Nippon India Active Momentum Fund: Invest in winners

Nippon India Mutual Fund has launched a New Fund Offer (NFO), Nippon India Active Momentum Fund. This is a thematic fund which will invest in the momentum stocks i.e. stocks which exhibit strong price uptrends. The NFO will open for subscription on 10th February 2025 and will close on 24th February 2025.

How momentum investing works?

Momentum, in the context of equity markets, refers to the tendency of stock price trends to persist. In very simple terms it means that prices follow a trend - if stock prices are rising, it may rise further and if stock prices are falling, it may fall further. Investors are generally drawn to stocks experiencing an upward trajectory thus creating the potential of “buying high and selling higher” instead of the traditional “buy low and sell high”.

Why is momentum a popular strategy with investors?

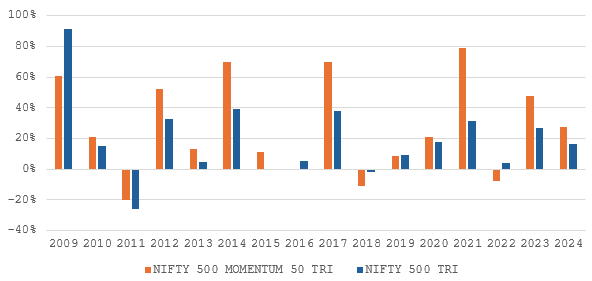

- Potential to outperform the broad market - The chart below shows the annual returns of momentum factor index versus the broad market index Nifty 500 TRI over the last 15 calendar years – momentum has outperformed 11 times in 15 years.

Source: Advisorkhoj Research, National Stock Exchange, as on 31st December 2024

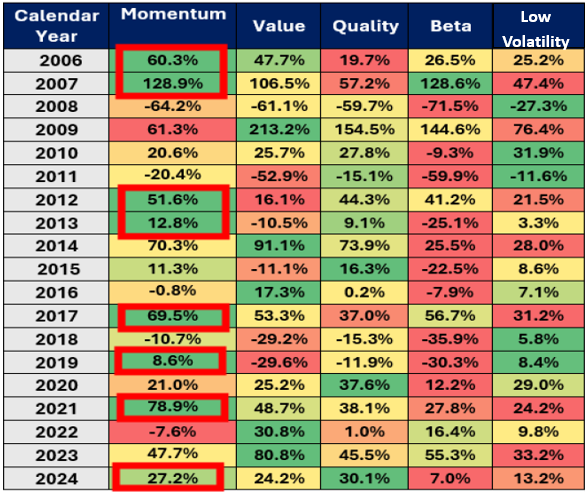

- Potential to give higher returns than other smart beta factors - Momentum has the potential to give superior performance more times than the other factors (see the chart below).

Source: Nippon India Mutual Fund Research, National Stock Exchange, as on 31st December 2024

- Momentum strategy can reduce downside risks – In momentum strategy, the fund manager will exit stocks that are falling more. This can aid in lowering risks in down markets by dispassionately exiting past winners in down-cycles

Nippon India Active Momentum Fund

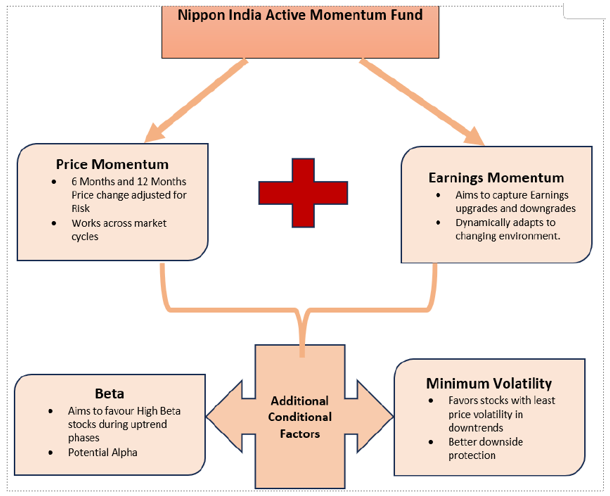

Momentum is becoming an increasingly popular factor in passive smart beta funds, with many index funds, tracking momentum factor indices. Nippon India Mutual Fund also has an index fund, Nippon India Nifty 500 Momentum 50 Fund, which tracks the Nifty 500 Momentum 50 factor index. While a passive fund has the benefit of lower costs, an active fund may have the potential of reducing high volatility during trend reversals and generate superior risk adjusted returns for investors.

The fundamental difference between other momentum-based strategies and the Nippon India Active Momentum Model is incorporating key factor of Earnings Revision in stock selection. The fund will attempt to have an optimal blend of price momentum and Earnings Revision). Pure Price Momentum can be of good quality and bad quality. A reliable, durable momentum in stock price is backed by earnings growth. Selecting stocks whose earnings have been revised upwards will help the fund in being agile and dynamic in stock selection. Similarly, exiting stocks whose earnings have revised downwards early in a down cycle, can arrest downward momentum in bear markets.

Along with price momentum and earnings revision, the fund manager will target high beta stocks in market upcycle, which will help in amplifying returns in bull markets. At the same time, during rough weathers or during large adverse macroeconomic events, when there is bear run, the fund manager will favour stocks with least price volatility which helps the fund in limiting downside losses.

How has the model performed?

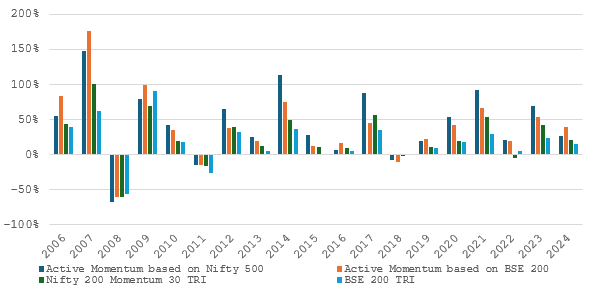

The chart below shows the returns of active momentum strategy based on the Nifty 500 and BSE 200 universe versus the momentum smart beta index (Nifty 200 Momentum 30 TRI) and the broader BSE 200 TRI. You can see that model has outperformed both the smart beta / factor index and the broad market index. This shows the potential of the active momentum strategy to create higher alphas compared to passive strategy across different market conditions.

Source: Nippon India MF, as on 31st December 2024

Superior risk return trade-off

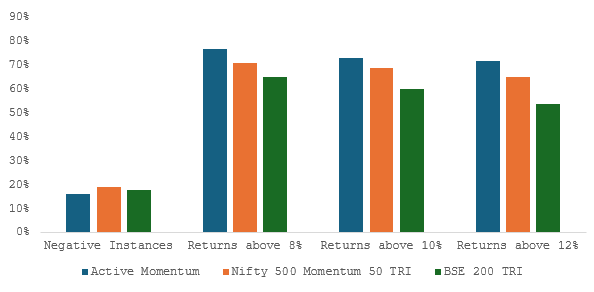

- The chart below shows the returns distribution of the active momentum model versus smart beta index (Nifty 500 Momentum 50 TRI) and broader market index (BSE 200 TRI) for 12-month periods. You can see that the active strategy limited downside risks (lesser negative instances) along with higher probability of 12%+ returns compared to passive strategy, as well as the broad market.

Source: Nippon India MF

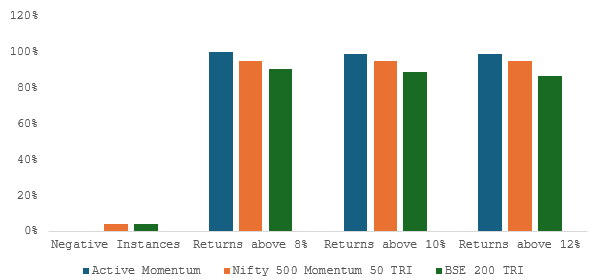

- The chart below shows the returns distribution of the active momentum model versus smart beta index (Nifty 500 Momentum 50 TRI) and broader market index (BSE 200 TRI) for 36-month periods. You can see that the active strategy limited downside risks (lesser negative instances) along with higher probability of 12%+ returns compared to passive strategy, as well as the broad market.

Source: Nippon India MF

Why invest in Nippon India Active Momentum Fund?

- The fund follows a disciplined, rules-based approach, which reduces emotional decision-making and human biases

- Incorporating Earnings Revision will reduce randomness of momentum factor and high volatility during trend reversals

- Earnings Revision factor will also ensure quality in the portfolio (i.e. price growth is supported by earnings growth) and limit negative surprises

- The conditional factors e.g. beta and minimum volatility can be used contra factors when the market / stocks look overbought or oversold, providing stability to your investment

- Higher potential of alpha creation since the fund would seek to invest in a focused portfolio around 30-40 stocks

Who should invest in Nippon India Active Momentum Fund?

- Investors looking for capital appreciation over long investment tenures

- Investors with high-risk appetites

- Investors with minimum 5-year investment horizon

- Investors can invest in lump sum or SIP

- Investors should consult their financial advisors or mutual fund distributors if Nippon India Active Momentum Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

- Importance of Passives Funds in Core and Satellite Portfolio Strategy

- Nippon India Mutual Fund: Massive in passive

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY