Motilal Oswal Business Cycle Fund: Invest in the potential winners in the current economic phase

Motilal Oswal MF has launched a New Fund Offer (NFO), Motilal Oswal Business Cycle Fund. The fund will invest in themes that are likely to benefit in the current business cycle phase. India is currently going through an expansionary economic growth phase. By investing in companies and sectors that are likely to outperform in the current economic cycle, the fund aims to create alpha for investors. The NFO has opened for subscription on 7th August 2024 and will close on 21stAugust 2024. In this article, we will review Motilal Oswal Business Cycle Fund NFO.

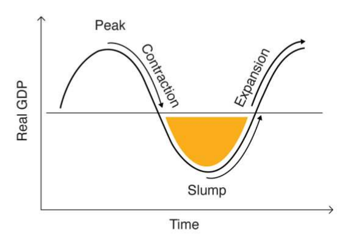

What are business cycles?

All markets go through cycles of economic growth and slowdown – these are known as business cycles (see the chart below). A business cycle usually has 4 phases – expansion, peak, contraction and slump. From the slump, the economy will recover and move into the expansionary phase again. This cycle keeps repeating over and over again.

Different companies and sectors react uniquely to each phase of the business cycle. In business cycle funds, the fund manager selects companies that are likely to perform well in each phase.

Source: Motilal Oswal MF

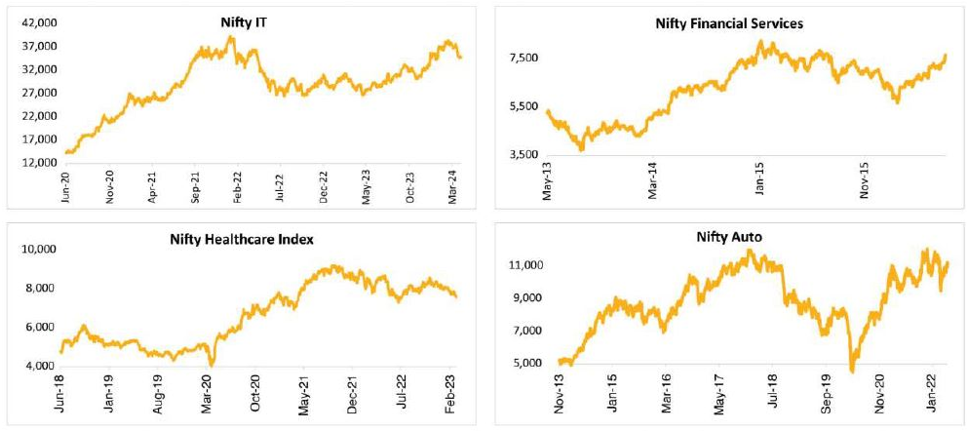

Winners rotate across industry sectors (see the chart below). Identifying which sectors are in the expansion phase of business cycles can generate alphas for investors.

Source: Motilal Oswal MF, as on 11th July 2024

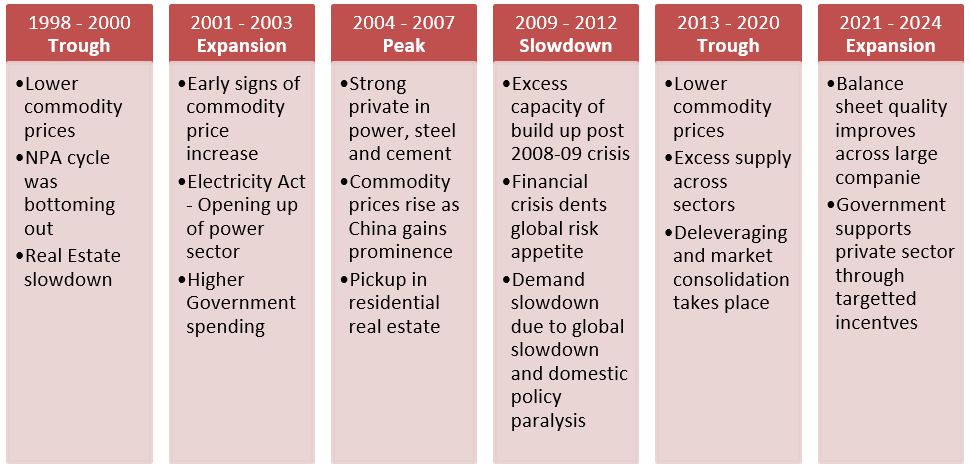

Movement of India’s economic cycle

Source: Motilal Oswal MF

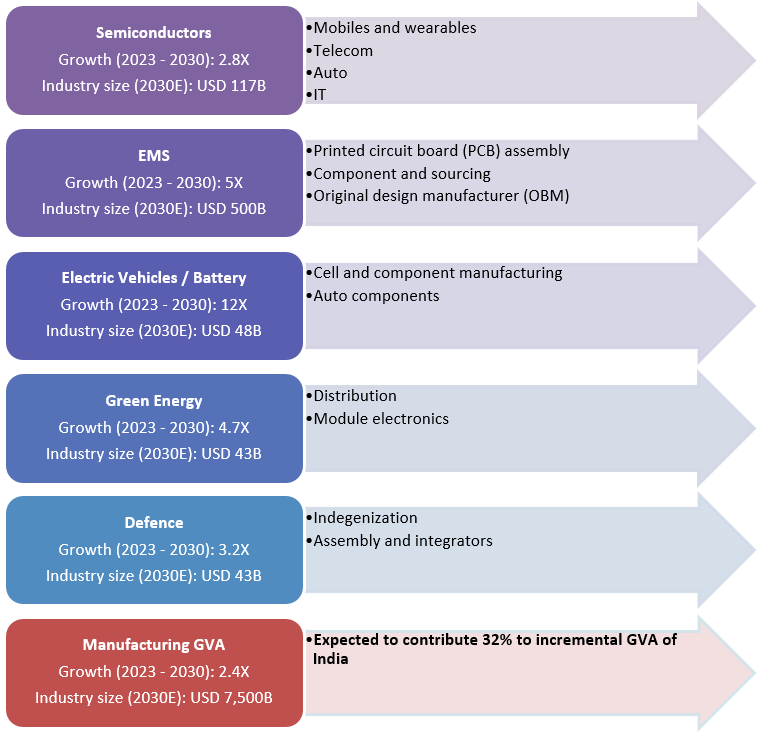

Sunrise sectors potentially driving economic growth in India

Motilal Oswal Business Cycle Funds – Focus Themes

- China + 1: Chemicals, electronic manufacturing services etc

- Manufacturing / Make in India: Automobiles and electric vehicles, auto ancillaries, power etc

- Financialisation: NBFCs

- Technology and technology services: New age consumer technology, high growth tech companies etc

- Urbanization: Leisure and luxury, travel and hospitality, premiumisation etc

- Telecom: Telecom services, Equipment and infrastructure services etc

- Healthcare ecosystem: Hospitals

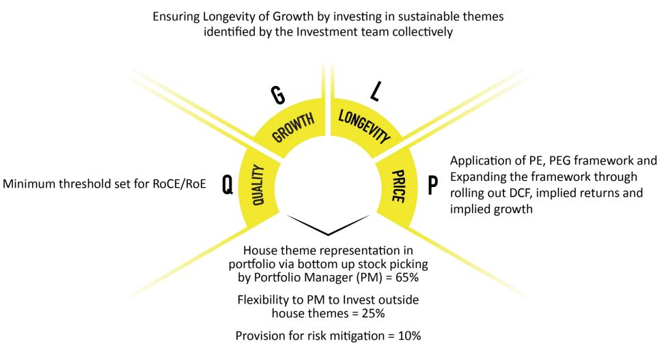

Motilal Oswal Mutual Fund’s QLGP Framework

Motilal Oswal MF follows a disciplined investment approach based on Quality (Q), Growth (G), Longevity (L) and a Price (P) framework.

Why invest in Motilal Oswal Business Cycles Fund?

- Advantage of early allocations to themes in wealth creation

- High Quality and High Growth* investing to generate long term alphas

- The fund may stand tall in investors’ portfolios weighed down by investments in multiple over-diversified funds

- Managed by Chief Investment Officer with exemplary track record in Midcap and Flexicap Funds

- Agile investment allocations across all market capitalization segments.

*The usage of the terms Hi-Quality and Hi-Growth portfolios purely depicts Motilal Oswal AMC’s internal fund management strategy / process which is based on qualitative and quantitative research parameter

Who should invest in Motilal Oswal Business Cycles Fund?

- Suitable for investors looking for tactical satellite allocations to their overall equity portfolio

- Investors who want superior returns on investment over sufficiently long investment tenure

- Investors with investment horizons of at least 3-7 years Investors with very high risk appetites

- You can invest in lump sum or SIP depending on your financial situation and investment needs

- Investors should consult with their financial advisors or mutual fund distributors if Motilal Oswal Business Cycles Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

LATEST ARTICLES

- Motilal Oswal Midcap Fund: One of the best performing midcap funds

- Motilal Oswal Multicap Fund: Outperforming the benchmark

- Motilal Oswal Large Cap Fund: One of the best performing large cap funds for current market conditions

- Motilal Oswal Innovation Opportunities Fund: Leveraging the innovative investment opportunities for long term growth

- Motilal Oswal ELSS Tax Saver Fund: One of the best performing ELSS

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY