Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

Nippon India Mutual Fund has launched two new index funds, Nippon India Nifty 500 Low Volatility 50 Index Fund and Nippon India Nifty 500 Quality 50 Index Fund. These two passive funds are smart beta funds which track factor indices. Factor indices are constructed using quantitative, rule-based investment strategies based on certain factors (e.g. momentum, volatility, quality, dividend yield etc). Nippon India MF is one the leading Asset Management Companies in the passive space, having launched the first Exchange Traded Fund (ETF) in India and has several other firsts to its credits as far as passive products are concerned. The NFOs opened for subscription on 16th April 2025 and will close on 30th April 2025. In this article we will review these two NFOs.

What are smart beta funds?

Most investors still associate passive equity investments with investing in broad market indices like Nifty 50 or Sensex. Broad market indices like Nifty 50 or Nifty 500 comprises of stocks that represent large segment(s) of the market. Factor indices on the other hand, select stocks based on certain factors which have historically driven portfolio returns and risk. Smart beta funds track factor indices. These funds combine passive and active methods of investing, providing the opportunity to generate alphas for investors.

Why invest in smart beta index funds?

- Smart beta funds have the potential of generating superior returns compared to broad market index e.g. Nifty 50, Nifty 500 etc.

- Low-cost investments. TERs are much lower than actively managed equity funds

- Provides diversification across market caps (Large Cap, Midcap, and Small Cap)

- Elimination of non-systematic risks like stock picking and portfolio manager selection

- Investors who do not have Demat accounts can invest in index funds

- You can invest from your regular savings through Systematic Investment Plans (SIPs)

Nippon India Nifty 500 Low Volatility 50 Index Fund

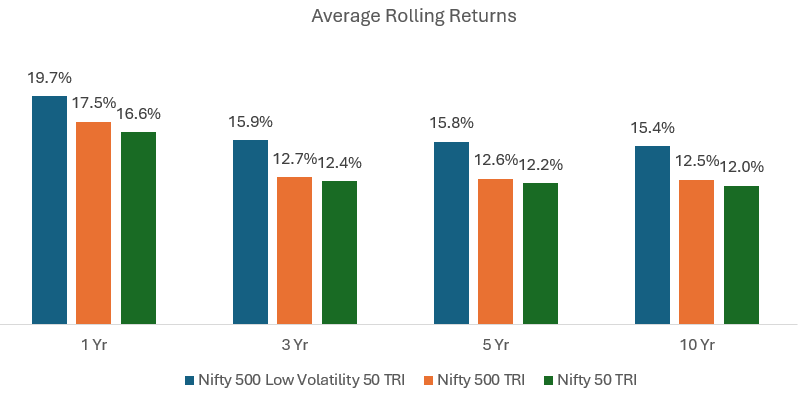

As the name suggests this fund will track the Nifty 500 Low Volatility 50 Index. The strategy is to select low volatility stocks (from the Nifty 500 universe) and generate superior risk adjusted returns. The chart below shows the rolling returns of Nifty 500 Low Volatility 50 Index versus the broad market indices Nifty 50 and Nifty 500 for different investment tenures since the inception of the index.

You can see the low volatility index outperformed the broad market indices across different investment tenures. The low volatility index outperformed Nifty 50 in 97% of instances and Nifty 500 in 93% of instances over 5-year investment tenures. Over 10-year investment tenures, Nifty 500 Low Volatility 50 Index outperformed Nifty 50 and Nifty 500 in 100% of the instances. Low volatility strategy has proved to be anomaly to high risk for high returns.

Source: NIMF, NSE, Advisorkhoj Research, Period: 01.04.2005 to 28.02.2025

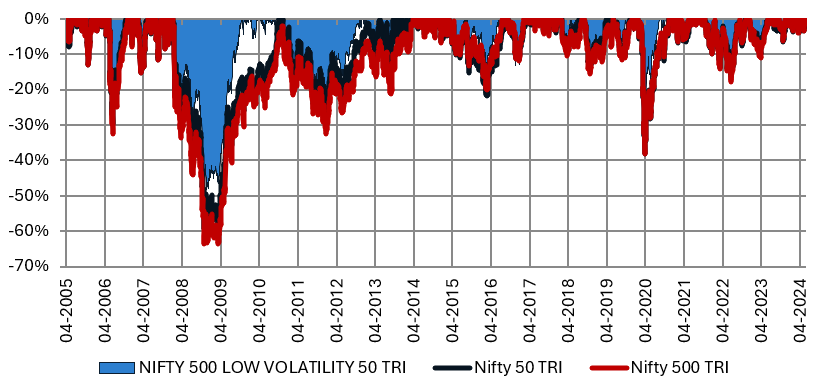

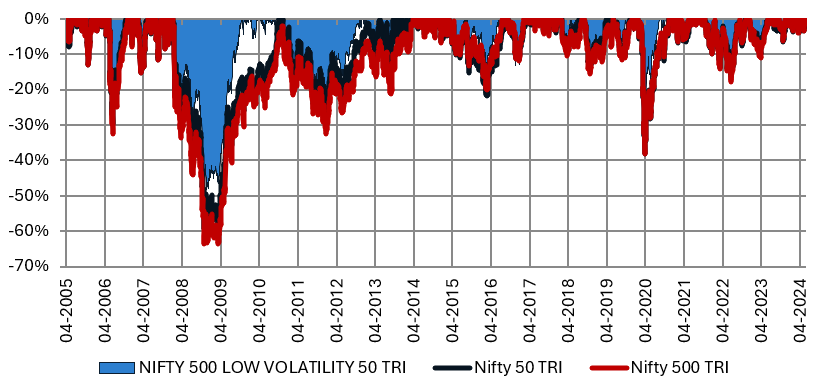

The chart below shows the drawdowns of Nifty 500 Low Volatility 50 Index compared to the broad market indices Nifty 50 and Nifty 500 TRI, since the inception of the low volatility index. You can see that the low volatility index was able to reduce downside risks for investors in volatile market conditions / deep corrections.

Source: NSE, Advisorkhoj Research, Period: 01.04.2005 to 31.03.2025

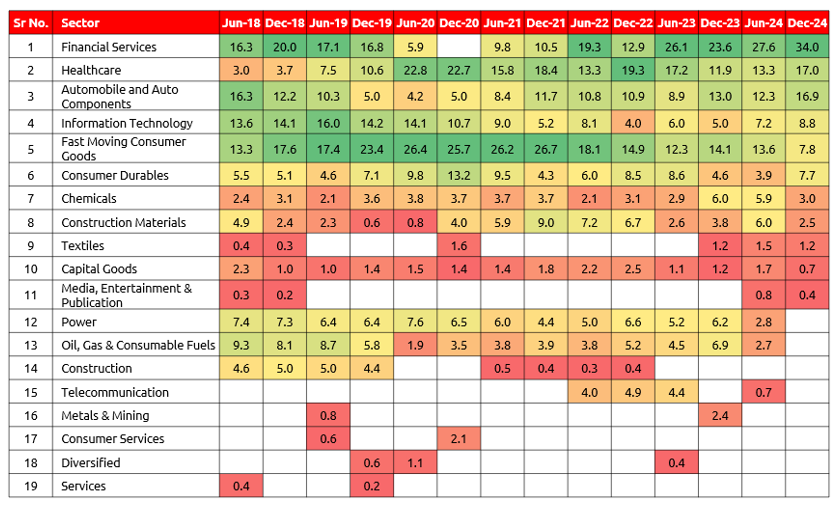

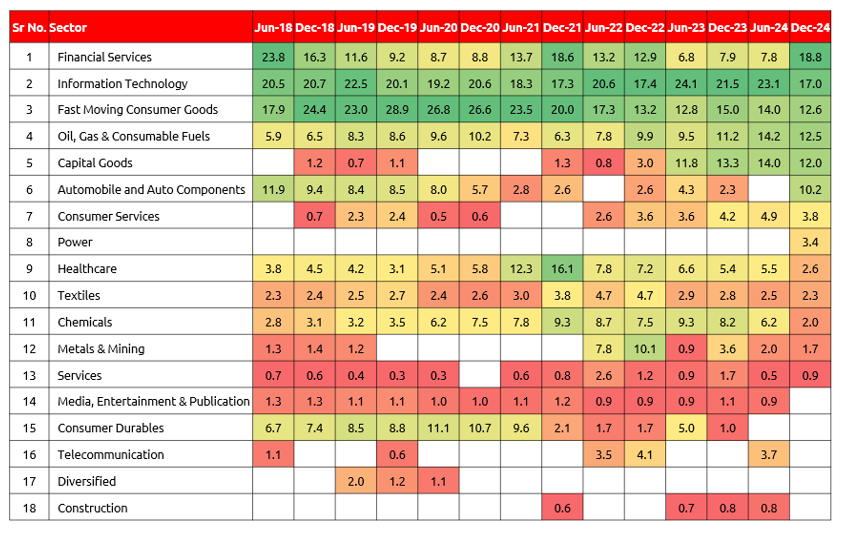

The chart below shows the sector rotation in the Nifty 500 Low Volatility 50 Index. You can see that certain sectors are consistently less volatile relative other sectors. From a market cap perspective, large caps tend to be less volatile than small and midcaps. Nifty 500 Low Volatility 50 Index has predominantly large cap bias.

Source: NIMF, Period: 30.06.2018 to 31.03.2024

Nippon India Nifty 500 Quality 50 Index Fund

As the name suggests this fund will track the Nifty 500 Quality 50 Index. Quality stocks are ones which have superior Return on Equity, lower debt equity ratio and lower earnings per share variability (stable earnings growth). These stocks usually have fundamentally stronger business model, sustainable competitive advantage, healthy balance sheets and superior profitability. Each of the three quality parameters i.e. ROE, Debt Equity Ratio and EPS variability are given equal weights in Nifty 500 Quality 50 Index.

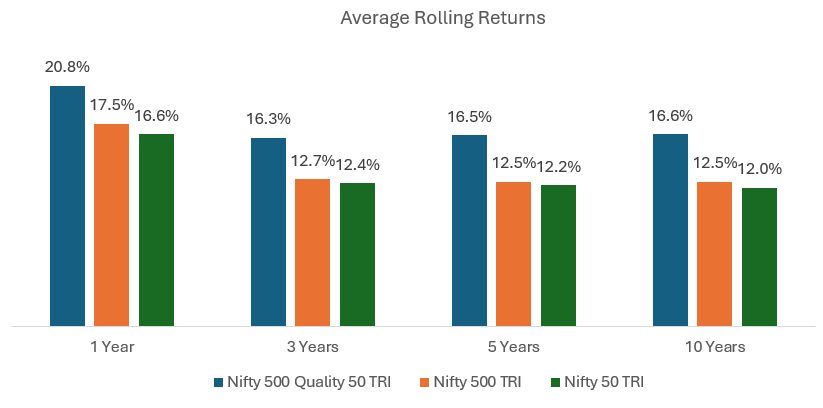

The chart below shows the rolling returns of Nifty 500 Quality 50 Index versus the broad market indices Nifty 50 and Nifty 500 for different investment tenures since the inception of the quality index. You can see the quality index outperformed the broad market indices across different investment tenures. The quality index outperformed Nifty 50 and Nifty 500 in 75% of instances over 5-year investment tenures. Over 10-year investment tenures, Nifty 500 Low Volatility 50 Index outperformed Nifty 50 and Nifty 500 in 100% of the instances.

Source: NIMF, NSE, Advisorkhoj Research, Period: 01.04.2005 to 28.02.2025

The chart below shows the drawdowns of Nifty 500 Quality 50 Index compared to the broad market indices Nifty 50 and Nifty 500 TRI, since the inception of the quality index. You can see that the quality index was able to reduce downside risks for investors in volatile market conditions / deep corrections.

Source: NSE, Advisorkhoj Research, Period: 01.04.2005 to 31.03.2025

The chart below shows the sector rotation in the Nifty 500 Quality 50 Index. You can see that certain sectors get consistently higher allocations in the quality index.

Source: NIMF, Period: 30.06.2018 to 31.03.2024

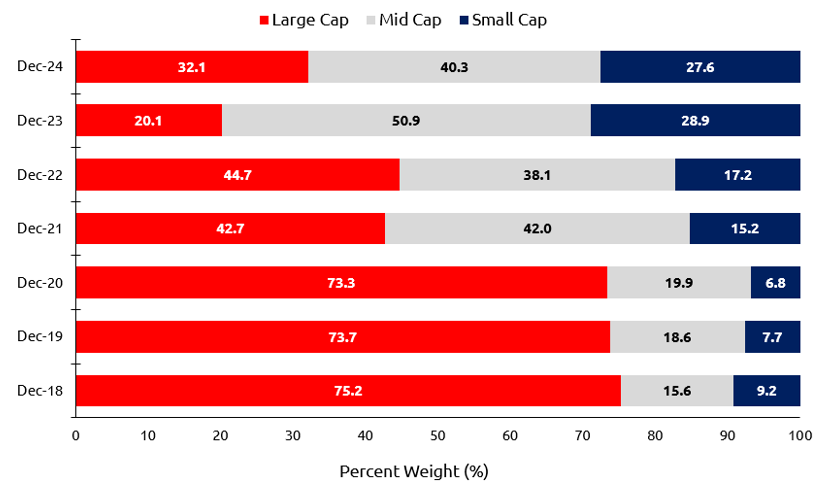

The chart below shows the market cap rotation in the Nifty 500 Quality 50 Index. You can see that the quality index had large cap bias in certain periods, while in other periods, the quality index had relatively higher allocations to midcaps.

Source: NIMF, Period: 30.06.2018 to 31.03.2024

Why invest in Nippon India Nifty 500 Low Volatility 50 Index Fund and Nippon India Nifty 500 Quality 50 Index Funds

Who should invest in Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds?

- Investors seeking capital appreciation

- Investors who prefer low volatility or quality stocks

- Investors with a high-risk appetite

- Investors having a long-term investment horizon (minimum 5 years)

- Investors seeking to add aggressive strategy to their portfolio

- You can invest in lump sum or through SIP depending on your investment preference or financial situation.

Conclusion

In this article, we have reviewed the smart beta fund NFOs of Nippon India Mutual Fund. Smart beta index funds can provide solutions for a spectrum of investment needs, styles and risk appetites. You should understand different underlying factors on which the factor indices and smart beta funds are constructed and make informed investment decisions. Consult with your financial advisor or mutual fund distributor if Nippon India Nifty 500 Low Volatility 50 Index Fund or Nippon India Nifty 500 Quality 50 Index Fund or both are suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

- Nippon India Active Momentum Fund: Invest in winners

- Importance of Passives Funds in Core and Satellite Portfolio Strategy

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY