Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

Nifty 50 is the most popular stock index in India. The Nifty 50 and the Sensex are known as the barometers of the stock market. Obviously passive funds tracking Nifty are very popular with investors. In the ETF space, Nifty 50 ETFs dominate in terms of assets under management (AUM) due to institutional investments e.g. EPFO. Even among index funds, which according to a Motilal Oswal survey are the preferred passive investment vehicles for retail investors, Nifty 50 index funds account for the highest AUM. As on 31st March 2024, Nifty 50 and Nifty Equal Weight 50 index funds account for 53% of equity index funds AUM (source: Advisorkhoj Research, based on AUMs declared by the AMCs as on 31st March 2024).

While Nifty 50 may continue to be India’s flagship index for years to come, investors should also explore the broader market represented by the Nifty 500 index, which comprises of the Top 500 companies. In this article, we will discuss why you should have Motilal Oswal Nifty 500 Index Fund (the only index fund tracking Nifty 500 index) in your investment portfolio.

Why you need to look beyond Nifty 50?

- Nifty 50 represents the Top 50 companies by market capitalization. Nifty 50 does not include 50 other large cap stocks (Nifty Next 50), midcap stocks (101st to 250th stocks by market cap) and small cap stocks (251st and smaller stocks by market cap).

- Nifty 50 is dominated by relatively few sectors. Financials, IT, Oil & Gas, FMCG, Auto, Construction, Healthcare, Metals and Telecom account for 90% weight of Nifty 50 (source: NSE, Nifty Factsheet, as on 31st March 2024).

- Nifty 50 is dominated by relatively few heavy weight stocks. The Top 10 stocks of Nifty 50, HDFC Bank, RIL, ICICI Bank, Infosys, L&T, TCS, ITC, Bharti Airtel, Axis Bank and SBI account for more than 50% weight in the Nifty 50 index (source: NSE, Nifty Factsheet, as on 31st March 2024).

- Nifty 50 stocks are large cap stocks. While large cap stocks are less volatile, midcap and small cap stocks offer higher growth potential.

Why invest in Nifty 500?

- Nifty 500 provides exposure to a much broader universe of stocks (top 500 companies) compared to top 50 companies in Nifty 50. Nifty 500 covers more than 90% of India’s listed universe.

- Nifty 500 provides more diversified sector exposure. While Financials, IT, Oil & Gas and FMCG account for more 65% weight of Nifty 50, Nifty 500 provides exposures to more than 20 sectors, including sectors where Nifty 50 companies have no presence e.g. capital goods, realty, textiles, media & entertainment, consumer services etc.

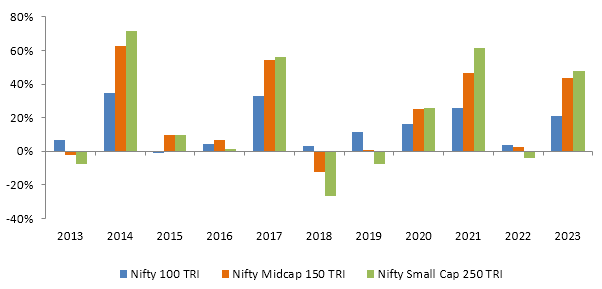

- Nifty 500 provides exposure to all 3 market cap segments e.g. large cap, midcap and small cap. Historical returns data shows that different segments of the market outperform / underperform in different market cycles (see the chart below). The large cap part of Nifty 500 can provide relative stability in volatile markets, while the mid and small caps can provide higher growth.

Source: National Stock Exchange, as on 31st December 2023

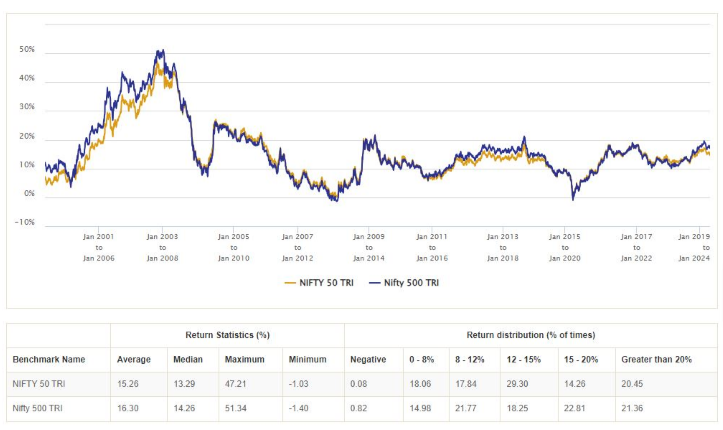

- Nifty 500 TRI has outperformed Nifty 50 TRI over 5 year investment tenures across different market / investment cycles. The chart below shows the 5 year rolling returns of Nifty 50 TRI and Nifty 500 TRI over the past 25 years (since the inception of the Total Return Indices, 1999). You can see that probability of getting 15%+ is significantly higher in Nifty 500 TRI, albeit with higher volatility.

Source: Advisorkhoj, National Stock Exchange, as on 31st March 2024

Nifty 500 and the India Growth Story

- Many investment experts believe that Nifty 500 index will be able to capture benefits from India Growth Story more than Nifty 50. An important part of the Growth Story is India’s potential of emerging as a major global manufacturing hub. Service sector industries account for than more than 50% of Nifty 50 index; the weight of manufacturing industry sectors is significantly higher in Nifty 500 index.

- In the long term, Nifty 500 will provide greater opportunities to benefit from the global supply chain and trade realignments that are currently underway e.g. China + 1 strategy.

- The broader market stocks e.g. midcaps and small caps are likely to benefit more from the structural initiatives of the Government e.g. Atmanirbhar Bharat, Make in India, Digital India, Atal Innovation Mission, Defence sector reforms, labour law reforms etc.

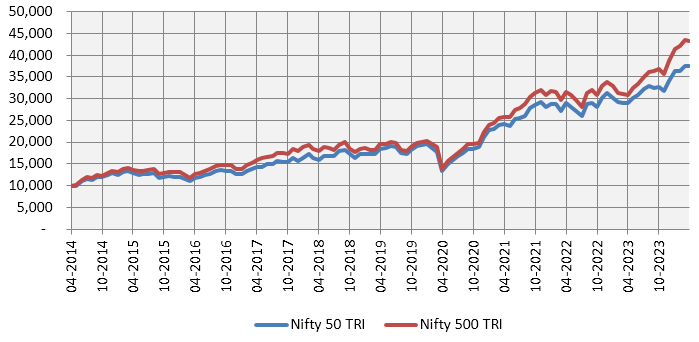

- Over the past 10 years, Nifty 500 has created more wealth than Nifty 50 (see the chart below). We expect the trend to continue in the years to come for the reasons mentioned below.

Source: National Stock Exchange, as on 31st March 2024

Motilal Oswal Nifty 500 Index Fund

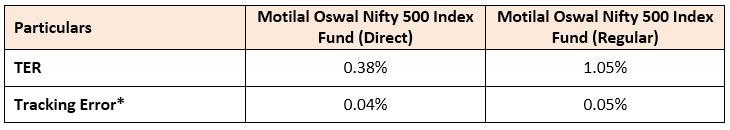

Motilal Oswal Nifty 500 Index Fund is the only index fund tracking the Nifty 500 index. The fund was launched in 2019 and has given 19.5% and 20.3% CAGR returns for the regular and direct plans respectively. The key statistics of the fund are as follows:-

Source: Motilal Oswal, Advisorkhoj Research, as on 31st March 2024. *From 25 Apr 2023 to 24 Apr 2024. Disclaimer: Past performance may or may not be sustained in the future

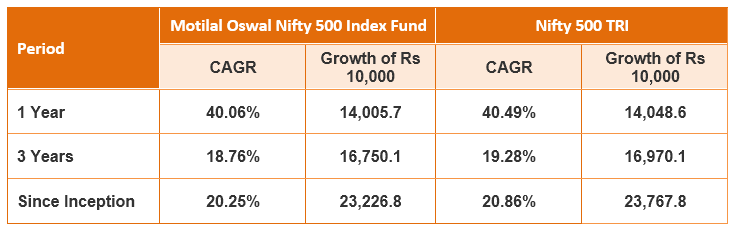

Motilal Oswal Nifty 500 Index Fund Performance

Source: Motilal Oswal, Advisorkhoj Research, as on 31st March 2024. Disclaimer: Past performance may or may not be sustained in the future

Why invest in Motilal Oswal Nifty 500 Index Fund?

- Broadest equity market exposure covering 90% of India’s listed universe.

- Passive exposure to companies that are likely to benefit from long India Growth Story.

- The only index fund tracking Nifty 500 index.

- Low tracking errors.

- Low cost and no unsystematic risks.

- You can invest from your regular savings through Systematic Investment Plan (SIP).

Investors should consult with their financial advisors or mutual fund distributors if Motilal Oswal Nifty 500 Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Why index funds make a good investment choice

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

- Motilal Oswal Flexicap Fund: Superb turnaround for this top performing fund

LATEST ARTICLES

- Motilal Oswal Multicap Fund: Outperforming the benchmark

- Motilal Oswal Large Cap Fund: One of the best performing large cap funds for current market conditions

- Motilal Oswal Innovation Opportunities Fund: Leveraging the innovative investment opportunities for long term growth

- Motilal Oswal ELSS Tax Saver Fund: One of the best performing ELSS

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY