Nippon India Nivesh Lakshya Fund: A good investment for your long term goals

Bank Fixed Deposits have been the traditional long term investment choice of average Indian households. As per Reserve Bank of India’s annual statistical publication on financial assets and liabilities of Indian households, bank FDs account for nearly 50% of average household savings with life insurance policies a distant second (source: RBI Quarterly Estimates of Household Financial Assets and Liabilities, March 2018). However, fixed deposit interest rates have been declining over the years and the long term outlook on interest rates is negative. This is a cause of concern for many investors who depend on FD interest for income or for accumulating a corpus.

Traditional investment schemes – Declining low real returns

Most people in India remain invested in sub-optimal assets in the long term. For example, we buy 20 – 25 year life insurance endowment policies. Historical data shows that IRR of endowment plans are only 5 – 6% (source: LIC historical bonus rates for traditional plans). Adjusted for inflation, the real returns from these investments are very low – close to zero. Bank Fixed Deposits and Government (Post Office) Small Savings Schemes are two of most favourite long term investments for most investors. Current FD rates are in the range of 6 – 6.75%. Further FD interest income is fully taxable @ income tax rate of the investor. For investors in the highest tax brackets, the inflation adjusted post tax returns are close to zero. Over the past 20 years, bank FD interest rates have come down by around 40% from 10 – 11% in 1999 to around just 6 – 6.75% in 2020 (see the chart below).

Source: SBI FD rates

Similarly Government Small Savings Schemes interest rates have come down from double digits to 7 – 8% over the last 20 years; moreover, the interest income from several Government Small Savings Schemes is taxable as per the income tax rate of the investors.

Interest rates are likely decline further in the future

Declining interest rates are undoubtedly a cause of concern for many investors, especially senior citizens who rely on interest on their savings for post retirement income, but lower interest rates is a reality investors must have to confront with as the Indian economy grows in size. As emerging economies grow in size to become developed economies, their levels of inflation and interest rates tend to come. The declining interest rate trend seen over the last 10 years or so was not unique to our economy but was seen across most major economies around the world (see the table of 10 year Government Bond yields of different countries below).

Source: Nippon India MF

In 2019 India overtook UK and France to become the 5th largest economy in the world. According to UK based Centre for Economic and Business Research, India is projected to overtake Germany and Japan to become the 3rd largest economy after United States and China in the next 10 – 15 years. Along with growth in GDP, we expect that interest rates in India will come down substantially in the future.

What should investors do – lock in prevailing rates for long term

Visibility of returns is important for the success of investment goals. In equity for example, we know that the in the next 10 – 20 years, the Sensex will be several times than what it is today. Therefore, in equity, it is always prudent to invest with a long investment horizon (volatility notwithstanding). Similarly in fixed income, we can say with the fair degree of confidence (based on historical trend and data from other economies as discussed above) that interest rates will come down in the future. To get visibility of returns it is prudent to lock-in the prevailing interest rates for as long as possible.

Re-investment risk in long term fixed income investments

Most investors have short to medium tenures for fixed income. For example - if the interest rates of 3 year and 10 year FDs are the same, investors are most likely to invest in a 3 year term deposit. The biggest drawback of short and medium term fixed income investing, which most investors are unaware of, is re-investment risk, i.e. you may re-invest the maturity proceeds at a lower interest rate. If you keep re-investing your maturity proceeds at lower and lower rates over a long period of time, you can lose quite a lot as we will illustrate with this example.

Mr A invests Rs 1 crore at current yields (assumed to be 6.5%) and locks in the yield for next 25 years. Mr B invests the same amount for 3 year period and keeps re-investing every 3 year at prevailing yields. Let us assume yields fall by 250 bps (2.5%) over the next 25 years. The chart shows the growth in investment of Mr A and B. You can see that Mr A’s corpus (blue line) grew to Rs 5.43 crores versus Rs Mr B’s corpus of (Rs 4.18 crores), almost Rs 1.3 crores higher.

Source: Nippon India MF

Nippon India Nivesh LakshyaFund – Fund Strategy

Debt funds avoid re-investment risk by holding securities (bonds, NCDs etc) till maturity but most long duration funds take duration calls i.e. invest in bonds of different maturities depending on expected interest rate changes to generate higher returns from bond price appreciation. Nippon India Nivesh Lakshya Fund is long duration with a difference. The scheme invests predominantly in long duration Government bonds (25-30 year maturities) and intends to hold these securities till maturity to lock-in the current yields for the long term. Portfolio will be rolled down i.e. incremental investments to be made in similar securities.

Nippon India Nivesh Lakshya Fund – Suitable for all interest rate scenarios

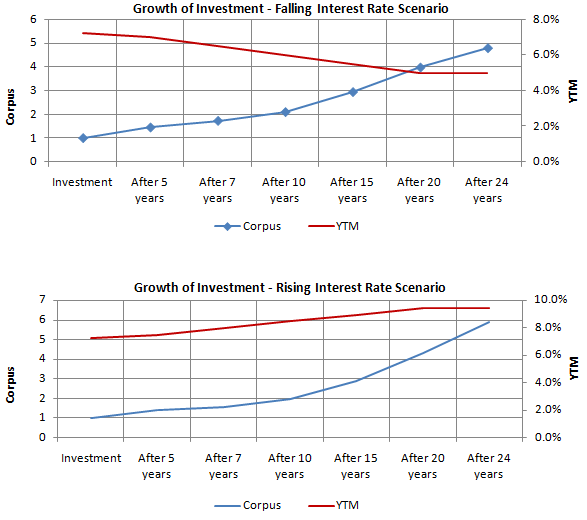

Many investors think that long duration funds are suitable only in falling interest rate regime. This is a misconception. Yields can be very volatile in the short term (12 – 24 months) but are less so in the long term.In fixed income investments both price change and yields come into play, and over long periods of time, the effect of price change (due to interest rate movements) is much less compared to the effect of yields on absolute returns. The chart below shows the growth of Rs 1 lakh investment over different long tenures in both rising and falling interest rate scenarios.

Source: Nippon India MF, Advisorkhoj Analysis

Regardless of the interest rate movement, return on investment tends to be similar in both rising & falling interest rate scenarios over the reasonably long period like 10 years, as it can be evidenced in the above charts. By investing for long tenures, you can insulate your portfolio from unknowns like interest rate risk.

Benefits of Nippon India Nivesh Lakshya Fund

- Visibility of Returns, if investments held till maturity of the underlying papers. We have explained the concept of yield to maturity (YTM) in our blog. For benefit of investors, who are new to Advisorkhoj, YTM is the expected return on investment if you hold a fixed income security (bought at current price) till maturity. The current YTM of the scheme portfolio is 7.17%. You can get this yield (adjusted for expense ratio) for the next 20 – 25 years, if you remain invested in the fund. Unlike funds which take duration calls, Nippon India Nivesh Lakshya Fund will not sell securities to benefit from price movement but continue to accrue the current yields till the maturity of the security.

- Long-term locking in of prevailing interest rates. The current yield of 8.13% coupon Government bond maturing in 2045 is 7.18% (scheme portfolio YTM is currently 7.17%). You can lock in these for a long period of time, irrespective of interest rate changes. We have seen earlier that the long term trend of interest rates is declining and will continue to decline in the future.

- Flexibility to withdraw investments any time at prevailing market prices. Investors should note that scheme NAV at any point of time will depend on the prevailing market prices of the underlying securities. Prices can go up or down depending on the interest rate situation and other factors – investors should decide accordingly depending on their needs. Nevertheless, the flexibility to withdraw provides an easy liquidity facility for investors not available in several traditional schemes like NSC, PPF, life insurance policies etc.

- Benefit of Indexation: One of the biggest advantages of debt funds is tax advantage in long term capital gains. While interest from bank FDs and several Government Small Savings Schemes are taxable as per the income tax rate of the investor, long term capital gains in debt funds (holding period of more than 3 years) are taxed at 20% after allowing for indexation benefits. Indexation benefits can reduce your tax obligations and reduce the effective tax rate

- Can be used to draw out annuities at current (high) yields, using Systematic Withdrawal Plan (SWP). You can get regular fixed cash-flows from your invest in Nippon India Nivesh Lakshya Fund using SWP. The balance units after each SWP instalment will continue to accrue the current (high) yields. Also for withdrawals made after 3 years from the date of investment, you can get the benefits of long term capital gains tax. As such, SWP from Nippon India Nivesh Lakshya Fund can be an excellent investment option for senior citizens who are looking for post retirement stable income for long periods of time.

Summary

In the approximately 18 months since inception, Nippon India Nivesh Lakshya Fund has given 16.2% CAGR returns (15.7% CAGR returns in the last 1 year). The scheme can be volatile in the short term depending on the interest rate regime, but as discussed in this blog post, we should always a very long term goal oriented view for investing in this scheme. In conclusion, we will compare some features of the scheme with other long term fixed income investing options.

Investors should consult with their financial advisors if Nippon India Nivesh Lakshya Fund is suitable for their long term financial goals.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Why investments in large cap based index funds and ETFs matter in your portfolio

- Importance of staying invested in the choppy market

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY