Motilal Oswal ELSS Tax Saver Fund: One of the best performing ELSS

Investors who opted for the Old Tax Regime can claim deductions of up to Rs 1.5 lakhs from their taxable income by investing in eligible schemes under Section 80C. Equity Linked Savings Schemes, which are market linked investments, offer tax savings and wealth creation opportunities for investors. In this article, we will review Motilal Oswal ELSS Tax Saver Fund, which is one the best performing ELSS.

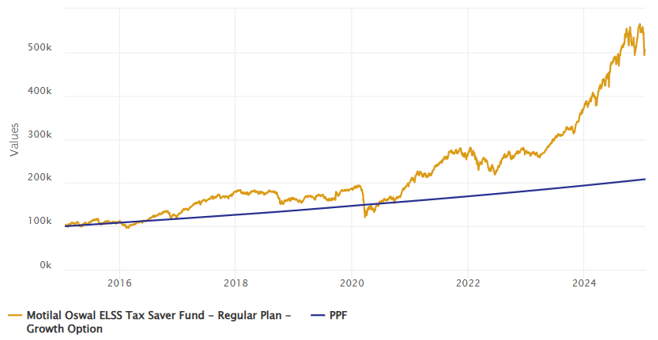

Higher wealth creation potential compared to PPF

The chart below shows the growth of Rs 1 lakh investment in Motilal Oswal ELSS Tax Saver Fund versus Public Provident Fund since the inception of the fund. You can see that despite higher volatility, the wealth creation potential of Motilal Oswal ELSS Tax Saver Fund is significantly higher over long investment tenure.

Source: Advisorkhoj Research, 17th January 2025

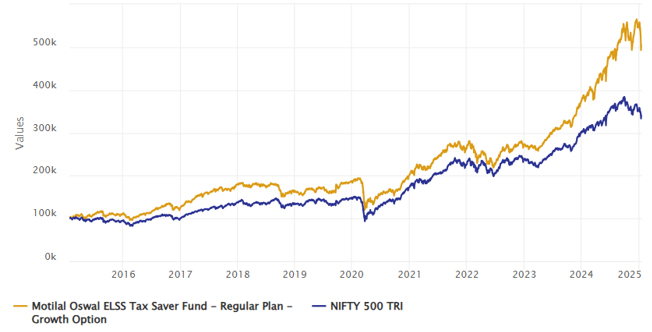

Outperformed the benchmark index

The chart below shows the growth of Rs 1 lakh investment in Motilal Oswal ELSS Tax Saver Fund versus it’s benchmark index Nifty 500 TRI since the inception of the fund. You can see that the fund has outperformed its benchmark.

Source: Advisorkhoj Research, as on 17th January 2025

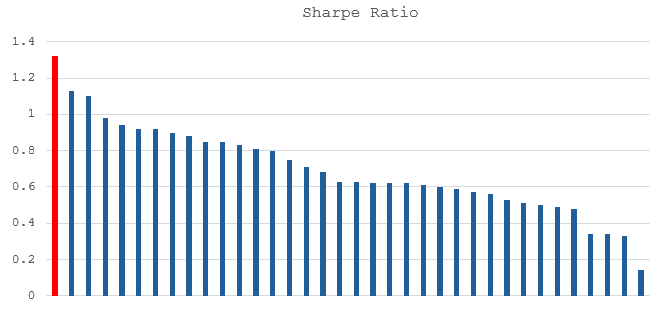

Superior risk adjusted returns

Sharpe ratio is a measure of risk adjusted returns. We looked at the Sharpe Ratio of ELSS funds which have completed 3 years. Motilal Oswal ELSS Tax Saver Fund (marked in red) has the highest Sharpe Ratio.

Source: Advisorkhoj Research, as on 31st December 2024

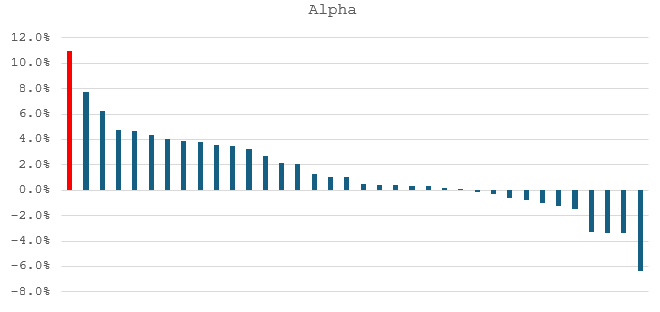

Motilal Oswal ELSS Tax Saver Fund (marked in red) also has highest alpha (risk adjusted returns relative to benchmark index) among all ELSS funds that have completed 3 years.

Source: Advisorkhoj Research, as on 31st December 2024

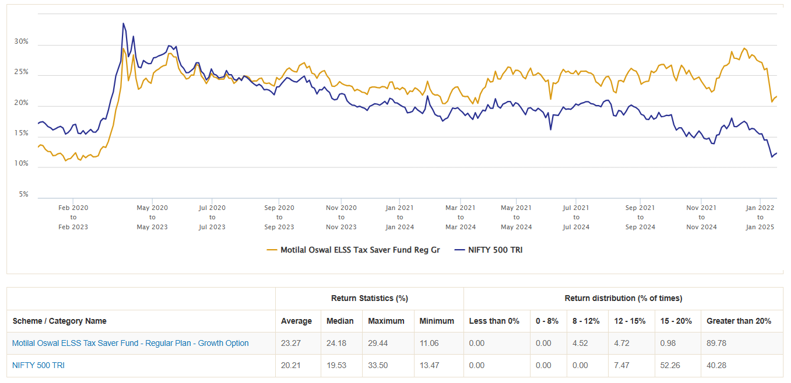

Consistent outperformance versus benchmark and peers

The chart below shows the 3 year rolling returns (ELSS has lock-in period of 3 years) of Motilal Oswal ELSS Tax Saver Fund versus its benchmark index over the last 5 years. You can see that the fund has beaten the benchmark index in different market conditions. The fund has given 15%+ CAGR returns in more than 90% of the instances (observations).

Source: Advisorkhoj Rolling Returns, 17th January 2025

The fund has also outperformed the category average rolling returns in different market conditions in the last 5 years.

Source: Advisorkhoj Rolling Returns, 17th January 2025

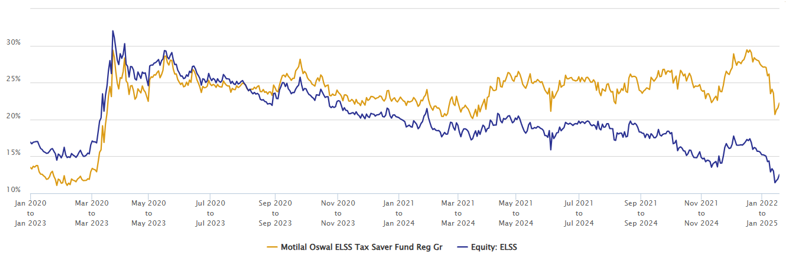

Consistently a top quartile fund

The graphic below shows the quartile rank of Motilal Oswal ELSS Tax Saver Fund for the last 12 quarters. The fund was in top quartile 9 times in the last 12 quarters. The fund has ranked in the top quartile for 7 consecutive quarters, including the quarter that end on 31st December 2024.

Source: Advisorkhoj Research, as on 31st December 2024

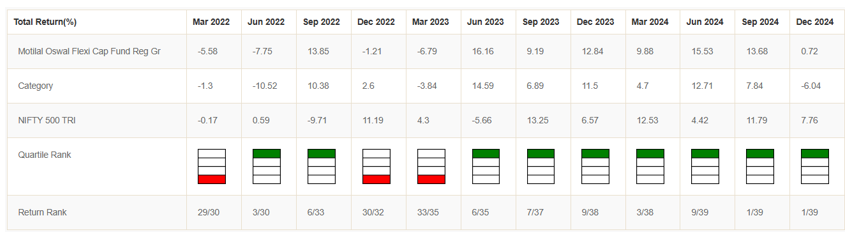

Wealth creation

The chart below shows the growth of Rs 10,000 SIP in Motilal Oswal ELSS Tax Saver Fund since the inception of the scheme. The SIP performance illustrates the wealth potential of the fund, while saving taxes every year.

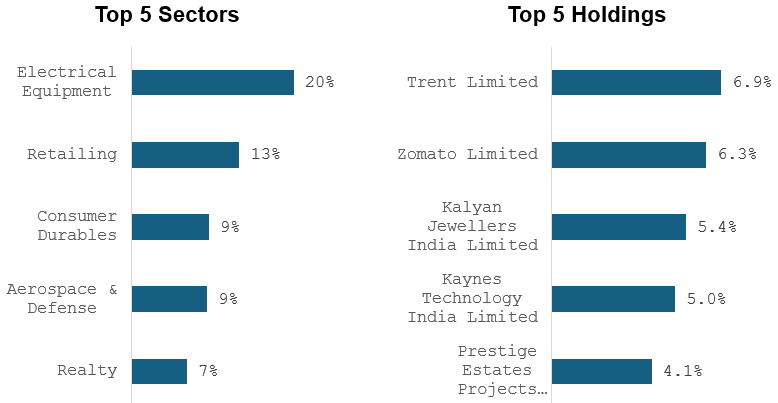

Portfolio positioning

High Quality portfolio of around 31 stocks with strong portfolio earnings growth. The fund has a high-quality portfolio, with focus on domestic growth. More than 70% of the scheme assets are invested in midcap and small cap stocks.

Source: Motilal Oswal MF, as on 31st December 2024

Who should invest in Motilal Oswal ELSS Tax Saver Fund?

- Investors looking to save taxes under Section 80C.

- Investors who want capital appreciation or wealth creation over long investment tenures

- The scheme has a lock-in period of 3 years. You cannot redeem units of the scheme before the completion of 3 years from the investment date.

- Investors with high-risk appetites

Investors should consult their financial advisors or mutual fund distributors if Motilal Oswal ELSS Tax Saver Fund is suitable for their investment needs.

To know more about Motilal Oswal ELSS Tax Saver Fund, click here.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

LATEST ARTICLES

- Motilal Oswal Multicap Fund: Outperforming the benchmark

- Motilal Oswal Large Cap Fund: One of the best performing large cap funds for current market conditions

- Motilal Oswal Innovation Opportunities Fund: Leveraging the innovative investment opportunities for long term growth

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Flexicap Fund: One of the best performing flexicap funds

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY