How to get the most from your mutual fund SIPs

One of the most encouraging trends of investor maturity in India is the increasing popularity of SIPs in India. As per AMFI data, there are more than 3 Crore SIP accounts as on January 2020. More than 1 crore SIP accounts were added in FY 2018-19 and a higher number is expected to be added in this financial year. Rs 8,532 Crores were invested through SIP in the month of January 2020 compared to just around Rs 4,100 Crores in January 2017. Comments and queries received by us in Advisorkhoj indicate that many of our readers are investing through SIPs. Many investors have created wealth by investing through SIPs. At the same, based on our interactions with investors, several investors are not able to reap maximum benefits from their SIPs.

In this blog post, we will discuss how existing as well as new SIP investors can maximize their SIP returns.

Have long investment tenures

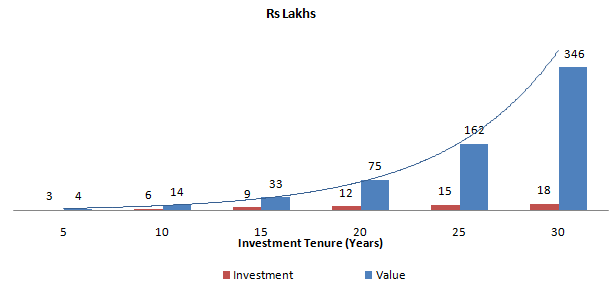

We work hard to earn money, but we should also make our money work hard so to make more money. You can make your money to work for you by investing it and the longer it remains invested, the more profits it can generate. Profits earned on profits, over long investment horizons, can create substantial wealth for you through the power of compounding. The most important ingredient in the power of compounding recipe is time – investment tenure. SIP is the best way to leverage the power of compounding. By investing small amounts at regular intervals (e.g. weekly, fortnightly, monthly etc.) you can start investing early and can invest over a much longer period of time. The chart below shows how much wealth investors can create over different investment tenures with monthly SIP of just Rs 5,000 (assuming 15% rate of return).

You can see that your wealth creation is exponential over longer tenures. By starting early you give yourself more time, for your money to grow through the power of compounding.

Read more about mutual fund SIPs and power of compounding

Be disciplined in the face of volatility

There is an old saying on Wall Street that the market is driven by just two emotions: fear and greed. However, these two emotions are extremely harmful to your financial interests. The legendary investor Warren Buffet advised a contrarian approach, Be fearful when others are greedy and be greedy when others are fearful.

Benjamin Graham, who Buffet considers as his investment guru, said that individuals who cannot master their emotions are ill-suited to profit the investment process. Equity markets are volatile in natures and while volatility can be emotionally stressful, you must remain disciplined and stick to your investment plan.

As per AMFI data, more than 20% of the outstanding SIP accounts got discontinued in FY 2018-19. The broader market was very volatile during this period and a large number of SIP cancellations would have been due to fear of losses. Such impulsive actions harm your long term financial goals. You must resist the urge of cancelling or stopping your SIP in market corrections.

Did you know Why to continue your SIPs even in high markets

In fact, corrections are the best time to invest systematically because your acquisition cost gets lowered through Rupee Cost Averaging (you buy mutual fund units at lower and lower costs in market corrections) and your long term returns are enhanced significantly.

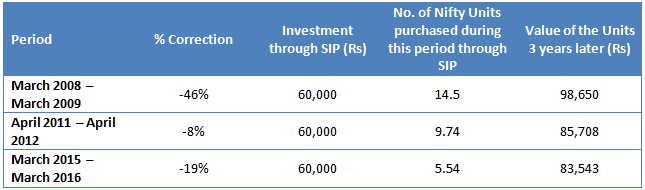

We have looked at the last 3 major corrections in the stock market (Nifty) and calculated how much returns you would have given up in just the next 3 years, if you stopped your SIP. Let us assume you were investing Rs 5,000 a month in Nifty 50 TRI.

You can see that, if you stopped your SIPs during the correction, you would have lost out on considerable amounts of profits (12 – 18% CAGR). Remain disciplined with your SIPs, even in the face of volatility and you will be rewarded in the long term.

Increase your SIP with rise in income

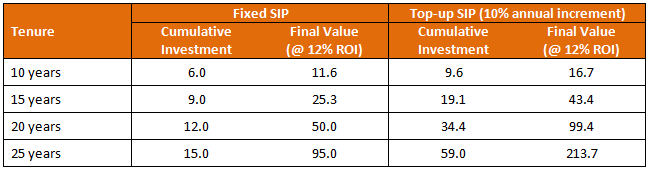

With rise in income the amount you can save also increases. You should also increase your SIP investments over time. By increasing your SIP instalments every year with increase in your salary, you can achieve your goals faster and / or accumulate a much larger corpus. The facility to increase your SIP instalments at regular intervals (e.g. yearly) is known as top-up SIP or step-up SIP. With top-up or step-up SIPs, you can increase your monthly SIP instalments by a fixed percentage (e.g. 10%, 15% etc.) or fixed amount (Rs 1000, 2000 etc.) at certain intervals.

You may like to read – How to get better returns from your mutual fund portfolio

Increasing your SIP instalments over time can generate substantially higher returns in the long run. Let us assume you start a monthly SIP of Rs 5,000. The table below shows the cumulative investments and investment values (assuming 12% ROI) of a simple (fixed SIP) and top-up SIP (assuming 10% annual increments) over different investment tenures. You will see that substantially larger corpus can be accumulated by increasing your SIP over time.

Amounts in Rs lakhs

Source: Sip Top-Up Calculator

Tactically invest in lump sum to take advantage of corrections

SIPs are the ideal investment options for long term financial goals, irrespective of market conditions. However from time to time, equity markets present very attractive investment opportunities which you can take advantage of by tactically investing in lump. In our view, 20% or more correction provides good investment opportunities to invest in lump sum if you have funds available. If you are worried that the market may fall even further then you can invest your lump sum funds in a liquid fund and invest from the liquid fund to equity fund through Systematic Transfer Plan (STP) over 3 – 6 months. Historical data shows that bear markets or corrections do not last very long before market rebounds – about 12 months at most. Therefore, once market has corrected 20% or more, 3 – 6 months STP will enable you catch lower prices and even the bottom.

Suggested reading – How Mutual Fund STPs help invest in volatile markets

Conclusion

In order to get the maximum returns from your SIP –

- You should start early and invest systematically over very long periods (ideally 10 years or longer).

- You should remain disciplined in your SIP investments even in the face of market volatility. SIPs works to your advantage in times of volatility by Rupee Cost Averaging of purchase price.

- By increasing your SIPs every year with rise in your income, you can reach your financial goals faster and accumulate more wealth.

- You should take advantage of high volatility by tactically investing in lump sum.

- Finally, you should always review the performance of your SIPs from time to time, to see if you are on track of your financial goals. You should take the help of a financial advisor if required.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY