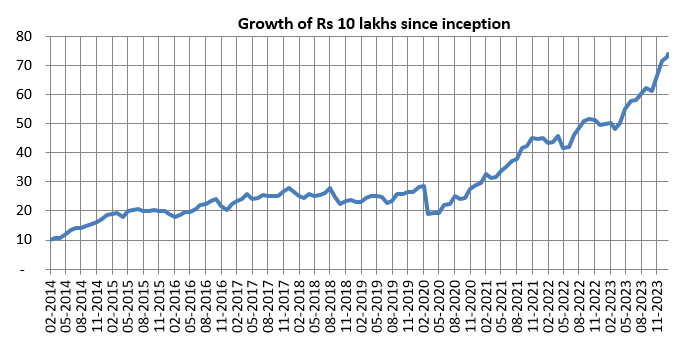

Motilal Oswal Midcap Fund: 7.4X in 10 years

Motilal Oswal Midcap Fund has an enviable wealth creation track record. If you had invested Rs 10 lakhs in Motilal Oswal Midcap Fund at the time of its inception, your investment would have grown in value to Rs 74 lakhs as on 31st January 2023 (see the chart below). The CAGR return of this scheme since inception is 22.3%.

Source: Advisorkhoj Research, as on 31st January 2024

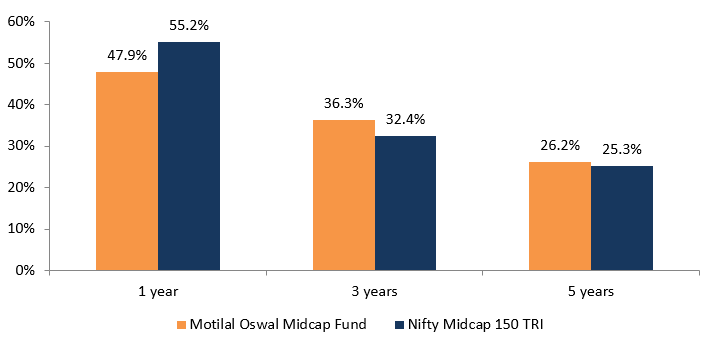

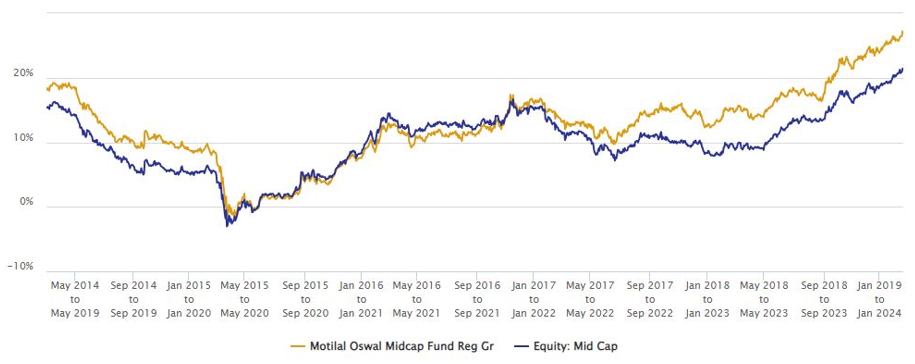

Outperformance versus benchmark

Motilal Oswal Midcap Fund has outperformed its benchmark index and created alphas over sufficiently long investment horizon.

Source: Advisorkhoj Research, as on 31st January 2024

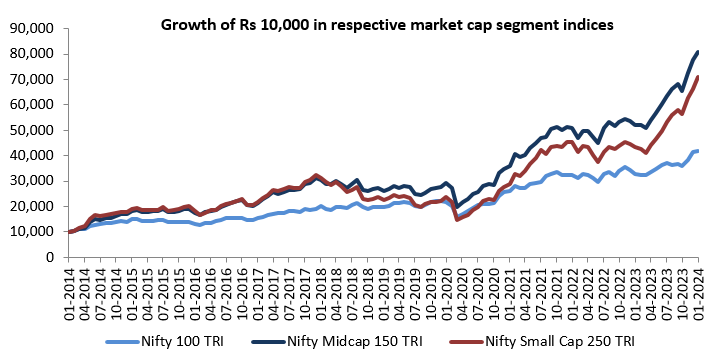

Midcaps versus large and small caps

Historical data shows that midcaps have outperformed large caps and small caps over long investment tenures (see the chart below)

Source: Advisorkhoj Research, as on 31st January 2024

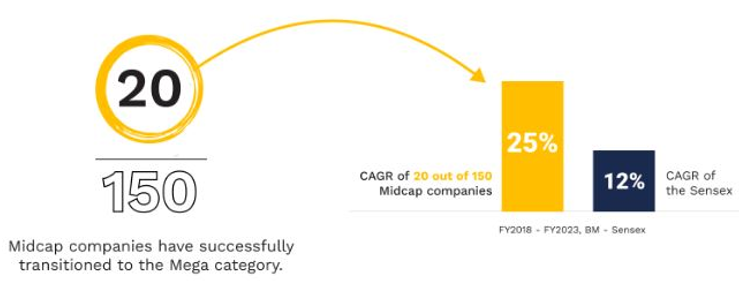

Why invest in midcaps?

- Midcaps exhibit a comparatively higher likelihood of advancing from the mid to mega stage.

Source: Motilal Oswal MF

- The Midcaps have demonstrated a high growth earnings increasing over the last 15 years. Midcaps are better compounding instrument as well as are wealth creators.

Source: Motilal Oswal MF

- Midcap are in Wealth creation stage having high growth potential with established track record.

- Midcap Fund provides opportunity to invest in unique industries which are not available in large cap fund e.g. Agricultural, Commercial & Construction Vehicle, Hospitals, Defence Manufacturing, IT – Services, Industrial Products, Industrial Manufacturing etc

About Motilal Oswal Midcap Fund

Motilal Oswal Midcap Fund has completed 10 years since launch. The scheme was launched in February 2014 and has Rs 7,972 crores of assets under management (as on 31st January 2024). The expense ratio (TER) of the fund is 1.76%. The scheme benchmark is Nifty Midcap 150 TRI. It invests minimum 65% of its assets in midcap stocks (101st to 250th stocks by market capitalization). Niket Shah and Rakesh Shetty are fund managers of the scheme. ET Prime has recently ranked Niket Shah among the Top 10 fund managers who generated most wealth for investors between 2018 and 2023.

Rolling returns - Outperformed peers over long investment tenures

The chart below shows the 5 year rolling returns of in Motilal Oswal Midcap Fund (rolled daily) versus the midcap funds category average since the inception of the scheme. Rolling returns is the most unbiased measures measure to evaluate fund's performance. We are showing 5 year rolling returns in this chart because in our opinion, you should have minimum 5 year investment horizon while investing in midcap funds. You can see that Motilal Oswal Midcap Fund was able to consistently outperform the midcap funds category average over 5 year investment tenures across different market conditions (both bull and bear markets).

Source: Advisorkhoj Rolling Returns, as on 31st January 2024

Consistently a top performer

The chart below shows the annual (calendar year) performance of Motilal Oswal Midcap Fund relative to its benchmark index, Nifty Midcap 150 TRI and midcap funds category over the last 10 years. You can see that the fund was in the top 2 quartiles, 7 times in the last 10 years, including 6 times in the Top quartile. This shows strong outperformance with consistency in performance. The fund has been in the top quartiles for the last 4 years consecutively.

Source: Advisorkhoj Quartile Ranks, as on 31st January 2024

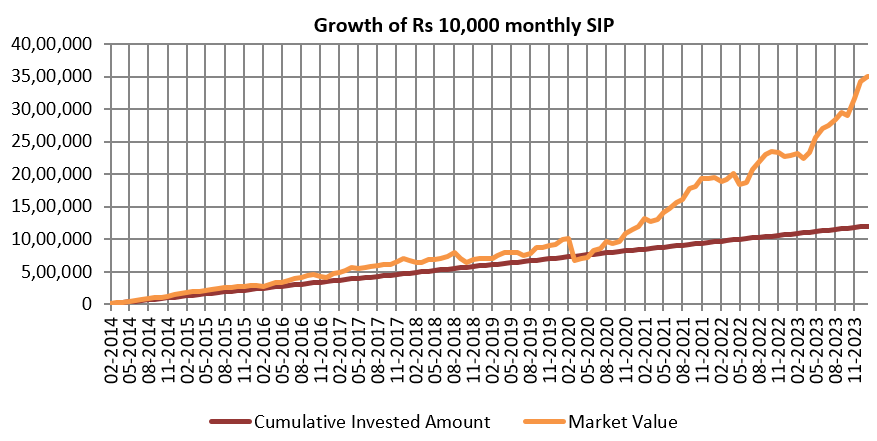

Wealth creation through SIP

Investing in midcap fund through SIP not only keeps you disciplined, it can also help you take advantage of volatility through Rupee Cost Averaging. The chart below shows the growth of Rs 10,000 monthly SIP in Motilal Oswal Midcap Fund since inception. You can see that with a cumulative investment of Rs 12 lakhs, you could have accumulated nearly Rs 35 lakhs (as on 31st January 2024).

Source: Advisorkhoj SIP Returns Calculator, as on 31st January 2024

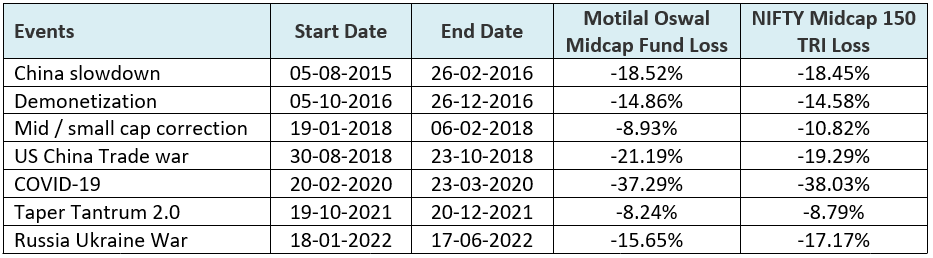

Performance in market drawdowns

We have shown the drawdowns of Motilal Oswal Midcap Fundversus the benchmark index in the biggest corrections over the last 10 years (since the scheme’s inception). You can see that in most big corrections, Motilal Oswal Midcap Fund was able to limit the downside risks for the investors in most major corrections.

Source: Advisorkhoj Research, as on 31st January 2024

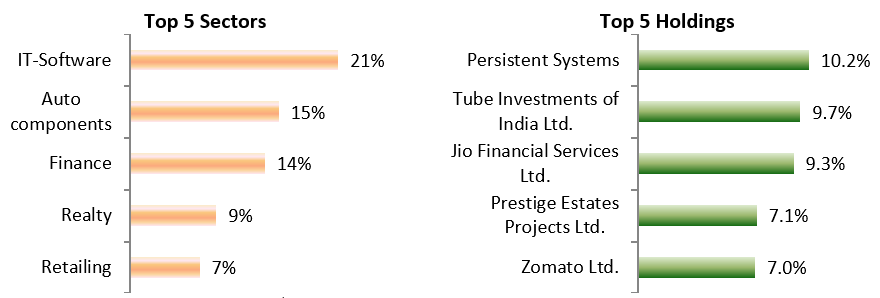

Current Portfolio Positioning

Source: MOSL, Fund Factsheet, as on 31st January 2024

Why invest in Motilal Oswal Midcap Fund?

- Crafted from a decade of financial acumen by pioneering early identification & investment in Midcaps.

- A portfolio of about ~35* carefully curated high conviction midcap stocks. *Based upon our current investment strategy.

- investing in Quality of business and management through our unique QGLP investment philosophy

- A House known for identifying high-growth themes

- The promoters of Motilal Oswal Asset Management Company (AMC) have invested ~ Rs1772 Cr.*, firmly aligning their interests with the investors’. *Data as on 31st January 2024.

Who should invest in Motilal Oswal Midcap Fund?

- Investors looking for capital appreciation and wealth creation.

- Investors should have at least 5 year investment horizon in this scheme.

- Investors with very high risk appetite.

- Investors can invest in this scheme either through lump sum or SIP depending on your investment needs.

Investors should consult their financial advisors or mutual fund distributors if Motilal Oswal Midcap Fund is suitable for their long term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

LATEST ARTICLES

- Motilal Oswal Large and Midcap Fund: A clear winner in Large and Midcap Funds

- Motilal Oswal Small Cap Fund: Strong performance in difficult market conditions

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Special Opportunities Fund: Provides exposure to special opportunities

- Motilal Oswal curated funds basket: Aim to transcend growth effortlessly

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY