Rolling down SDLs are good long term fixed income investment solutions

Debt mutual funds offer investors a variety of solutions for different types of risk profiles and investment needs. Investors usually have three considerations when investing in debt funds viz. low risk, higher returns compared to traditional investments and visibility of returns.

In this blog post, we will discuss “rolling down SDL”, a good investment solution for investors looking for better long term returns without significantly higher risk.

What are State Development Loans?

State Development Loans (SDLs) are bonds issued by the State Governments to meet their borrowing needs. They are similar to G-Secs which are issued by the Central Government (Government of India). Like G-Secs, SDLs do not have any credit risk because they are also sovereign; like the Central Government, States also have the power to impose taxes under the Constitution of India. So from a credit risk standpoint, SDLs are just like G-Secs. The yields (rate of interest) of SDLs are usually slightly higher than the yields of G-Secs.

What is maturity roll-down?

The shape of yield curve is usually upward sloping i.e. bonds of longer maturity give higher yields than a bond of lower maturity. If you buy a long dated bond (long maturity) and hold it, then you lock-in higher yield even as the bond maturity rolls down (reduces). Let us understand this with the help of an example. Let us assume a 10 year bond is available at 6.7% yield while 9 year bond is available at 6.5% yield. You invest in the 10 year bond. So after 1 year, your 10 year bond will effectively be a 9 year bond but with additional 0.2% yield. Since the duration of the bond reduces over time, the interest rate risk also reduces. At the same time, the price of the bond appreciates because investors will be ready to pay more for an older bond with higher yield and same residual maturity as a newer bond with lower yield and same maturity.

Benefits of roll-down strategy with SDLs

There are two types of investment strategy in long duration debt mutual funds (a) active duration management, wherein the fund manager takes duration calls based on the interest rate outlook (b) roll down strategy, which is essentially investing in long term SDLs or G-Secs and holding them till maturity. The benefits of roll-down with SDLs are as follows:-

- No interest rate risk if held till maturity: Interest rate changes will have any effect on your returns if you hold a bond till maturity. You will get coupons (interest) at regular intervals and the principal on maturity. Investors should note that the price of a bond may fluctuate with interest rate changes, but the price fluctuations will have no impact on your returns if you hold the bond till maturity.

- No credit risk: SDLs are issued by State Governments and have no credit risk. As mentioned these securities are also sovereign debt securities. There is no risk of default.

- Visibility of returns over long investment tenures: If you hold a bond giving a certain yield till maturity, your internal rate of return (IRR) will be the yield of the bond, irrespective of what future interest rates will be.

- Superior returns compared to traditional investments: The yields of SDLs are usually higher than interest rates of traditional fixed income investments. SDL yields in RBI’s auction held on 23rd March 2021 were in the range of 6.85%.

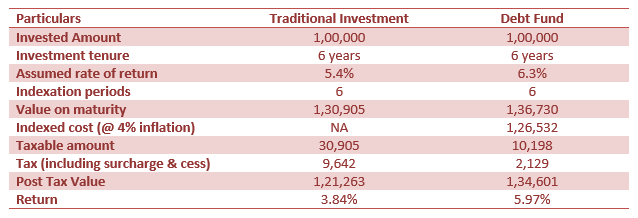

- Tax efficient returns over 3 years plus investment tenure: While FD interest is taxed as per the investor’s income tax rate, long term capital gains (investment holding period of 3 years or longer) of debt mutual funds. The table below provides illustration of indexation benefits in long term capital gains taxation

![Illustration of indexation benefits in long term capital gains taxation Illustration of indexation benefits in long term capital gains taxation]()

Why invest in roll-down with SDL funds now?

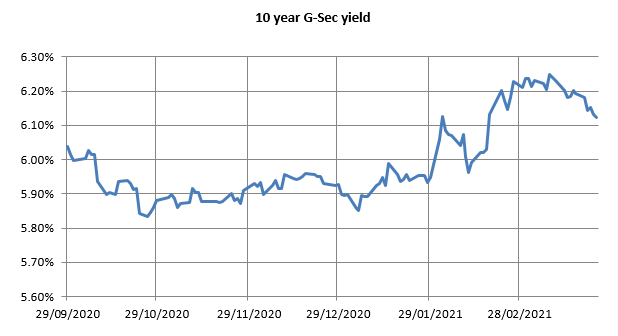

Investors can lock-in higher yields by investing in SDLs with a roll down strategy. Bond yields have spiked since the beginning of the year (see the chart below) and may rise further as US Treasury bond yields harden. As mentioned before SDL yields are usually slightly higher than G-Sec yields. You can lock-in these yields for the long term by investing in long dated bonds.

Source: in.investing.com

Conclusion

If you are worried about low interest rates, you may consider investing in debt mutual funds which have the potential of giving superior tax efficient returns over long investment tenures. In this post, we have discussed how SDLs with maturity roll down strategy can be good investment solutions with reducing risk over the investment tenure. You should have long investment tenures for this type of funds and should be prepared for short term volatility. You should consult with your financial advisor about debt funds which invest in SDLs with a roll down strategy.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY