Nippon India Mutual Fund: Massive in passive

Passive funds have surged in popularity globally. As per AMFI data, passive assets under management (AUM) multiplied 6X in last 5 years. ETFs account for 73% of the passive AUM, while index funds account for nearly 27% of the passive AUM. Nippon India Mutual Fund is a pioneer in passive investing in India. Nippon India ETF Nifty 50 BeES is India’s oldest ETF launched in 2001. Nippon India ETF Gold BeES launched in 2007 is India’s first Gold ETF. Launched in 2010, Nippon India ETF Hang Seng BeES is India’s first international ETF. Nippon India MF’s passive AUM is over Rs 1.65 lakh crores, with 1.46 crores folios.

Wide range of ETF products

Nippon India MF offers Exchange Traded Funds (ETFs) across 4 different asset classes covering a wide range of risk appetites and investment needs: -

- Equity

- Fixed Income

- Commodities

- International equity

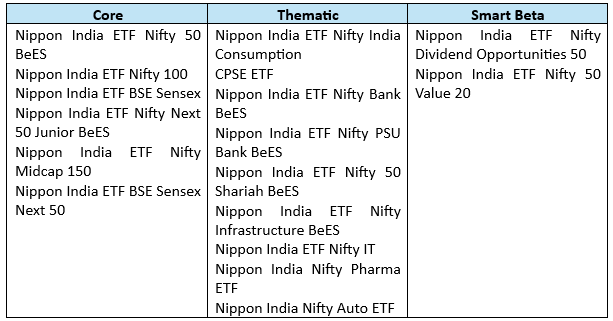

Nippon India MF Equity ETFs – Horses for courses

Nippon India MF has 17 ETFs which track domestic equity indices. These ETFs can be broadly divided into 3 categories.

- Core: These ETFs track broad market indices like Nifty, Sensex, Nifty Next 50, Sensex Next 50, Nifty 100, Nifty Midcap 150 etc. Role in your portfolio - these ETFs should form a part of your core investment portfolio for your long-term financial goals.

- Thematic: These ETFs track thematic indices i.e. indices which includes stocks / companies from only one investment theme or industry sector e.g. CPSE, Bank Nifty, Nifty PSU Bank, Nifty India Infrastructure, Nifty India Consumption, Nifty IT, Nifty Pharma, Nifty Auto etc. Role in your portfolio - these ETFs can be part of your satellite portfolio. Winner rotates across sectors. You should have long investment horizons if you are unable to time your entry or exit.

- Smart Beta: Smart beta ETFs track factor indices. Factor indices are types of indices that select stocks based on certain specific criteria like value, dividend opportunities, quality or low volatility. Picking stocks with specific factors can help investors build a portfolio that may produce relatively superior risk-adjusted returns compared to the market. Nippon India MF has smart beta funds tracking the Nifty 50 Value 20 and Nifty Dividend Opportunities 50 indices. Role in your portfolio - these ETFs can be part of your satellite portfolio. You should have long investment horizons if you are unable to time your entry or exit.

Nippon India MF Fixed Income ETFs – Solutions for varied investment needs

Fixed income ETFs can be categorized into 3 types: -

- Liquid ETFs: These ETFs invest in highly liquid, short-term debt or money market instruments. If you have idle funds, you can park them in Nippon India ETF Nifty 1D Rate Liquid BeES.

- G-Sec ETFs: For longer investment tenures you may consider investing in Nippon India ETF Nifty 5 yr Benchmark G-Sec and / or Nippon India ETF Nifty 8-13 yr G-Sec Long-Term Gilt. Since these ETFs invest in Government securities, there is no credit risk in this fund.

- Target Maturity Funds: Target maturity funds are open ended ETFs with a specified maturity date. If you want to invest for a fixed term, you can invest in Nippon India MF’s target maturity fund, Nippon India ETF Nifty SDL Apr 2026 Top 20 Equal Weight. This fund invests only in State Government securities and therefore have no credit risk.

Other asset classes

Apart from equity and fixed income, you can get exposure to other asset classes like commodities and international through Nippon India MF’s ETFs. Nippon India ETF Gold BeES and Nippon India Silver ETF can provide you exposure to gold and silver respectively. If you want exposure to international equities, you can consider investing in Nippon India ETF Hang Seng BeES. Hang Seng will provide you exposure to the largest companies listed in Hong Kong stock Exchange.

Benefits of investing in ETFs

- Low Cost

- No unsystematic risks

- No fund manager bias

- Ability to buy / sell on real time basis.

You need demat and trading account to invest in ETFs.

Nippon India MF ETFs – Liquidity

After the NFO period, you can buy or sell ETF units only in the stock exchange at market prices, unless you are transacting in lot sizes (creation units) as specified in the Scheme Information Document. Liquidity is an important consideration when you are investing in ETFs. In extreme market conditions, when there is high selling pressure and lack of buyers, investors of less liquid ETFs may be forced to sell their ETF units at prices lower than the Net Asset Value (NAV) of the ETFs. The market prices (bid / ask prices) of liquid ETFs are much closer to their indicative NAVs. Trading volumes is an indicator of liquidity of ETFs. Nippon India MF’s ETFs account for 55% of the trading volumes of ETFs.

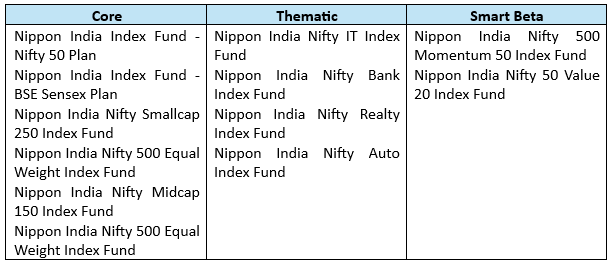

Nippon India MF Index Funds – Benefits of passive and convenience of mutual funds

If you do not have demat account, then you can get the benefits of passive investing through Nippon India MF’s index funds. Index funds are passive schemes. Like ETFs, they track market indices. Total expense ratios of index funds are significantly lower than actively managed funds. Nippon India MF’s index funds provide you exposure to many indices that are tracked by Nippon India MF’s ETFs. In addition, you can get exposure to certain indices (market cap segments, industry sectors, smart beta factors etc) which are not tracked by Nippon India MF’s ETFs.

Suggested reading: All you wanted to know about Index Funds

Other Nippon India passive solutions

- Passive equity FOFs: These funds invest in ETFs e.g. Nippon India Nifty Next 50 Junior BeES FOF, Nippon India Passive Flexicap FOF.

- Gold funds or FOFs: You can get exposure to gold through Nippon India Gold Savings, even if you do not have demat account.

- Silver FOFs: You can get exposure to silver through Nippon India Silver ETF FOF, even if you do not have demat account.

Why invest in Nippon India MF’s passive funds?

- Funds suitable for wide variety of investment needs and risk appetites.

- Funds for all asset classes e.g. equity, fixed income, commodities, international etc.

- Large trading volumes (for ETFs) and high liquidity.

- Low tracking error. Most Nippon India MF’s ETFs have tracking error of less than 0.1 – 0.2%

- Wide range of passive investment options for investors who do not have demat accounts.

- 23 years of experience and track record of managing passive funds. Massive in passive.

Investors should consult their financial advisors or mutual fund distributors, if Nippon India MF’s passive funds (ETFs, Index Funds or FOFs) are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

- Nippon India Active Momentum Fund: Invest in winners

- Importance of Passives Funds in Core and Satellite Portfolio Strategy

- The time for Hybrid is here: Why is it important to make hybrids part of your portfolio

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY