Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

Current market context

The market has bottomed out in November and is in a consolidation phase now. The sharp correction has brought down valuations but concerns remain due to corporate earnings outlook. The Reserve Bank of India has revised India’s GDP growth outlook for fiscal year 2025 down to 6.6% (source: RBI MPC 6th December 2024). From the long term perspective, India is in a macro sweet spot due to moderating inflation, narrowing fiscal deficit, strong forex reserves, healthy corporate balance sheets, as well as structural factors like rising per capita income, favourable demographics and growing consumption. Indian equity as an asset class has wealth creation potential for long term investors.

Why have large and midcap funds in your portfolio?

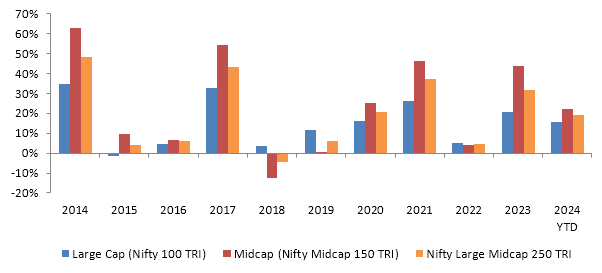

- Winner rotates across different market cap segments in different market phases (see the chart below). It is difficult for investors to anticipate which market cap segment will outperform and when. A mix of large and midcap stocks will provide market cap based asset allocation solution.

Source: Advisorkhoj Research, Data for period: 01/01/2014 to 31/11/2024. Disclaimer: Past performance may or may not be sustained in the future.

- Historically, large and midcaps have had decent participation in market up-cycles and also provided relative downside protection across market cycles (see the chart below). The chart below shows the 3 year rolling returns of large and midcap index versus the large cap and midcap indices since the inception of the index (1st April 2005).

Source: Advisorkhoj Research, Data for period: 01/04/2005 to 31/11/2024.

- Large cap indices like Nifty 100 has a heavier tilt towards certain sectors like BFSI, IT, Oil and Gas, FMCG. Large and midcap funds provide exposure to sectors where large caps have no presence e.g. textiles, media and entertainment etc.

- Beyond large caps, sectors with significant midcap presence can benefit from India’s consumption-driven economic growth, rising per capita income, changing global supply chain landscape (e.g. China + 1), Government’s policies e.g. import substitution (Make in India), digitization, infrastructure spending, shift from unorganized to organized sectors etc. Large and midcap funds can provide investors exposure to a broader range of investment opportunities in the above mentioned themes.

- There is a scope for large and midcap fund managers to create alpha by taking positions (overweight / underweight) in a particular market cap segment or sector as per the fund manager’s views.

Motilal Oswal Large and Midcap Fund – Wealth creation story

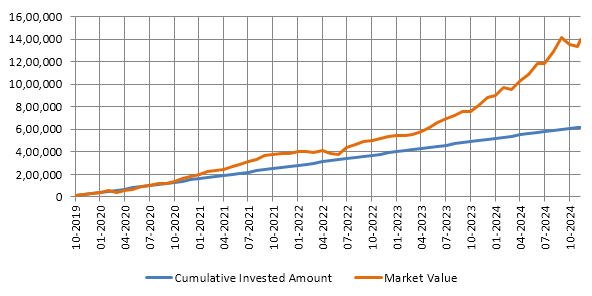

Motilal Oswal Large & Midcap Fund was launched in October 2024. The chart below shows the growth of Rs 10,000 monthly SIP in Motilal Oswal Large & Midcap Fund since the inception of the scheme. With a cumulative investment of Rs 6.2 lakhs, you could have accumulated a corpus of nearly Rs 14 lakhs (as on 30th November 2024) in the last 5 years.

Source: Advisorkhoj Research, as on 30th November 2024

Consistency of rolling returns versus benchmark index

The chart below shows the 3 year rolling returns of Motilal Oswal Large & Midcap Fund versus its benchmark index Nifty Large Midcap 250 TRI. You can see that the fund has consistently outperformed the benchmark index most of the times.

Source: Advisorkhoj Rolling Returns, as on 10th December 2024

Consistency of rolling returns versus peers

The chart below shows the 3 year rolling returns of Motilal Oswal Large & Midcap Fund versus the category average rolling returns. You can see that the fund has consistently outperformed the category average since the inception of the fund.

Source: Advisorkhoj Rolling Returns, as on 10th December 2024

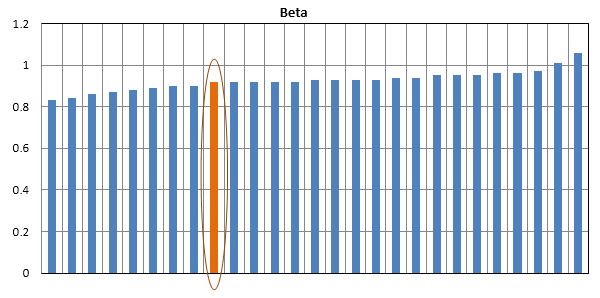

Lower systematic risk relative to peers

Beta is a measure of systematic risk of a fund. We looked at the betas of large and midcap funds which completed minimum 3 years (see the chart below). You can see that Motilal Oswal Large and Midcap Fund (marked in orange) has lower beta compared to most of its peers.

Source: Advisorkhoj Research, as on 30th November 2024

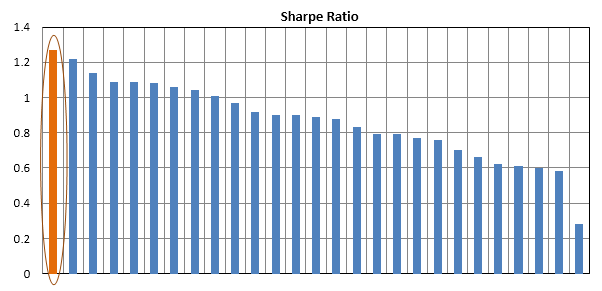

Superior risk adjusted returns compared to peers

Sharpe ratio is a measure of risk adjusted returns of a fund. We compared the Sharpe Ratios of large and midcap funds which completed minimum 3 years (see the chart below). You can see that Motilal Oswal Large and Midcap Fund (marked in orange) delivered the highest Sharpe Ratio among its peers.

Source: Advisorkhoj Research, as on 30th November 2024

Consistently a top quartile performer

Consistency is one of the most important performance attributes of a mutual fund scheme. The graphic below shows the quartile rankings of Motilal Oswal Large and Midcap Fund for the last 12 quarters. You can see that the fund has been in the top 2 quartiles in 10 out of last 12 quarters and in the top quartile in 8 out of last 12 quarters.

Source: Advisorkhoj Research, as on 30th September 2024

Investment strategy

- Invests in a mix of high quality Large and mid cap companies

- Aims to create a high growth and low volatility portfolio

- Focused on investing in industry leaders, positioned to benefit from market consolidation

- Identifying companies with competitive advantages that can enable sustained profitability

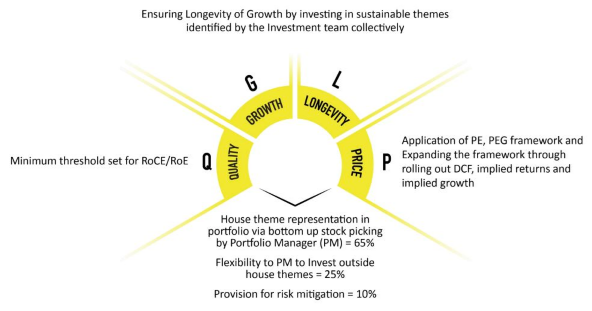

Investment Process (Q-G-L-P)

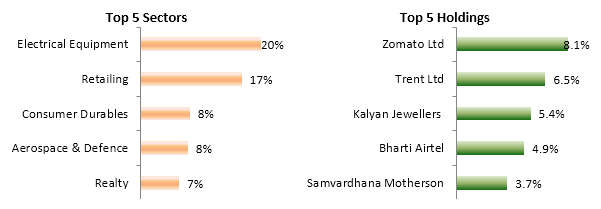

Current portfolio positioning

Source: Motilal Oswal, as on 30th November 2024

Why invest in Motilal Oswal Large and Midcap Fund?

- Portfolio construction oriented towards delivering long term stable growth with low to moderate volatility

- Top down sector/theme view combined with bottom up stock selection

- Diversification across sectors; Basket approach to play identified themes in the portfolio

- Quality and Growth oriented equity style with focus on industry leaders

Why should invest in Motilal Oswal Large and Midcap Fund?

- Investors looking for capital appreciation and wealth creation

- Investors should have at least 5 year investment horizon in this scheme

- This fund can be suitable for new or first time investors

- Investors with very high risk appetite

- Investors can invest in this scheme either through lump sum or SIP depending on your investment needs

Investors should consult with their financial advisors or mutual fund distributors if Motilal Oswal Large and Midcap Fund is suitable for their investment needs.

To know more about Motilal Oswal Large and Midcap Fund, click here.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

- Motilal Oswal Flexicap Fund: Superb turnaround for this top performing fund

LATEST ARTICLES

- Motilal Oswal Multicap Fund: Outperforming the benchmark

- Motilal Oswal Large Cap Fund: One of the best performing large cap funds for current market conditions

- Motilal Oswal Innovation Opportunities Fund: Leveraging the innovative investment opportunities for long term growth

- Motilal Oswal ELSS Tax Saver Fund: One of the best performing ELSS

- Motilal Oswal Flexicap Fund: One of the best performing flexicap funds

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY