Motilal Oswal Large Cap Fund: One of the best performing large cap funds for current market conditions

Current market context

The stock market has been volatile from the last 4 to 5 months. The Nifty 50 is down almost 13% (as on 21st February 2025) from its 52-week high. Strong US Dollar and weaker than expected corporate earnings has triggered heavy FII sell-off. The market rebounded briefly after a favourable Union Budget which provided relief to the middle class through tax cut. However, the bear grip on the market has intensified in past few weeks due to concerns about the trade policies of the new Trump Administration.

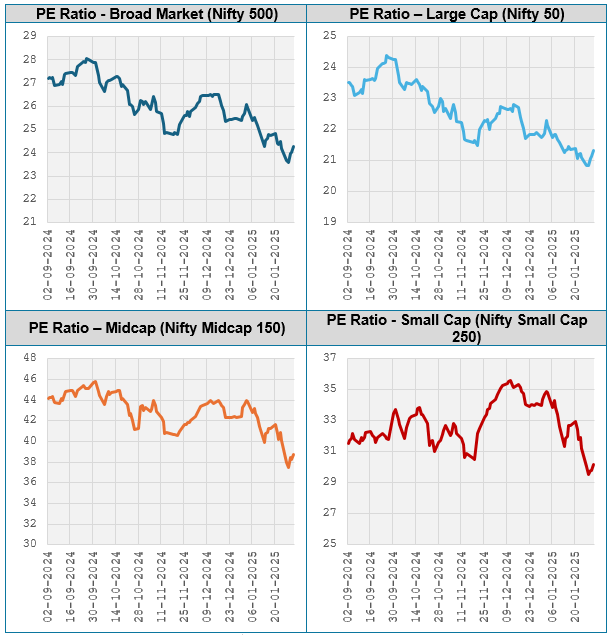

Large cap valuations are more attractive

Heavy FII selling impacted large caps more than other market cap segments, since FIIs invest mostly in large cap stocks. As a result, large cap valuations are more attractive on a relative basis compared to midcap and small cap stocks (see the charts below). In current market conditions, large cap funds can be suitable investment options for long term investors due to valuation comfort and greater resilience / stability in bearish market conditions. In this article, we will review Motilal Oswal Large Cap Fund, one of the best performing large cap funds in the last 1 year.

Source: National Stock Exchange as on 31st January 2025

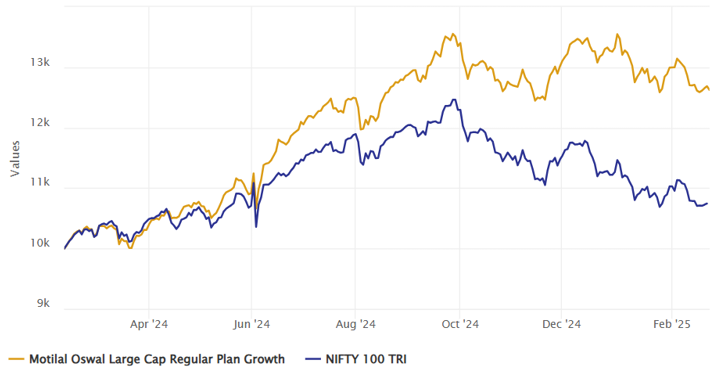

Motilal Oswal Large Cap Fund – Outperformed the benchmark index

The fund has recently completed 1 year. As per SEBI’s mandate large cap funds must invest 80% of their assets in the Top 100 companies by market capitalization. Motilal Oswal Large Cap Fund has outperformed the benchmark index since the inception of the fund (see the chart below).

Source: National Stock Exchange as on 21st February 2025

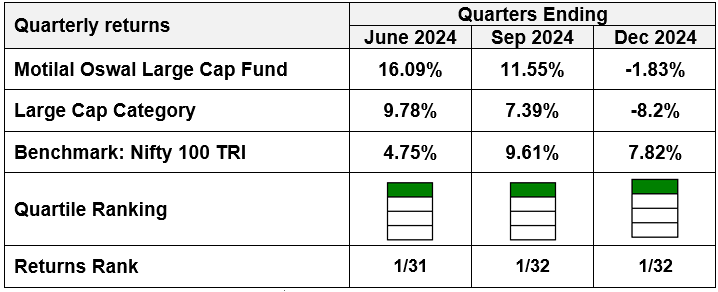

Consistently outperformed the peers – Top quartile performer

Motilal Oswal Large Cap Fund has consistently outperformed its peers and has been a top quartile ranked fund for the last 3 consecutive quarters. In fact, it has been the top ranked for 3 consecutive quarters (see the chart below).

Source: National Stock Exchange as on 31st December 2024

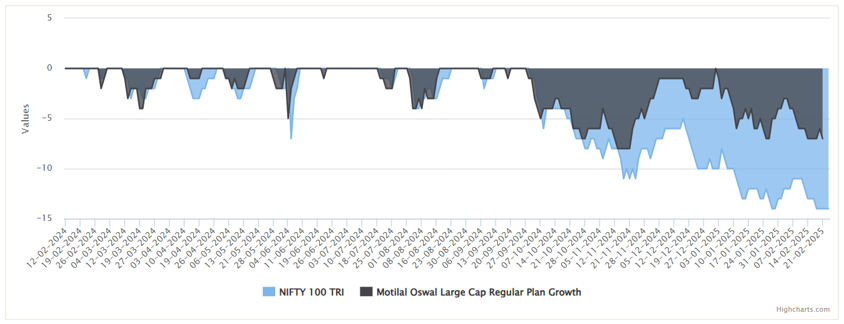

Limited downside risks for investors

The chart below shows drawdowns of Motilal Oswal Large Cap Fund versus its benchmark index, Nifty 100 TRI. You can see that the fund experienced significantly smaller drawdowns relative to the benchmark index.

Source: National Stock Exchange as on 21st February 2025

Superior risk adjusted returns

Up-Market Capture Ratio and Down-Market Capture ratio can give us a sense of risk adjusted returns. Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund. We looked at the market capture ratios of Motilal Oswal Large Cap Fund over the last 1 year.

The Up Market Capture Ratio of the fund over last 1 year was 165% which implies that if the benchmark index went up by 1% in a month, then the fund’s Net Asset Value (NAV) went up by 1.65%; in other words, the fund was able to beat the market in up-cycles. The Down-Market Capture Ratio of the fund was only 49% which implies that if the benchmark index went down by 1% in a month, then on an average, the fund’s NAV went down by only 0.49%; in other words, the fund was able to limit the downside risk of investors in falling markets.

Motilal Oswal Large Cap Fund – Salient Features

- Motilal Oswal Large Cap Fund will have a significantly higher active share (i.e. deviation from the weights of the benchmark index). Motilal Oswal Large Cap Fund will have active share of 60 – 80%.

- The portfolio of Motilal Oswal Large Cap Fund will be more concentrated relative to peer funds in its category. The fund invests in a focused portfolio of up to 30 high conviction stocks – higher potential of alpha creation.

- The Nifty 100 TRI have significantly higher weights in the Top 3 stocks by market capitalization. Motilal Oswal Large Cap Fund, on the other hand, has balanced diversification is equal weights in the high conviction portfolio stocks.

- Motilal Oswal Large Cap Fund aims to identify quartile Nifty 100 stocks and have an equally weighted portfolio of these stocks, such that these stocks comprise 80 – 85% of the fund portfolio.

- In addition, the fund managers will also invest in potential multi-bagger stocks and IPOs / newly listed companies (up to 15%).

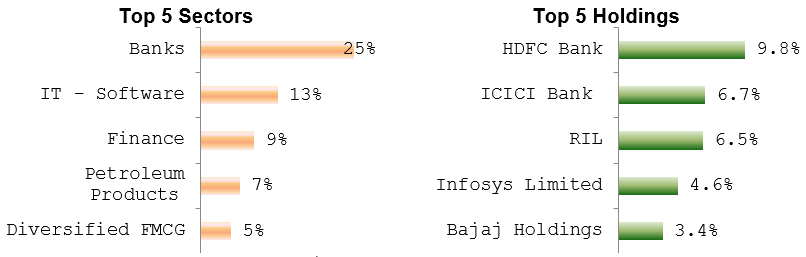

Current Portfolio Positioning

Source: Motilal Oswal Mutual Fund as on 31st January 2025

Who should invest in Motilal Oswal Large Cap Fund?

- Investors looking for capital appreciation over long-term investment horizon

- Investors with high-risk appetites

- Investors with minimum 5 years investment tenures

- This fund can be suitable for new / first time investors

- You can invest either in lump sum or through SIP

Investors should consult with their financial advisors or mutual fund distributors if Motilal Oswal Large Cap Fund is suitable for their investment needs.

To know more about Motilal Oswal Large Cap Fund, click here.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

LATEST ARTICLES

- Motilal Oswal Multicap Fund: Outperforming the benchmark

- Motilal Oswal Innovation Opportunities Fund: Leveraging the innovative investment opportunities for long term growth

- Motilal Oswal ELSS Tax Saver Fund: One of the best performing ELSS

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Flexicap Fund: One of the best performing flexicap funds

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY