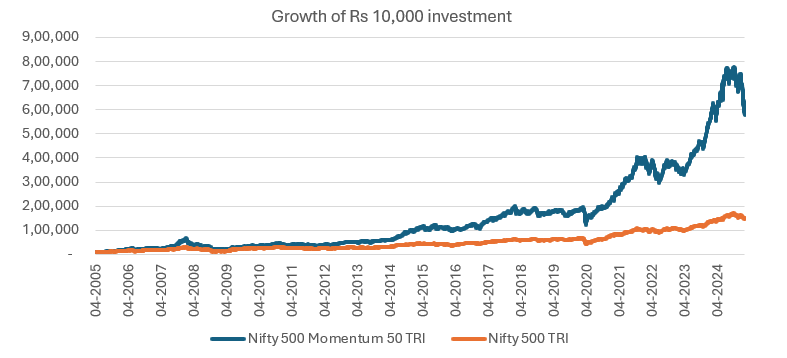

Higher wealth creation potential

The chart below shows the growth of Rs 10,000 in the momentum factor index (Nifty 500 Momentum 50 TRI) versus the broad market index, Nifty 500 TRI since the inception of the momentum factor index. You can see the wealth creation of the momentum investing over long investment tenures

Source: National Stock Exchange, Advisorkhoj Research, as on 31st January 2025

Suitable for SIP

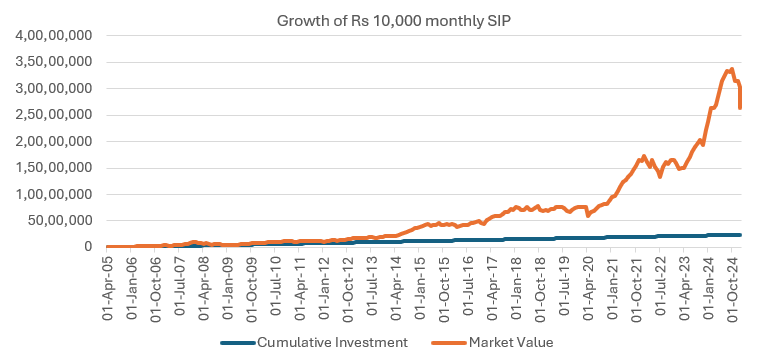

Since momentum stocks tend to be more volatile, you can take advantage of the volatility through Rupee Cost Averaging by investing through Systematic Investment Plan (SIP). The chart below shows the growth of Rs 10,000 monthly SIP in the momentum factor index (Nifty 500 Momentum 50 TRI) since the inception of the factor index (nearly 20 years back). With a cumulative investment of around Rs 24 lakhs, you could have accumulated a corpus of Rs 2.6 crores.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st January 2025

Who should invest in momentum funds?

- Investors seeking capital appreciation over long investment tenures.

- Investors seeking to add aggressive strategy to their portfolio.

- Investors with a high-risk appetite.

- Investors having a long-term investment horizon (minimum 5 years).

Investors should consult their financial advisors or mutual fund distributors which momentum fund can be suitable for their investment needs

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY