Motilal Oswal Manufacturing Fund: Why you should invest in the key driver of India Growth Story

Motilal Oswal has launched a thematic NFO based on manufacturing theme (Motilal Oswal Manufacturing Fund). The fund will invest in companies in the manufacturing sectors. There are relatively few mutual fund schemes in the manufacturing theme compared to sectors like Banking and Financial Services, Pharma etc. However, manufacturing as a theme is increasingly attracting investor interest. In this article we will review Motilal Oswal Manufacturing Fund. The NFO has opened for subscription on 19th July 2024 and will close on 2nd August 2024.

Importance of manufacturing in India Growth Story

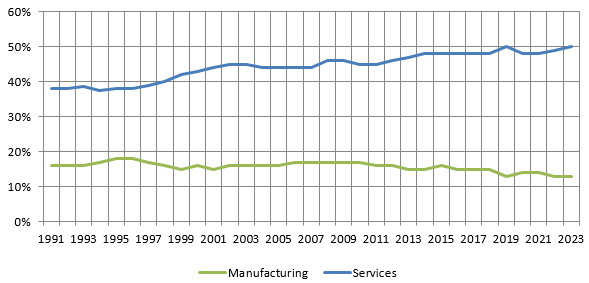

Industrialization is the main driver of economic development and prosperity of nations. Developed economies are highly industrialized and manufacturing is the backbone of economic development. Manufacturing industries can becomes source of employment for large sections of the population, reduce economic inequalities and drive economic growth. India has traditionally been a consumption driven economy and services sectors have contributed a large percentage to our GDP (see the chart below). Service sector contributes 50% to India’s GDP versus only 13% contribution from manufacturing. Services also lead manufacturing in terms of employment (31% of India’s workforce in services versus 25% in manufacturing) and GDP growth.

Source: World Bank, % Value Add to GDP, as on 31st December 2023

However, there is a trend change towards manufacturing. In FY 2023-24, the growth in Real Gross Value Add (GVA) of manufacturing (9.9%) was higher the real GDP growth rate. By FY 2031, the share of manufacturing will increase to 21% of the GVA (up from 13% in 2023). Manufacturing will drive increase in India’s share of global exports – expected to grow to 4.5% of global exports by 2031 (source: Motilal Oswal Mutual Fund). Wage cost advantage, higher labour productivity, low corporate tax rate and improving infrastructure will provide India the competitive edge in the global manufacturing market. Accordingly, manufacturing is set to play a key role in India Growth Story.

Government’s push for manufacturing

The Government has made manufacturing a key priority for economic development of India. From the Make in India initiative in 2014 to Atmanirbhar Bharat (2020), the Government’s focus has been to transform India into a global manufacturing hub.

- Make in India (2014): To turn India into centre for manufacturing, design and innovation

- Industrial corridor development programme (11 corridors): To improve the connectivity and logistics

- India Stack: Leveraging technology to ease economic bottlenecks and provide services at scale

- PM Gati Shakti - NMP: Multi-modal infrastructure platform. Monetization plan aimed at creating a circular financing model

- PLI schemes: Various schemes for 14 sectors (with an incentive outlay of Rs. 1.97 lakh crore) to enhance manufacturing capabilities and exports

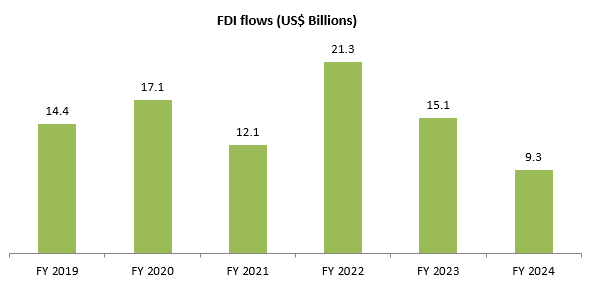

Higher FDI flows in manufacturing

The Government has liberalized the Foreign Direct Investment (FDI) policy allowing 100% FDI in nearly all sectors, except for certain prohibited sectors. The defence industry allows 74% FDI under automatic route and 100% under the government route. FDI equity inflow in the manufacturing sector increased by 55% to reach $148.97B in 2014 - 23 compared to $96 B in the previous nine years (2005-2014). In last 5 years alone FDI flows in manufacturing was more $75B, despite the COVID-19 pandemic slump.

Source: Ministry of Finance, Government of India, as on 31st March 2024

Outlook for manufacturing

- With favourable demographics e.g. young population, rising per capita income, large and growing middle class, India is the largest aspirational population in the world. Rising prosperity will lead to higher discretionary spending and demand for premium products.

- Unlike other manufacturing dominated economies e.g. China, Indian economy is heavily dependent on domestic consumption. India’s domestic demand also makes Indian manufacturing less sensitive to global business cycles.

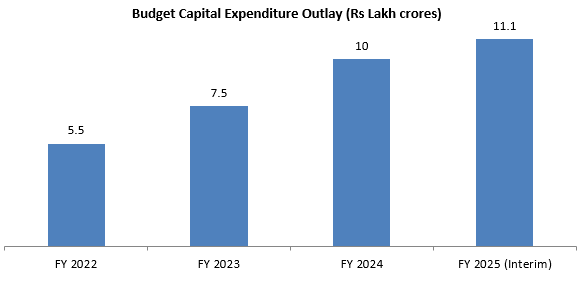

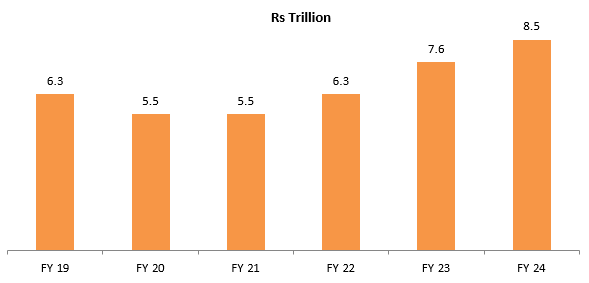

- Infrastructural inadequacies have prevented manufacturing industries realize its full potential and also constrained private capex investments. The Government has made a massive push in infrastructure spending since FY 2021. In the last 3 years, the Government spend Rs 23 lakh crores on infrastructure development in areas of roads, highways, ports, power transmission etc. Government spending is likely to have a multiplier effect on private capex investments and industrial growth in India.

Source: Ministry of Finance, Government of India

- The long awaited surge in private sector is now a reality with higher private sector investments post COVID (see the chart below).

Source: Motilal Oswal MF, Government estimates

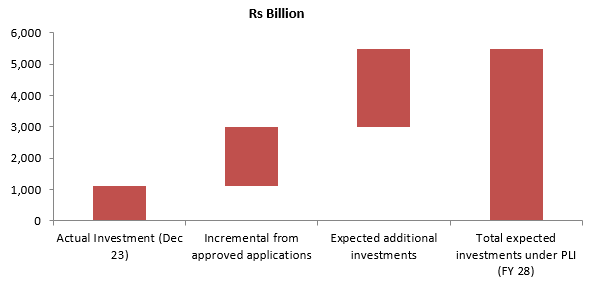

- The PLI scheme is also driving private sector capex spending with Rs 1.1 trillion of actual investments as on December 2023. Total private capex till FY 28 (final year of PLI) is expected to be around Rs 5.5 trillion (see the chart below).

Source: Motilal Oswal MF, Government estimates

- There is a surge in new projects since FY 2020-21 across diverse sectors like electronics, non electrical machinery, electrical machinery, construction materials, chemicals etc

- Changing global supply chain dynamics e.g. China + 1 and India’s growing geopolitical clout has the potential to make India a global manufacturing hub

- India is in a favourable macro-economic situation relative to other major economies. The International Monetary Fund (IMF) predicts India’s GDP to grow by 6.8% in FY 2025, positioning it as the fastest-growing G-20 economy and forecasted to the third-largest economy by 2028

- With fiscal deficit narrowing and inflation cooling, the stage is set for interest rate cuts in the coming quarters. Lower interest rates will reduce cost of financing and boost capex spending

- In our view, the outlook for manufacturing is very bright in the medium to long term.

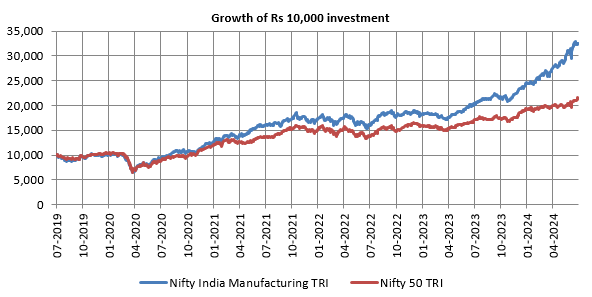

Manufacturing as an investment theme has outperformed broad market

Lower weightage in the leading market indices

The weightage of services sectors in leading market indices like Nifty and Sensex is significantly higher than manufacturing sectors. As such, a thematic fund which focuses only on manufacturing industries and companies will be more suitable for investors who want exposure to the manufacturing theme, as opposed to investing in a diversified equity fund.

About Motilal Oswal Manufacturing Fund

- Exposure into diverse sectors of manufacturing and are likely to benefit from the growth of the manufacturing theme which will benefit of the current capex cycle.

- Invest in companies that are likely to benefit from government incentives & the entire manufacturing opportunity available in India.

- Invest in sectors which offer allied services associated with the entire manufacturing lifecycle.

- Invest across market cap segments

- The fund will generally practice a focused, high-conviction active portfolio strategy.

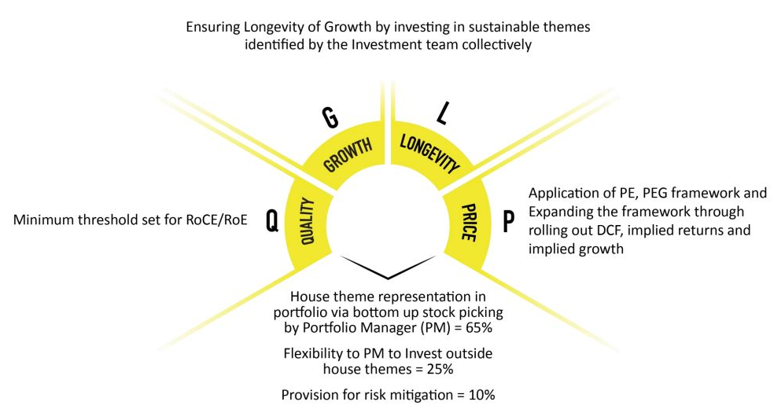

- The portfolio will essentially follow Motilal Oswal’s QGLP philosophy; following Hi-Quality Hi-Growth Investing and invest in Quality businesses with high growth potential and with sufficient Longevity of that growth potential at an acceptable Price.

- Minimum 80% investment in manufacturing theme across sectors, as per guidelines.

QLGP Framework

Motilal Oswal MF follows a disciplined investment approach based on Quality (Q), Growth (G), Longevity (L) and a Price (P) framework.

Why Motilal Oswal?

- Long and successful track record of Wealth Creation

- Expertise in picking multibaggers stocks

- Proven QGLP stock selection framework

- The promoters of Motilal Oswal have their skin in the game with personal investments in the schemes of the AMC.

Who should invest in Motilal Oswal Manufacturing Fund?

- Suitable for investors looking for tactical satellite allocations to their overall equity portfolio

- Investors who want superior returns on investment over sufficiently long investment tenure

- Investors with investment horizons of at least 3-7 years Investors with very high risk appetites

- You can invest in lump sum or SIP depending on your financial situation and investment needs

- Investors should consult with their financial advisors or mutual fund distributors if Motilal Oswal Manufacturing Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

LATEST ARTICLES

- Motilal Oswal Large and Midcap Fund: A clear winner in Large and Midcap Funds

- Motilal Oswal Small Cap Fund: Strong performance in difficult market conditions

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Special Opportunities Fund: Provides exposure to special opportunities

- Motilal Oswal curated funds basket: Aim to transcend growth effortlessly

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY