Motilal Oswal Flexicap Fund: Superb turnaround for this top performing fund

Motilal Oswal Flexicap Fund is one of the Top 5 flexicap funds. In the last 1 year, the Fund gave 53.52% return outperforming its benchmark index Nifty 500 TRI (39.26% return) by a wide margin (source: Advisorkhoj Research, as on 30th April 2024).

Motilal Oswal Flexicap Fund has a decade of track record, celebrating its 10th anniversary recently. The fund focusses on high growth themes which are leading the markets and are expected the leverage on India’s Growth Potential. A high growth-oriented portfolio better suited to capture the wealth creation potential from the golden decade of India.

We have said a number of times in our blog that a fund may go through a period of underperformance for a variety of reasons, but the hallmark of a fund house with strong capabilities and processes, is that their funds are able to make recovery.

The performance of Motilal Oswal Flexicap Fund is a testimony of the inherent strengths of Motilal Oswal as an asset management company. The fund house has its skin in the game as the promoters of Motilal Oswal Mutual Fund have themselves invested more than Rs. 6,000 crores in the schemes of their asset management company. This inspires confidence among investors of the fund.

Source: Advisorkhoj Research

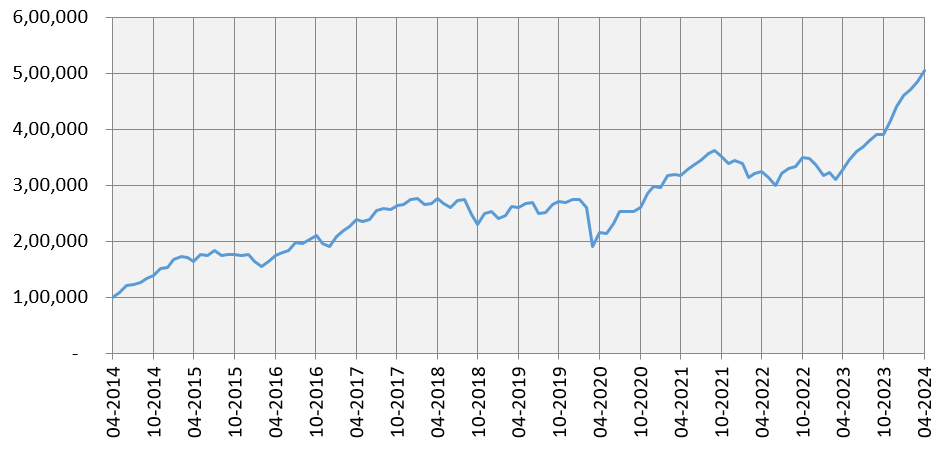

Wealth creation Track Record

If you had invested Rs 1 lakh at the time of its launch a decade back, your investment would have multiplied 5 times to more than Rs 5 lakhs (as on 30th April 2024). The wealth creation track record of this fund is a testimony of the growth potential of Indian equities across different market cap segments and the capabilities of Motilal Oswal AMC.

Source: Advisorkhoj Research

Rolling Returns

The chart below shows the 1 year returns of Motilal Oswal Flexicap Fund versus its benchmark index Nifty 500 TRI. Rolling returns is the most unbiased measure of mutual fund performance because rolling returns are across all market conditions. You can see that the fund, after a very consistent start, went through a period of underperformance versus the market benchmark index but has made a strong recovery.

Source: Advisorkhoj Rolling Returns

Superior Risk Adjusted Returns

Market capture ratio is a measure of the performance of a mutual fund relative to its benchmark index in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the scheme, while Down Market Capture Ratiotells us how much percentage of the market’s downside was capture by the scheme. Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of this Fund over the last 10 years.

The Up Market Capture Ratio of Motilal Oswal Flexicap Fund over last 10 years was 94% which implies that if the benchmark index went up by 1% in a month, then the scheme’s Net Asset Value (NAV) went up by 0.94%. The Down Market Capture Ratio of the fund was 83% which implies that if the benchmark index went down by 1% in a month, then the scheme’s Net Asset Value (NAV) went down by 0.83%. The market capture ratios of this Fund is a clear indication of strong risk adjusted returns of the fund.

Why invest in Flexicaps?

- Invest across the market cap spectrum without restrictions.

- Dynamic shift between Large cap, Mid cap and Small cap segments of the market.

- Market cap agnosticism provides diversification benefits.

- Risk mitigation.

- Market cycles of Large caps, Mid caps and Small caps outperforming/underperforming.

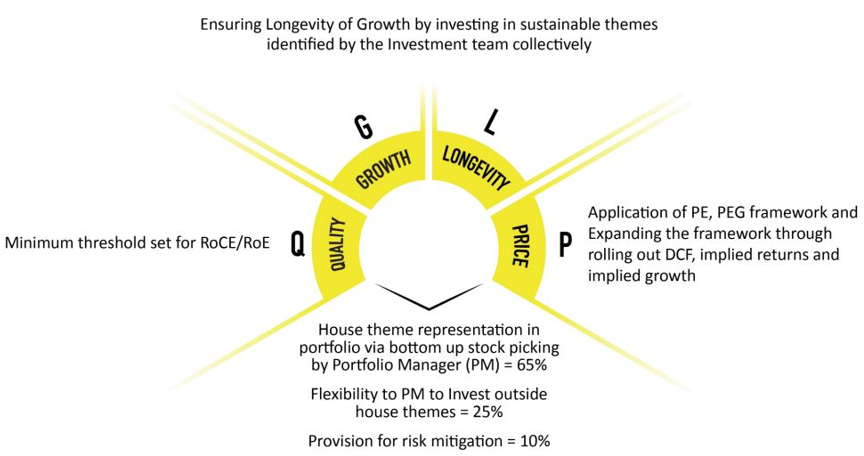

QGLP Investment Framework

Motilal Oswal MF follows a disciplined investment approach based on Quality (Q), Growth (G), Longevity (L) and a Price (P) framework.

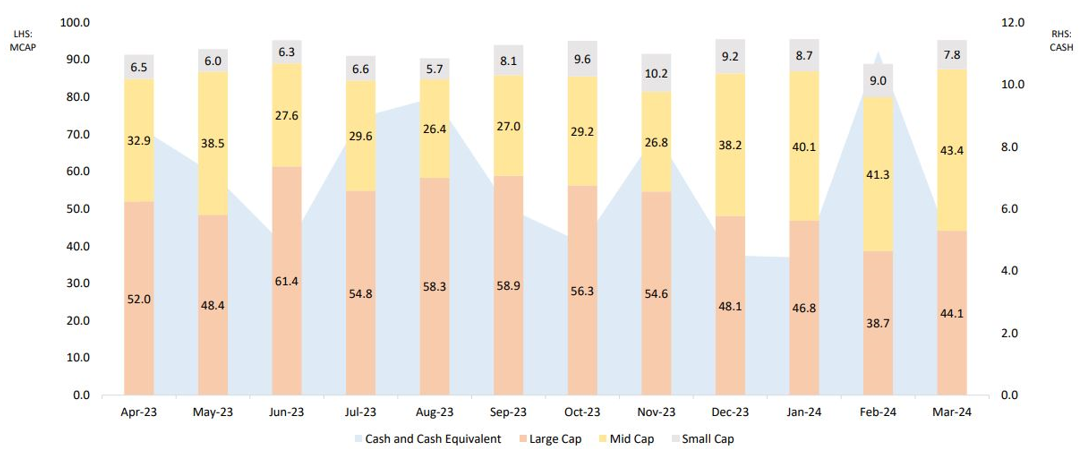

Active market cap allocations

Source: Motilal Oswal MF, as on 30th Apr 2024

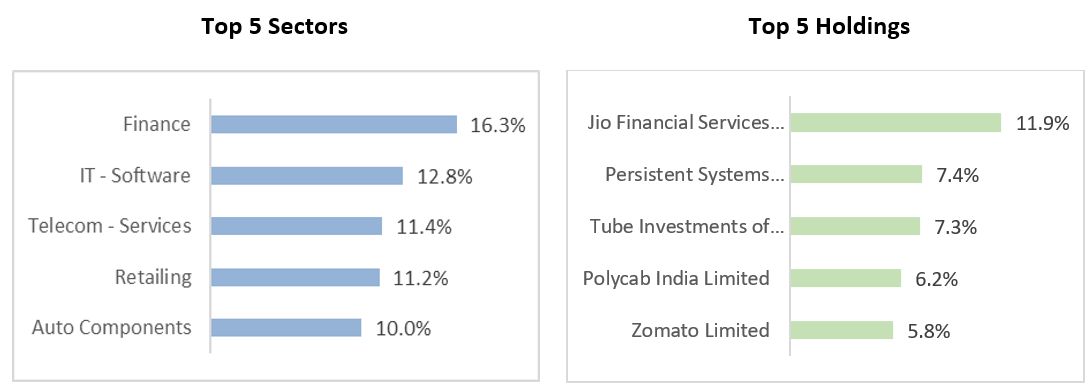

Current portfolio positioning

Source: Motilal Oswal MF, as on 30th Apr 2024.

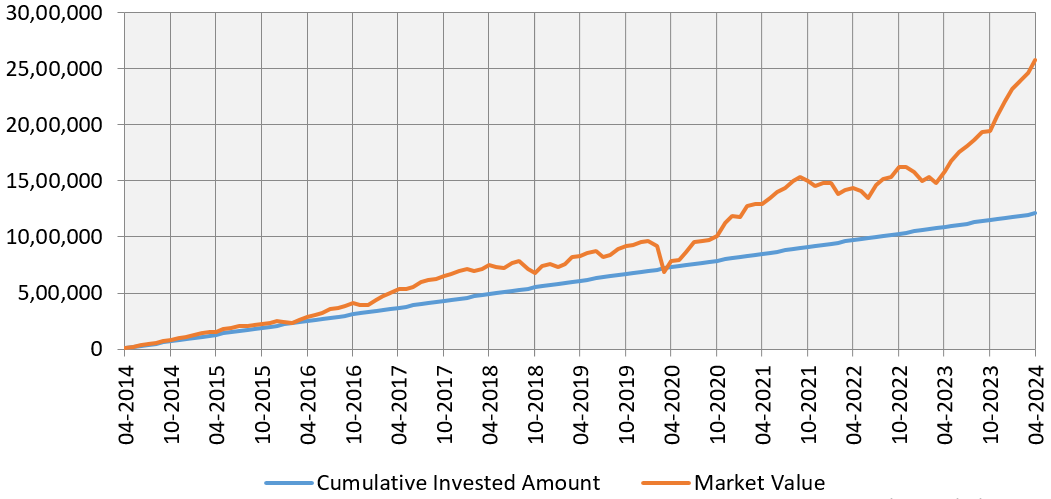

Wealth creation through SIP

The chart below shows the growth in value of Rs 10,000 monthly SIP since the inception of Motilal Oswal Flexicap Fund. With a cumulative investment of Rs 12.1 lakhs, you could have accumulated a corpus of Rs 25.78 lakhs in the last 10 years or so (as on 30th April 2024).

Source: Motilal Oswal MF, as on 30th April 2024.

Why invest in Motilal Oswal Flexicap Fund?

- The fund has a 10 year plus wealth creation track record.

- High conviction portfolio of around 25 stocks.

- The fund invests in the house identified high growth themes, which have proven to be wealth creators.

- Focus on quality and growth (QGLP investment framework).

- The promoters have skin the game (promoter of Rs 1,993 crores in the scheme, as on 28th March 2024).

Who should invest in Motilal Oswal Flexicap Fund?

- Investors with long term investment horizon i.e. 5 years or more.

- Investors with a high-risk appetite who can tolerate the short term volatility associated with equity investments.

- They are suitable for investors who want to invest from their monthly savings through SIP for their long term financial goals like children’s higher education, marriage, retirement planning, wealth creation etc.

- Investors who wish to avoid the complexities of determining allocation among large, mid, and small-cap stocks independently.

You should consult with your financial advisor, if Motilal Oswal Flexicap Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

LATEST ARTICLES

- Motilal Oswal Multicap Fund: Outperforming the benchmark

- Motilal Oswal Large Cap Fund: One of the best performing large cap funds for current market conditions

- Motilal Oswal Innovation Opportunities Fund: Leveraging the innovative investment opportunities for long term growth

- Motilal Oswal ELSS Tax Saver Fund: One of the best performing ELSS

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY