Why invest in Motilal Oswal Nifty 500 Momentum 50 Index Fund NFO?

Motilal Oswal Mutual Fund has recently launched a New Fund Offer (NFO), Motilal Oswal Nifty 500 Momentum 50 Index Fund. As the name suggests, the fund will track the Nifty 500 Momentum 50 Index. The Nifty 500 Momentum 50 Index tracks the performance of 50 high momentum stocks in the Nifty 500 index. Momentum investing is one the most popular investing strategies globally; historical data shows that Indian equity market is a very much a momentum driven market, like many other equity markets across the world. In this article, we will review Motilal Oswal Nifty 500 Momentum 50 Index Fund NFO. The NFO opened for subscription on 4th September and will close on 18th September.

What is momentum in equity market?

Momentum is a physics concept, but when applied to capital markets, in very simple terms it means that prices follow a trend - if stock prices are rising, it may rise further and if stock prices are falling, it may fall further. The underlying hypothesis market momentum is that markets will continue to move in a particular direction for a longer period than what rational investors may be expecting. Why is this so?

Why momentum cannot be ignored?

The majority of investors exhibit irrational behaviour. Eugene Fama, the father of “Efficient Market Hypothesis”, acknowledged that “premier market anomaly is momentum. Stocks with low returns over the past year tend to have low returns over the next few months, and stocks with high past returns tend to have high future returns”. Positive momentum will make an overvalued stock, even more overvalued, and an undervalued stock, more fairly valued. Negative momentum will make an undervalued stock, even more undervalued, and an overvalued stock, more fairly valued. Momentum causes stocks to become overvalued or undervalued. This is the reality of equity market which cannot be ignored, but you can certainly take advantage of it.

How momentum investing works?

It works on price trends. The old Gujarati saying, “Bhav Bhagwan Che (Price is Almighty)” is apt for momentum investing. In momentum investing, you will buy when market is trending upwards and sell when market is trending downwards. Price is all important in momentum investing. There is no concern for company’s fundamentals in momentum investing. Momentum investing is essentially “buy high and sell higher”.

How successful has momentum investing been as an investment strategy?

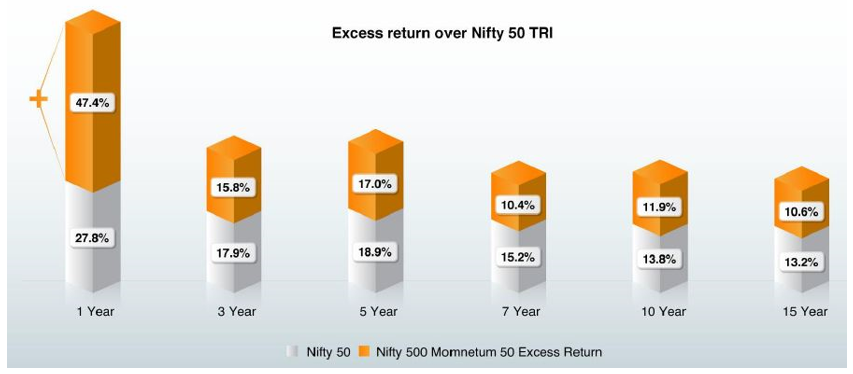

Given the nature of markets, especially here in India, momentum investing as a strategy can be expected to work well in bull markets, but how has momentum performed over long investment tenures? Momentum as an investment strategy has been extremely successful in creating excess returns over the market benchmark index (Nifty 50), but it has also been successful over very long investment tenures like 5 years, 7 years, 10 years etc (see the chart below). As mentioned earlier, Nifty 500 Momentum 50 Index comprises of 50 high momentum stocks from Nifty 500 universe.

Source: Motilal Oswal MF, as on 31st July 2024

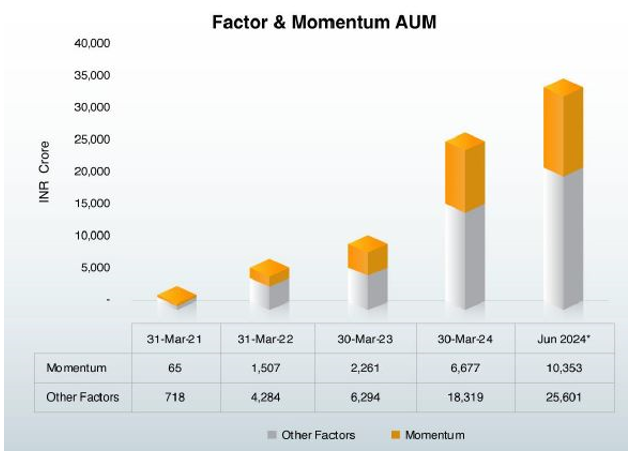

Momentum investing is rapidly growing in India

Factor indices are constructed based on quantitative, rule based investment strategies based on factors which historically driven portfolio returns and risk. Factor indices are also known as strategy indices or smart beta indices. Factor indices select stocks from the constituents of a certain benchmark index like Nifty 50, Nifty 500 etc based on certain factors like Momentum, Volatility, Beta, Alpha, Dividend Yield, Value, and Quality etc. Though Factor investing is relatively new in India, however out the total AUM in factor based passive funds, Momentum Funds have the highest share (see the chart below)

Source: Motilal Oswal MF, as on 30th June 2024

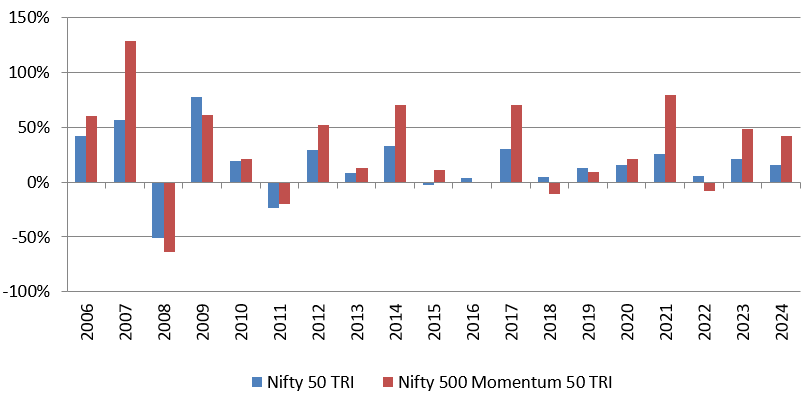

Consistency of outperformance versus Nifty

The momentum index, Nifty 500 Momentum 50 Index Fund, outperformed Nifty 50 TRI in 12 out the last 19 years.

Source: NSE, as on 31st July 2024

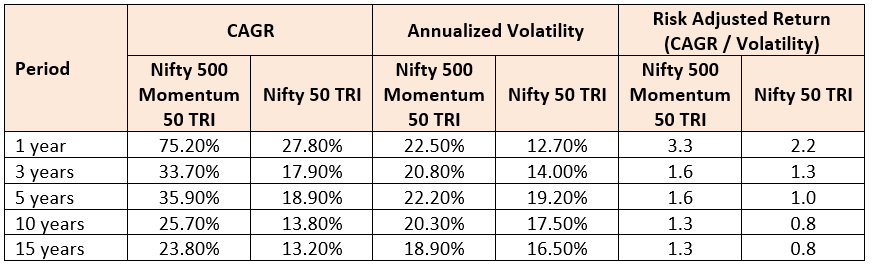

Superior risk adjusted returns

Source: Motilal Oswal MF, as on 31st July 2024

Why invest in Motilal Oswal Nifty 500 Momentum 50 Index Fund?

- Offer exposure to Momentum from universe of large cap, mid cap and small cap stocks

- Low cost exposure to Momentum factor

- Rules based and Transparent methodology

- Potential to outperform in upward trending markets

- You do not need demat account to invest in Motilal Oswal Nifty 500 Momentum 50 Index Fund.

- You can invest in this fund through SIP.

- You redeem your units with the AMC instead of selling it the stock exchange.

Who should invest in Motilal Oswal Nifty 500 Momentum 50 Index Fund?

- Investors looking for capital appreciation over long investment tenures through passive investing.

- Investors who want to invest in a factor index based on momentum strategy.

- Investors with very high risk appetites.

- You should have minimum investment tenure of 3 to 5 years.

- Investors should consult with their financial advisors or mutual fund distributors if Motilal Oswal Nifty 500 Momentum 50 Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

LATEST ARTICLES

- Motilal Oswal Multicap Fund: Outperforming the benchmark

- Motilal Oswal Large Cap Fund: One of the best performing large cap funds for current market conditions

- Motilal Oswal Innovation Opportunities Fund: Leveraging the innovative investment opportunities for long term growth

- Motilal Oswal ELSS Tax Saver Fund: One of the best performing ELSS

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY