Motilal Oswal Innovation Opportunities Fund: Leveraging the innovative investment opportunities for long term growth

Motilal Oswal Mutual Fund has launched a New Fund Offer, the Motilal Oswal Innovation Opportunities Fund an open-ended thematic fund. The NFO opened for subscription on 29th January 2025 and closes on 12th February 2025. Mutual Fund industry veterans Mr. Niket Shah, Mr. Atul Mehra, Mr. Sunil Sawant and Mr. Rakesh Shetty will be managing the funds. The scheme will aim to invest in companies that will benefit from the adoption of innovative strategies or following the innovation theme.

Meaning and Scope of innovation

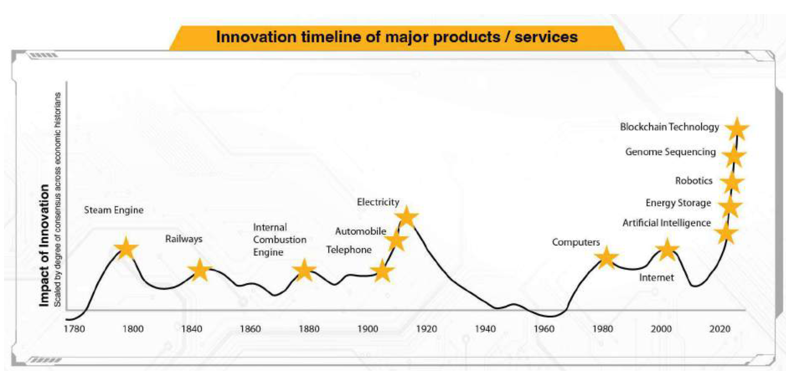

Innovation is the ability to create new products/ ideas, services, processes or improving on some existing models Innovation has shaped the progress of human civilization since the earliest days. From the discovery of fire to the invention of wheels, the use of metals, the industrial revolution and computers, innovation has been the bedrock of technological advancement. Therefore, the scope of innovation is all pervading. Innovation can be a part of advancement in areas as diverse as financial services, processes, or consumer markets. Any technological advancements, development of new and improved ideas, products and services are all indicative of innovation.

Source: Spark Invest, Motilal Oswal AMC

What is innovation-based thematic investing?

Today’s competitive landscape heavily relies on innovation. Businesses that make innovation an integral part of their business processes, can improve their market share, increase their productivity, revenues and profits.

Investing in Innovation theme, refers to a focus on companies that use innovative solutions to create new markets. This increases market share or enlarges an existing market. Investing in Innovation as a theme has the scope to touch all types of companies and benefit from them. Investment in innovation theme is gaining increasing popularity with global retail and institutional investors over the past few years.

Innovation is a diversified investment theme

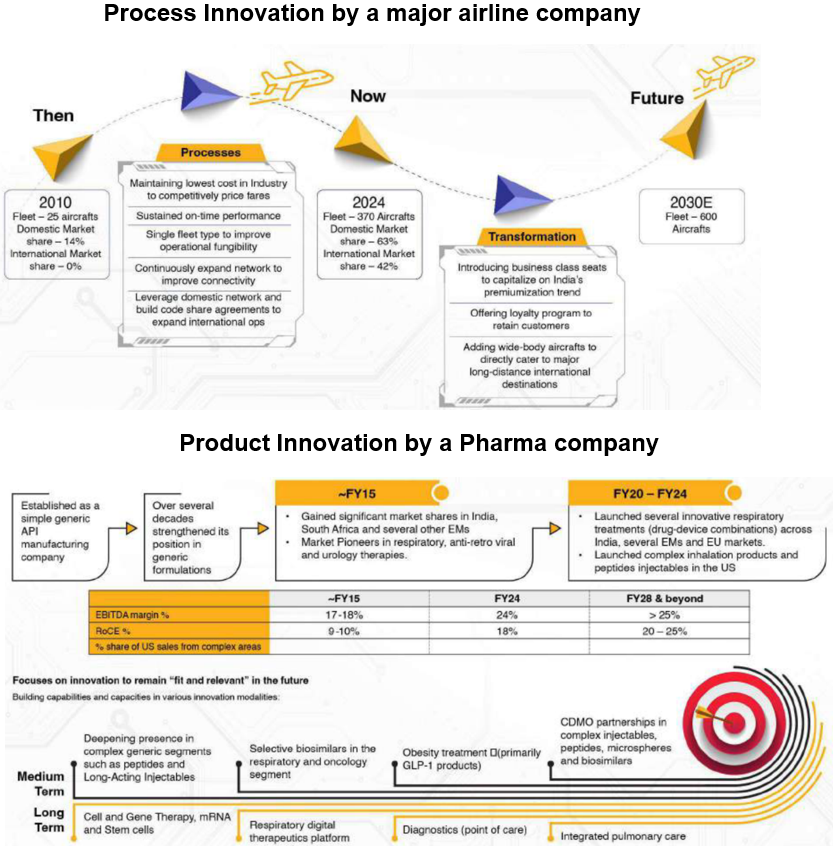

Many investors only associate technology with innovation. The NASDAQ 100 comprises of the most innovative listed companies in the United States. If you look at the sector composition of NASDAQ, you will see that innovators were spread across different sectors like tech, consumer discretionary, healthcare, telecom, industrials, consumer staples etc. Companies in India, across different industry sectors, have benefitted from innovations. Here are some examples of innovators in our market across diverse industry sectors.

Source: Spark institutional Equities. The above graphs/sectors/ companies are for illustration purpose only and should not be used for development or implementation of any investment strategy.

Innovation and wealth creation

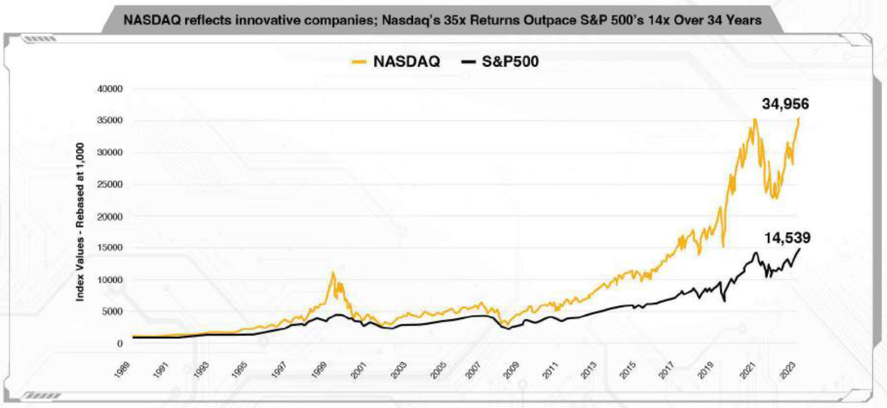

Historical returns data provides sufficient evidence that innovative companies gave significantly higher than average returns compared to the broad market. The chart below shows the returns of the NASDAQ 100 (comprising of companies that are focused not only on technology but also other sectors having an innovation factor present within) versus the S&P 500 (the broad market index of 500 large cap companies in the US). You can see that the NASDAQ-100 outperformed the S&P 500 by large margins across different time-scales. The chart shows that NASDAQ delivered 35X returns over a period of 34 years as compared to the 14X returns of S&P 500.

Source: MOSL Nasdaq Composite index. Bloomberg

India is at an Inflection point of Innovation

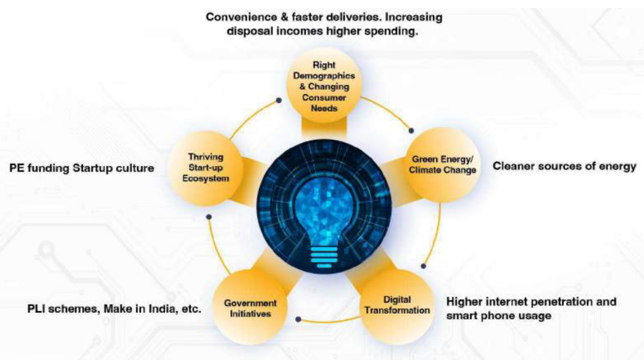

India is on the cusp of a ground breaking innovation era, driven by its thriving start up ecosystem, cutting-edge technologies like AI and fintech, and favourable government policies. With a young, dynamic workforce and increasing global investments, innovations across sectors like healthcare, renewable energy, and digital infrastructure are flourishing.

Source: Motilal Oswal AMC. The above graph is for illustration purpose only

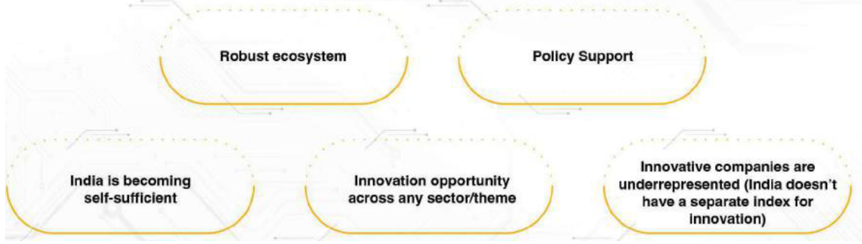

Drivers of Innovation in India

Source: Motilal Oswal AMC. The above graph is for illustration purpose only

Government’s flagship initiatives to create and promote innovation

Indian government has launched several flagship initiatives to foster innovation and boost economic growth. Programs like Start up India and Digital India have created an ecosystem encouraging entrepreneurship, digital transformation, and skill development. The Make in India initiative has attracted global investments, while Atal Innovation Mission fosters R&D and incubation centres. Tax incentives, eased compliance norms, and funding support through schemes like Fund of Funds for Start-ups (FFS) have catalysed innovation across fintech, AI, and green energy. By empowering businesses and individuals, these initiatives position India as a global innovation hub.

Source: Motilal Oswal AMC. The above graph is for illustration purpose only

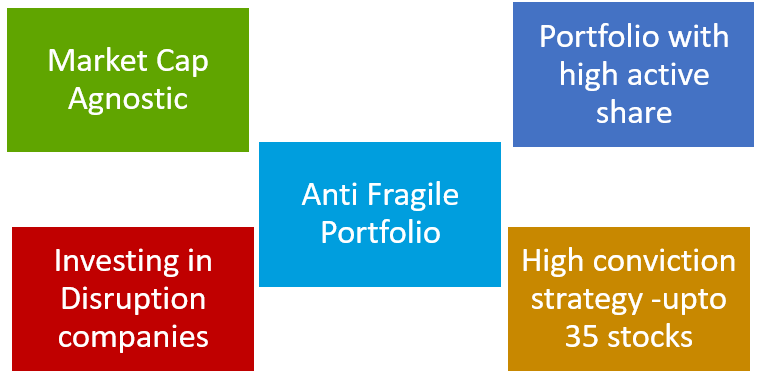

Motilal Oswal Innovation Opportunities Fund

The Motilal Oswal Innovation Opportunities Fund aims to generate returns by investing in stocks of target companies which are Innovators in developing new services, products or technologies, Adaptors who function by adopting new strategies or technologies and Enablers: for example, those who aim to provide infrastructure or tools for innovation. The scheme will target companies that drive market share growth.

The portfolio positioning of the fund is illustrated below.

Source: MOSLAMC

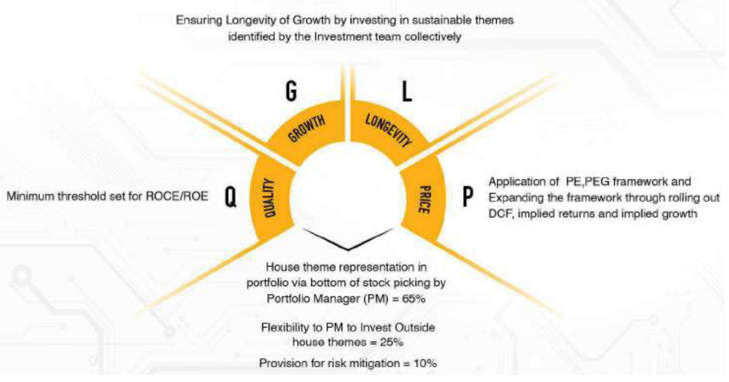

Disciplined investing following QGLP investment process:

The fund follows a disciplined investment strategy by following the QGLP investment process. (See illustration below). The QGLP philosophy ensures that the scheme invests is quality companies with a long-term growth potential.

Source: MOSLAMC

Who should invest in the Motilal Oswal Innovation Opportunities Fund?

- Investors looking to participate in India’s Innovation growth story with a true to label dedicated fund

- Investors looking to diversify their portfolio

- Investors who a have the risk appetite for investing in a thematic fund

- Investors who want an exposure to stocks of companies that will benefit from the adoption of innovative strategies or following the innovation theme

- Investors with a high to Very high-risk appetite

- Investors who can stay invested for the long term (minimum 5 to 7 years).

Consult your financial advisor or mutual fund distributor to understand why and how to include the Motilal Oswal Innovation Opportunities fund in your portfolio.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

LATEST ARTICLES

- Motilal Oswal Multicap Fund: Outperforming the benchmark

- Motilal Oswal Large Cap Fund: One of the best performing large cap funds for current market conditions

- Motilal Oswal ELSS Tax Saver Fund: One of the best performing ELSS

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Flexicap Fund: One of the best performing flexicap funds

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY