Motilal Oswal Flexicap Fund: One of the best performing flexicap funds

Motilal Oswal Flexicap Fund completed 10 years a few months back. It is the best performing flexicap fund in terms of 1 year returns and among the top quartile funds in terms of 3 year returns. Motilal Oswal Flexicap Fund was a top quartile fund for several years after the fund was launched. Then it went through a period of relative underperformance. We have said several times in the past that a fund may not always remain in the upper quartiles for a variety of reasons, but recovery in performance is the hallmark of a well managed fund. You can see that Motilal Oswal Flexicap Fund made a strong recovery in the last 2 years and is now again a top quartile fund. In this article, we will discuss why this fund has been able to reclaim its place back among the top performing funds.

Source: Advisorkhoj Research, as on 31st October 2024

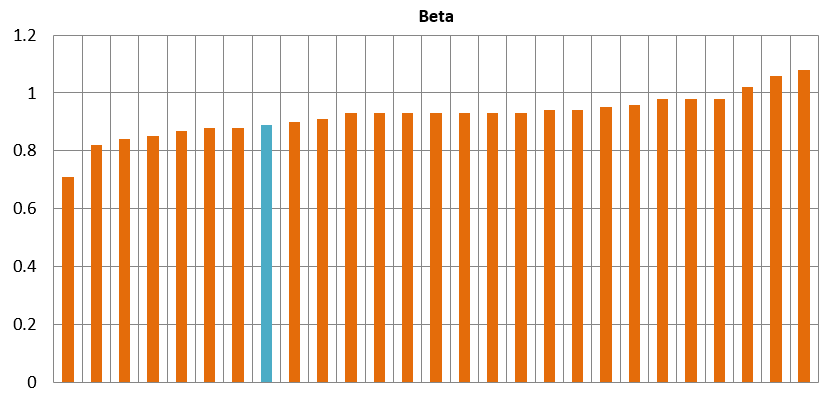

Lower systematic risks (beta)

We looked at the betas of all flexicap funds, which have completed 3 years (as on 31st October 2024). You can see that Motilal Oswal Flexicap Fund (marked in blue) has lower beta compared to most of its peer funds.

Source: Advisorkhoj Research, as on 31st October 2024

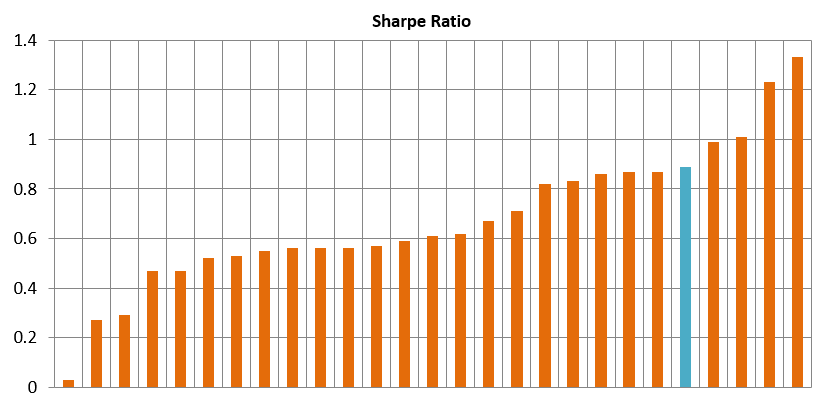

Superior risk adjusted returns

Sharpe ratio is a measure of risk adjusted returns of a mutual fund scheme. The chart below shows the Sharpe ratios of all flexicap funds, which have completed 3 years (as on 31st October 2024). You can see that Motilal Oswal Flexicap Fund (marked in blue) has higher Sharpe Ratio compared to most of its peer funds.

Source: Advisorkhoj Research, as on 31st October 2024

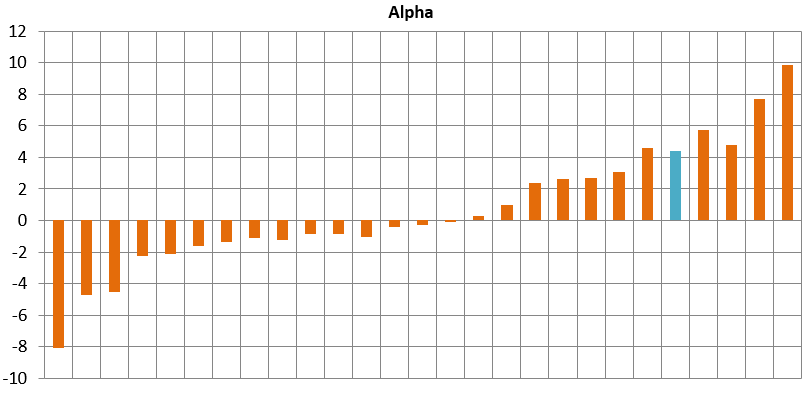

Higher alpha

Alpha is a measure of the performance of a fund versus its benchmark index on a risk adjusted basis. The chart below shows the alphas of all flexicap funds, which have completed 3 years. You can see that Motilal Oswal Flexicap Fund (marked in blue) was not only able to generate positive alphas, the alpha of the fund was higher than most of its peers.

Source: Advisorkhoj Research, as on 31st October 2024

Market capture ratios

Market capture ratio is a measure of the performance of a mutual fund scheme relative to its benchmark index in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund. Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of Motilal Oswal Flexicap Fund over the last 3 years.

The Up Market Capture Ratio of Motilal Oswal Flexicap Fund over last 1 year was 99% which implies that if the benchmark index went up by 1% in a month, then the scheme’s Net Asset Value (NAV) went up by 0.99%. The Down Market Capture Ratio of the fund was 77% which implies that if the benchmark index went down by 1% in a month, then the scheme’s Net Asset Value (NAV) went down by 0.77%. The market capture ratios of Motilal Oswal Flexicap Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

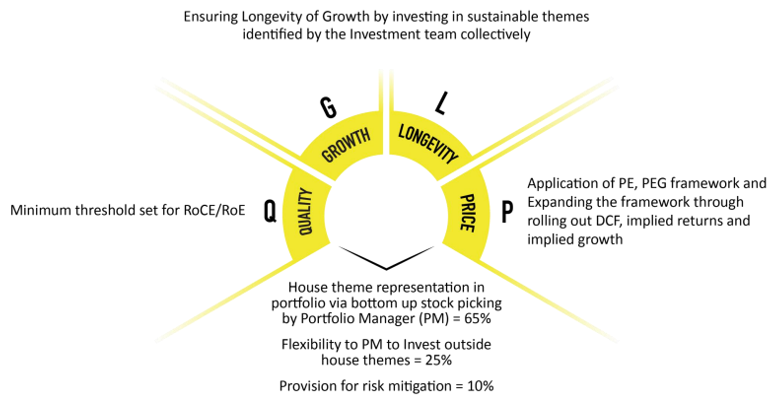

Investment strategy

- INVESTMENT PHILOSOPHY: Q-G-L-P

- INVESTMENT UNIVERSE: Consisting of, but not limited to opportunities from NIFTY 500 Universe

- CURRENT HOLDINGS: Sector Leaders Across Market Caps

- INVESTMENT FRAMEWORK: Winner Categories, Category Winners

- PORTFOLIO ORIENTATION: Economic Recovery Play

Disciplined Investing following “Q-G-L-P” Investment Process

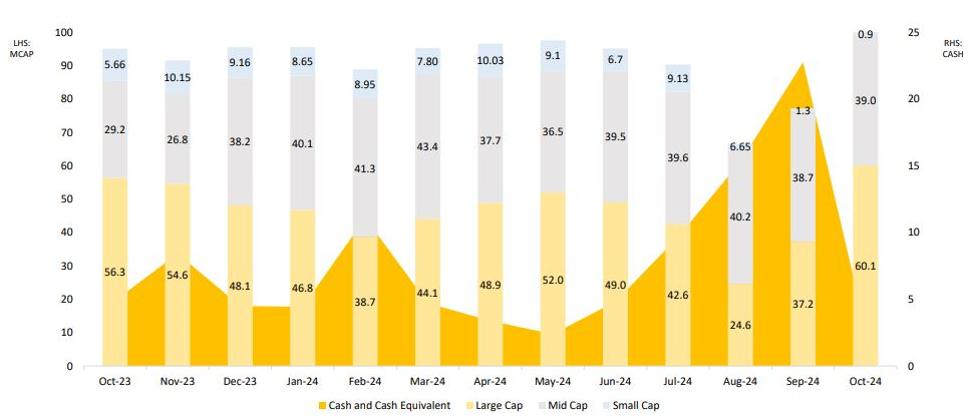

Market cap mix – Large cap tilt

Source: Motilal Oswal MF, as on 31st October 2024

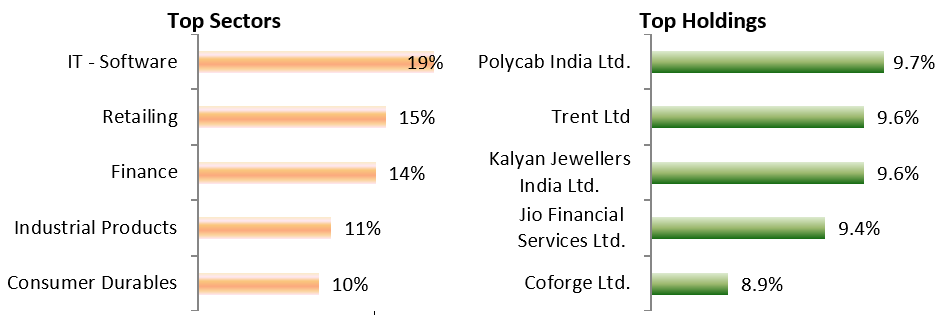

Current portfolio positioning

Source: Motilal Oswal MF, as on 31st October 2024

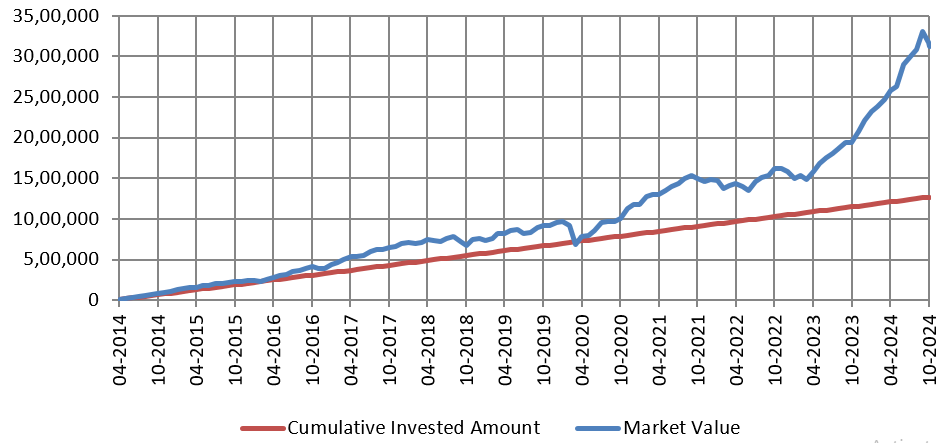

Wealth creation through SIP

The chart below shows the Rs 10,000 monthly SIP in Motilal Oswal Flexicap Fund since the inception of the fund. With a cumulative investment of Rs 12.7 lakhs, you could have accumulated a corpus of Rs 31.2 lakhs (as on 31st October 2024) over the last 10 years or so.

Source: Advisorkhoj Research, as on 31st October 2024

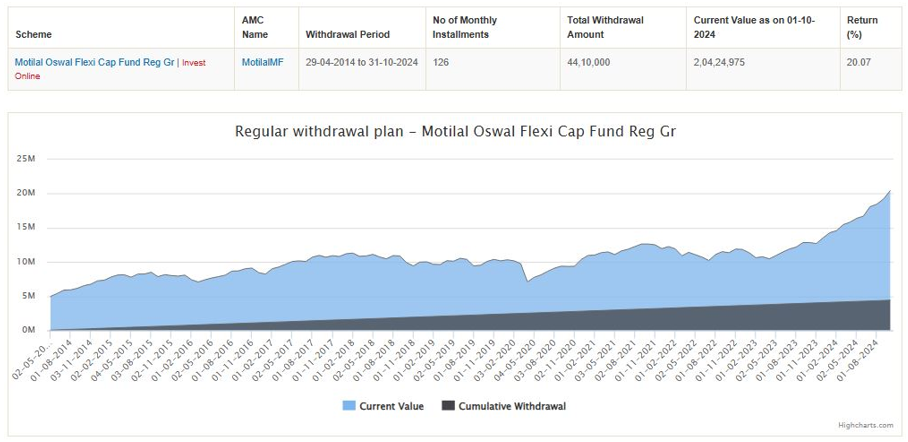

Strong SWP performance

The chart below shows the results of SWP from Motilal Oswal Flexicap Fund since the inception of the scheme. If you invested Rs 50 lakhs in Motilal Oswal Flexicap Fund and started a monthly SWP of Rs 35,000 from the fund, your investment would have grown to over Rs 2 crores despite cumulative withdrawal of nearly Rs 45 lakhs.

Source: Advisorkhoj Research, as on 31st October 2024

Why invest in Motilal Oswal Flexicap Fund?

- Flexi Cap nature allows flexibility to allocate across market capitalization

- High Quality portfolio of around 18 stocks with strong portfolio earnings growth

- 9+ year track record with outperformance in 5 out of 9 financial year periods

- Key sector allocation to participate in structural businesses like Banking, Finance and Auto

- Skin in the game – the promoters of Motilal Oswal have stake in the fund

Who should invest in Motilal Oswal Flexicap Fund?

- Investors looking for capital appreciation over long investment tenures

- Investors with high-risk appetites

- Investors with minimum 5-year investment tenures

- Depending on your investment needs, you can invest either in lump sum or SIP

Investors should consult with their financial advisors or mutual fund distributors if Motilal Oswal Flexicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

LATEST ARTICLES

- Motilal Oswal Multicap Fund: Outperforming the benchmark

- Motilal Oswal Large Cap Fund: One of the best performing large cap funds for current market conditions

- Motilal Oswal Innovation Opportunities Fund: Leveraging the innovative investment opportunities for long term growth

- Motilal Oswal ELSS Tax Saver Fund: One of the best performing ELSS

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY