Going hybrid in the current environment

Current Market Context

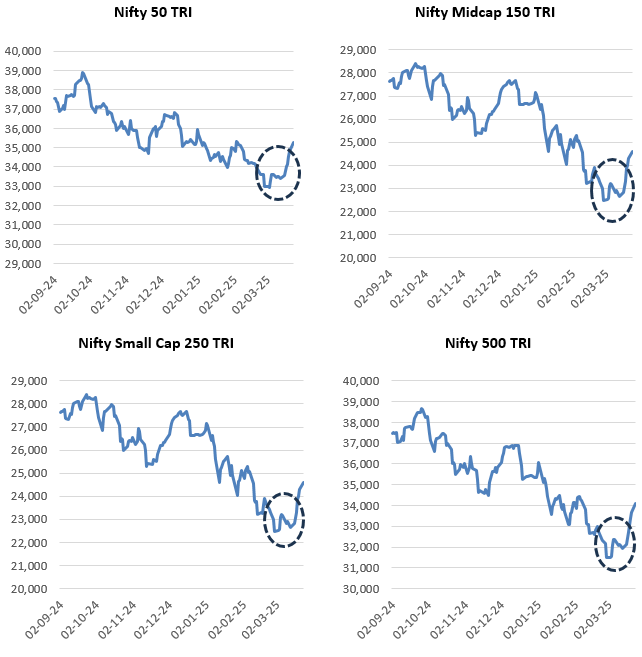

Equity market has been volatile for the last 6 months. Concerns about Trump Administration’s trade policies, earnings growth outlook and weakening Rupee led to FII selling. Large cap stocks were impacted more in the initial phase of correction, with large cap stocks falling nearly 17% from 52-week highs. The broader market (midcap and small caps) saw deep cuts in CY 2025. The midcap index (Nifty Midcap 150 TRI) entered the bear territory in March following a 20% correction from 52 week high, while small caps fell by 26%.

Market bounced back following positive global cues

The market has bounced back in the last few days on the hopes of softening stance on trade policies by the US Government (see the graphic below). Cooling inflation in India also creates conditions for RBI rate cut in the next MPC meeting.

Source: NSE, Advisorkhoj. As on 24th March 2025

Why hybrid in current market conditions?

Though it is too early to say whether the market has bottomed out, we are seeing signs of consolidation in equity markets. However, one should expect the markets to remain volatile in the near term since global trends lack short term clarity. Meanwhile gold is rising giving 17% returns in last 6 months (as on 25th March 2025, source: MCX), underscoring the need for balanced investing. In such times, asset allocation is key. Hybrid funds, blending equity and debt help manage risks while seeking growth.

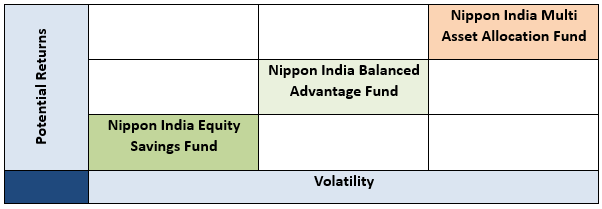

Different asset classes have low or even negative correlation of returns in different investment cycles. Diversifying your investment across asset class will bring stability to your portfolio and improve consistency i.e. if one asset class underperforms, the outperformance of another asset class will balance the risks. As such, hybrid funds like balanced advantage funds, multi asset allocation funds, equity savings funds etc. can add stability and diversification to your investment portfolio. In this article, we will discuss about 3 different hybrid funds offered by the Nippon India Mutual funds - Nippon India Equity Savings Fund, Nippon India Balanced Advantage Fund and Nippon India Multi Asset Allocation Fund which provides asset allocation solutions to investors of different risk appetites and investment needs.

Select funds according to your risk appetite

Different hybrid funds have different risk return profiles. You should select a fund based on your risk appetite. Consult your financial advisor if you need help in understanding your risk appetite and which fund can be suitable for your risk profile and investment needs

Nippon India Equity Savings Fund

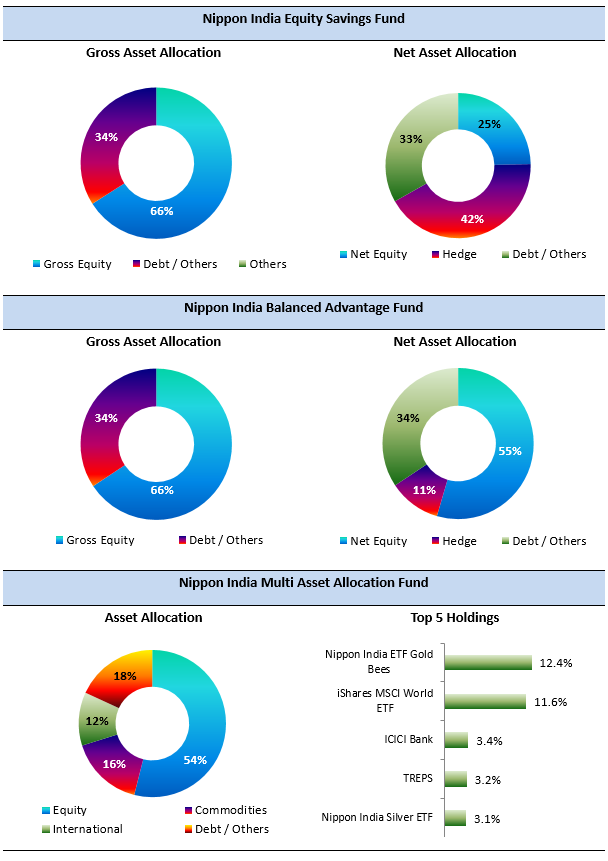

Equity savings funds can partially hedge their equity allocation using derivatives, while maintaining gross equity allocation of at least 65% - thus these funds enjoy equity taxation. These funds must invest at least 10% of their assets in debt and money market instruments. The asset allocation of Nippon India Equity Savings Fund is as follows: -

- Equity Allocation - The net equity (unhedged equity) allocation of the fund can range from 25 - 40%. The equity portion will have high active share (minimum 60%) and have a large cap bias (minimum 65%). It invests across industry sectors.

- Arbitrage Allocation - The fund allocates 25 - 70% to arbitrage opportunities. Arbitrage allocation reduces risk and ensures equity taxation for the fund.

- Debt allocation - The debt allocation of the fund can range from 10 - 35%. The modified duration of the debt portion is maintained between 2 - 4 years (moderate interest rate risk). The credit quality is high.

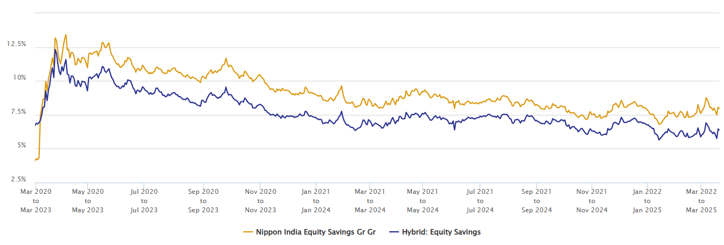

he chart below shows the 3 year rolling returns of Nippon India Equity Savings Fund versus the Equity Savings category average over the last 5 years. You can see that the fund was consistently able to outperform the category average. Though the volatility of the fund is lower than the category average and the fund was able to give 8%+ CAGR returns in more than 80% of the instances (observations) with no instances of negative returns. Lower volatility is one of the main attributes of Equity Savings Funds. The risk return trade off of this fund is favourable for investors who do not have high risk appetite or for new investors.

Source: Advisorkhoj Rolling Returns as on 25th March 2025

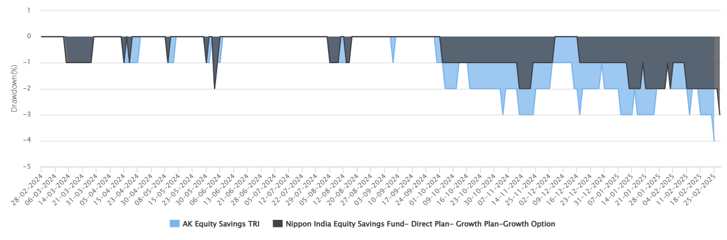

Let us now see how this fund was able to limit downside risks for investors. The chart below shows the drawdowns of Nippon India Equity Savings Fund versus our equity savings index over the last 1 year. You can see that the fund was able to limit downside in volatile market conditions.

Source: Advisorkhoj Research as on 28th February 2025

Nippon India Balanced Advantage Fund

Balanced Advantage Funds dynamically manage their asset allocation according to market conditions. Nippon India Balanced Advantage Fund uses an in-house proprietary dynamic asset allocation model which takes into consideration fundamental, technical and macro parameters:

- Valuations: The model uses 1 year forward P/E. Valuations are fulcrum of the model.

- Trend following/momentum: This is a unique parameter which aids in maximizing Upside Potential and Limiting downside risk.

- Trade weighted US Dollar: A strong Dollar typically coincides with weaker phases of Equity prices, while a weaker Dollar coincides with strong equity performance.

- Global Demand Indicators: A combination of Lumber/Copper/Nickel prices acts as a strong indicator of global economy and markets.

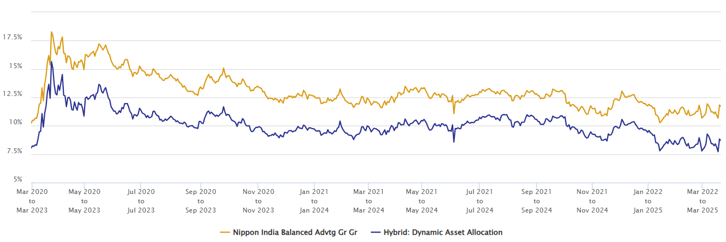

The chart below shows the 3 year rolling returns of Nippon India Balanced Advantage Fund versus the Balanced Advantage Funds category average over the last 5 years. You can see that the fund was able to consistently outperform the category average. Performance consistency in different market conditions is in our view one of the most important performance parameters, because investors are looking for consistency and stability when they invest in Balanced Advantage Funds. The fund did not give negative returns and gave double digit returns in 100% of the instances (see the chart below).

Source: Advisorkhoj Rolling Returns as on 25th March 2025

Nippon India Multi Asset Allocation Fund

Multi Asset Allocation Funds are mandated by SEBI to invest in at least 3 or more asset classes. Minimum allocation to each asset class will be 10%. Nippon India Multi Asset Allocation Fund is a "true to label multi asset fund" as it invests in 4 asset classes:

- Equity Allocation - Multi Cap investment strategy, blend of growth and value stocks, large cap bias, focus on alphas creation through stock selection.

- Debt Allocation - Debt portfolio is managed with a moderate duration; duration range of 1.25 - 2.25 years, predominantly invest in high credit quality assets, focused on Accrual Income.

- Commodities allocation - The fund invests in Exchange Traded Commodity Derivatives (ETCDs). Maximum commodity exposure will be 20%. Minimum 10% investment in gold through ETFs / ETCDs. 5 - 10% exposure to other commodities.

- Overseas equity allocation - Investment across geographies through investment in MSCI World Index. Overseas equities could act as an effective diversification tool as well as benefit from any currency depreciation.

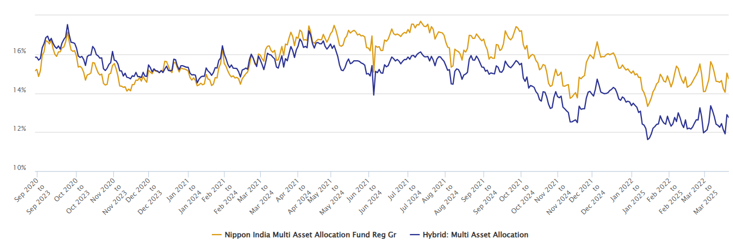

The fund was launched in August 2020 and is among the Top 3 Multi Asset Allocation Funds. Nippon India Multi Asset Fund is one the very few multi asset allocations funds which has allocations to international equities. The chart below shows the 3 year rolling returns of Nippon India Multi Asset Allocation Fund versus the Multi Asset Allocation Funds category average since the inception of the fund. You can see that the fund was able to consistently outperform the category average over the last 4 years. The fund was able to give 12%+ CAGR returns in 100% of the instances (observations) across different market conditions since its inception.

Source: Advisorkhoj Rolling Returns as on 25th March 2025

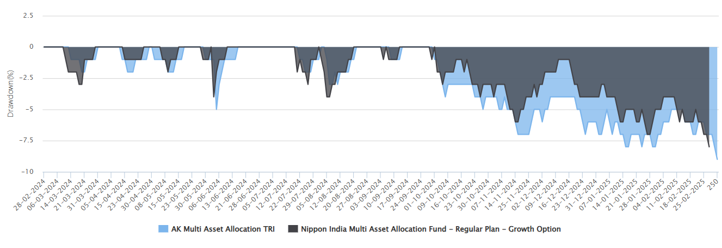

Let us now see if this fund was able to limit downside risks for investors in volatile market conditions. The chart below shows the drawdowns of Nippon India Multi Asset Allocation Fund versus our multi asset allocation index over the last 1 year. You can see that the asset allocation strategy of the fund was able to limit downside in volatile market conditions.

Source: Advisorkhoj Research as on 28th February 2025

Current Asset Allocation

Source: Nippon India MF Factsheet, as on 28th February 2025

Taxation

Nippon India Balanced Advantage Fund and Nippon India Equity Savings Fund enjoy equity taxation. Short term capital gains (investment holding period of less than 12 months) from Nippon India Balanced Advantage Fund and Nippon India Equity Savings Fund will be taxed at 20%. Long term capital gains (investment holding period of more than 12 months) of up to Rs 1.25 lakhs will be tax exempt and taxed at 12.5% thereafter. Minimum holding period for long term capital gains taxation for Nippon India Multi Asset Allocation Fund is 2 years. Short term capital gains from Nippon India Multi Asset Allocation Fund will be added to your income and taxed as per your income tax slab. Long term capital gains from the fund will be taxed at 12.5%.

Who can invest?

- Investors looking for capital appreciation and income over long investment horizons.

- Investors who want to reduce portfolio volatility by diversifying across multiple asset classes.

- Investors with minimum 3 - 5 years investment tenure.

- Investors with moderately high to high-risk appetites.

- You can select Nippon India Equity Savings, Balanced Advantage and Multi Asset Allocation Funds depending on your risk appetite. You can also invest in a combination of 2 or more funds.

Consult your financial advisors or mutual fund distributors to find out which Nippon India MF hybrid fund will be suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

- Nippon India Active Momentum Fund: Invest in winners

- Importance of Passives Funds in Core and Satellite Portfolio Strategy

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY