Why index funds make a good investment choice?

The passive space in the mutual fund industry has grown at a very fast pace over the past few years. Passive assets under management (AUM) have multiplied 4.5 times in the last 4 years from Rs 1.9 lakh crores to Rs 8.8 lakh crores. Institutional investors account for a significant portion of passive AUM especially exchange traded funds (ETFs), but retail interest in passive is also growing. Retail investors prefer to invest through index funds than ETFs. Index funds AUM stood at nearly Rs 2.1 lakh crores as on 29th February 2024, growing 26X in last 4 years (CAGR of 137%, source: AMFI). The number of folios for index funds has grown from 4.8 lakhs in 2020 to more than 72 lakhs in 2024.

The product universe of index funds has matured considerably with many more product choices available for different investment needs and risk profiles - the number of index fund schemes has grown from 32 in February 2020 to 203 in February 2024. Today we have index funds across different asset classes like domestic equity, international equity, debt (fixed income), commodities etc. In this article we will discuss why index funds make a good investment choice for investors of different risk profiles and investment needs; both new and experienced investors. We will discuss passive funds from the Motilal Oswal MF stable, which offers among the widest range of passive products in Indian mutual fund industry.

Motilal Oswal MF offers a wide range of passive investments for different needs:-

- Large cap: These funds invest in the market index of large companies – the Top 100 companies by market capitalization are classified as large cap companies. The large cap index funds are among the most popular passive funds. The large cap index funds track the most popular market indices like the Sensex and Nifty 50, which are considered to be the barometer of the Indian stock market. Nifty 50 Equal Weight, Nifty Next 50 etc are also popular large cap indices. Motilal Oswal Nifty 50 Index Fund / ETF, Motilal Oswal Nifty 50 Index Fund and Motilal Oswal Nifty Next 50 Index Fund are popular offerings in the large cap passive space.

- Broader Market: 101st to 250th companies by market cap are classified as midcaps, while 251st and smaller companies are classified as small cap. Though midcaps and small caps are more volatile, they offer higher growth potential over long investment horizons. You can get exposure to midcaps and small caps through Motilal Oswal Nifty Midcap 100 ETF, Motilal Oswal Nifty Midcap 150 Index Fund, Motilal Oswal Nifty Small Cap 250 Index Fund, / ETF, and Motilal Oswal Nifty Microcap 250 Index Fund. If you want exposure across different market cap segments, Motilal Oswal Nifty 500 Index Fund / ETF can get exposure to large cap, midcap and small cap stocks

- Banking and Financial services sector: You can get sector specific exposure through index funds. For example Motilal Oswal Nifty Bank Index Fund provides your exposure to leading banks. PSUs etc. On the other hand, Motilal Oswal S&P BSE Financials ex Bank 30 Index Fund can provide you exposure to financial services excluding banks.

- Healthcare sector: You can invest in the healthcare sector through Motilal Oswal S&P BSE Healthcare Index Fund / ETF.

- Realty sector: You can invest in the realty sector through Motilal Oswal S&P Nifty Realty ETF.

- Smart beta: Funds tracking factor indices are known as smart beta index funds / ETFs. Factor indices are constructed based on quantitative, rule based investment strategies based on factors which historically driven portfolio returns and risk. Example of factor indices are:-

- Nifty 200 Momentum 30 index comprises of 30 high momentum stocks selected from the Nifty 200 index, based on 6 and 12 months returns adjusted for volatility. Scheme - Motilal Oswal Nifty 200 Momentum 30 Index Fund / ETF.

- S&P BSE low volatility index comprises of 30 stocks with lowest volatility in the BSE LargeMidcap Index. Scheme - Motilal Oswal S&P BSE Low Volatility Index Fund / ETF.

- S&P BSE Quality index provides exposure to high quality stocks selected from the BSE LargeMidcap Index on the basis of factors like return on equity (ROE), leverage (debt / equity ratio) etc. Scheme - Motilal Oswal S&P BSE Quality Index Fund / ETF.

- S&P BSE Enhanced Value Index comprises of 30 stocks with most attractive valuations in the BSE LargeMidcap Index. Valuations are determined by Book Value to Price, Earnings to Price and Sales to Price ratios. Scheme - Motilal Oswal S&P BSE Enhanced Value Index Fund / ETF.

- International Equities - Index funds provide low-cost opportunities to diversify your investments in international markets. These funds provide richer diversification to your investment portfolio, and also exposure global megatrends especially in areas of advanced technologies. You can get broad exposure to US market through Motilal Oswal S&P 500 Index Fund. If you want technology heavy exposure to the US market Motilal Oswal NASDAQ 100 ETF / FOF (NASDAQ 100 comprises of the top 100 stocks that are listed on NASDAQ stock exchange) and Motilal Oswal NASDAQ Q 50 ETF (NASDAQ Q 50 index comprises of the stocks that are next in line for inclusion in the NASDAQ 100 index). Motilal Oswal Developed Market ex US ETFs FOF can provide you exposure to the developed markets outside the US.

- Fixed income or debt – Motilal Oswal 5 year G-Sec ETF / FOF provides investment opportunities in Government securities of 5 year tenors. With yields coming off their peak and impending rate cuts in coming months / quarters Motilal Oswal 5 year G-Sec ETF / FOF can be a good debt investment option in this interest rate environment.

- Commodities – Commodities like precious metals provide diversification benefits to your portfolio, while serving as a hedge against inflation in the long term. Motilal Oswal Gold and Silver ETFs FOF can provide your exposure to commodities like Gold and Silver in approximately 70%: 30% ratio.

- Multi Asset - Motilal Oswal Asset Allocation Passive FOF provides asset allocation solutions for different risk profiles. FOF has two plans – Aggressive and Conservative. The asset allocation of the Aggressive Plan is around 70% in equity, 20% in debt and 10% in Gold. The asset allocation of the Conservative Plan is around 50% in debt, 30% in domestic equity, 10% in international equity and 10% in Gold.

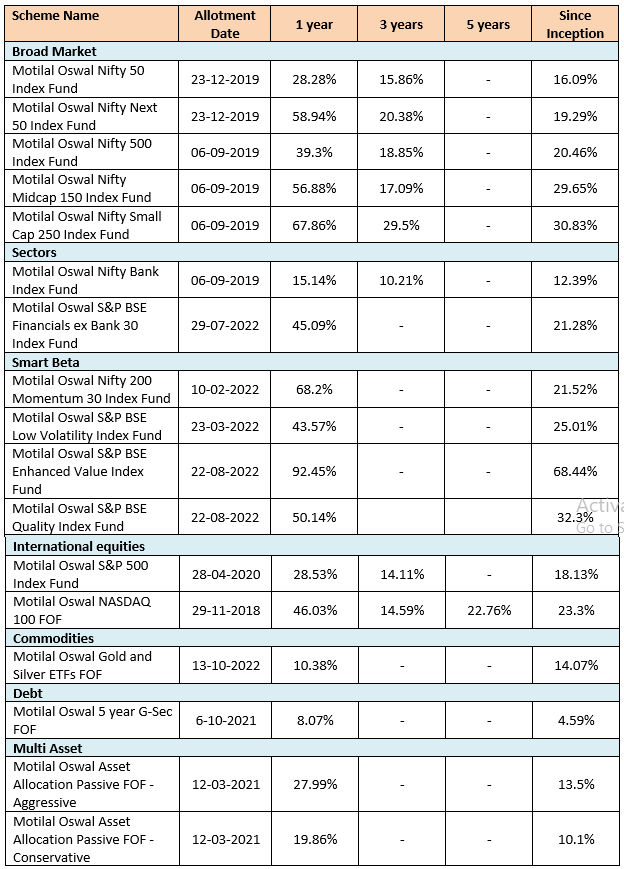

Performance of Motilal Oswal MF Index Funds (including passive Fund of Funds)

Source: Motilal Oswal MF, as 29th February 2024, returns over periods exceeding 1 year are annualized (CAGR). Only Performances of schemes that have completed 1 year have been shown in the table. Disclaimer: Past performance may or may not be sustained in the future.

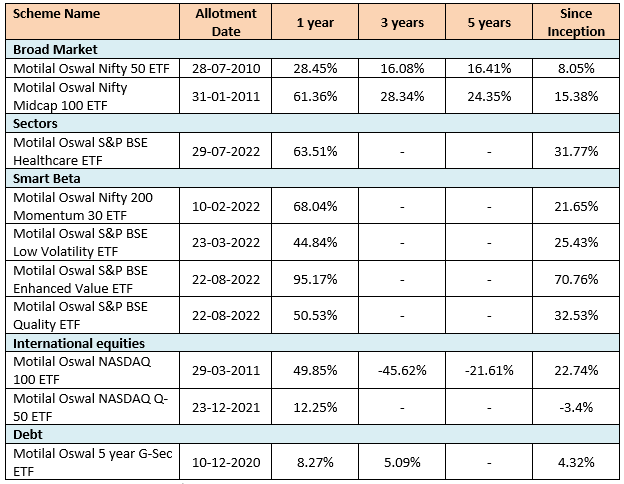

Performance of Motilal Oswal MF ETFs

Source: Motilal Oswal MF, as 29th February 2024, returns over periods exceeding 1 year are annualized (CAGR). Only Performances of schemes that have completed 1 year have been shown in the table. Disclaimer: Past performance may or may not be sustained in the future.

Index funds are for both risk taking investors & new investors

You can see that index funds provide a wide range of choices for investors of different risk profiles and investment needs. You can invest in different asset classes, market cap segments, and sectors according to your risk appetite. Index funds are also suitable investment options for new investors. They do not have any unsystematic risk and fund selection is relatively simple. You can start investing in index funds with relatively small amounts through systematic investment plans (SIP) and remain invested over long investment (please note SIP option is not available in ETFs).

Benefits of index funds

- Low cost compared to actively managed funds

- No unsystematic risks

- No fund manager bias

- Suitable for both experienced and new investors

Should you invest in ETFs or Index Funds?

ETFs and index funds are similar in many respects, but the main difference between the two is that ETFs trade on stock exchanges just like shares of listed companies. You need demat account to invest in ETFs. Index funds on the other hand, are mutual fund schemes. While you can buy / sell ETFs on the exchange, you can invest or redeem index funds with the Asset Management Company (AMC) directly or through your mutual fund distributors. The Total Expense Ratios (TERs) of ETFs are usually lower compared to index funds. Should you invest in ETFs or index funds? If you have Demat account, you can invest in ETFs to take advantage of lower TERs. If you do not have Demat account and do not have the experience of buying / selling in the stock market, then index funds can provide excellent investment options. If you are a new investor, you can start your investment journey with index funds; as you gain more experience over time, you can explore ETFs as investment options.

Conclusion

Motilal Oswal Mutual Fund offers a wide array of passive investment options (ETFs, index funds and FOFs) across different asset classes, market cap segments, sectors, smart beta strategies and asset allocation solutions. You can select a fund according to your risk appetite and investment needs. Consult with your financial advisor, if you need help in selecting the right fund for your portfolio.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

LATEST ARTICLES

- Motilal Oswal Small Cap Fund: Strong performance in difficult market conditions

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Special Opportunities Fund: Provides exposure to special opportunities

- Motilal Oswal curated funds basket: Aim to transcend growth effortlessly

- Motilal Oswal Multicap Fund: Strong performance in its first year since launch

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY