Motilal Oswal Multicap Fund: A promising new multicap fund for long term investors

Motilal Oswal Asset Management Company has launched a new equity scheme on the mutual fund platform, Motilal Oswal Multicap Fund. The New Fund Offer opened for subscription on 28th May and will close on 11th June. This fund is an open ended equity mutual fund scheme which will invest in all three market cap segments, large cap, midcap and small cap. As per SEBI’s mandate multicap funds must invest minimum 25% of their assets in each of the three market cap segments. The multicap fund category is a relatively new equity category with 24 schemes. Motilal Oswal Multicap Fund will be the latest entrant in this category.

Market capitalization segments

- Large cap: Top 100 stocks by market capitalization are classified as large cap stocks. These companies are established names, have mature businesses and market share leadership in their respective industry sectors. They have a high percentage of institutional (FII and DII) ownership and their shares are traded in large volumes, making these stocks highly liquid. Large cap stocks tend to be less volatile.

- Mid cap: 101st to 250th stocks by market capitalization are classified as midcap stocks. Midcap stocks can be industry leaders in their respective market niches or can be challengers in other industry sectors. Midcap stocks are comparatively less liquid and more volatile than large cap stocks. With growing institutional participation in midcaps (both FIIs and MFs), liquidity of these stocks can improve significantly. Midcap stocks may have higher earnings growth potential compared to large cap stocks. Today’s midcap stocks can be future large cap stocks.

- Small cap: 251st or smaller stocks by market capitalization are classified as small cap stocks. These companies tend to be relatively younger and are still in the early to mid stages of their growth journey. Small cap stocks have relatively low percentage of free floating shares compared to large caps and midcaps. They can be more volatile than large and midcap stocks. Small cap stocks usually have higher earnings growth potential compared to large and midcap cap stocks. These stocks can become midcap or large caps stocks in the future. Price discovery in small cap may not be as efficient as large or midcaps, which can be exploited by fund managers to create wealth for investors when valuation re-rating takes place.

Case of Indian equities

India is in a macro sweet spot. India is the 5th largest economy in the world and is expected to become the 3rd largest economy by 2027 (as per IMF’s forecasts). Our GDP grew by 8.2% in FY 2023-24 exceeding earlier forecasts. IMF is forecasting India’s GDP to grow by 6.8% in FY 2025, making it the fastest growing G-20 economy. India’s fiscal deficit in FY 2023-24 is estimated to be 5.8% and will be pared down to 5.1% in FY 2024 -25. Interest rates have peaked and the 10 year G-sec yield has been softening over the past year or so.

Corporate earnings have been growing at the healthy rate over the past several years. Nifty EPS grew at 22% on a year on year (YOY) basis in March 2024 (source: MOSL). Nifty’s TTM PE multiple stood at 21.4 (as on 31st May 2024), which is well below the last 10 year historical average. On the political front the NDA is expected to form a Government for the third time, albeit with a reduced majority; policy stability and continuity is expected in the Government’s third term. Solid macroeconomic conditions, healthy corporate earnings,peaking of interest rates, moderate inflation print, and ongoingpolicy momentum shall drive growth.

Why Multicap?

- Multicap strategy can exploit a much larger and more diverse opportunity set spread across large, mid and small cap stocks. The fund manager can find investment opportunities in industries that are unique to particular market cap segments e.g. non ferrous metals and telecom (large cap), realty, tyres and capital goods (midcap), shipping, casting / forging, stock / commodity broking (small cap).

- The reforms implemented by the Government especially in the areas of manufacturing (Atmanirbhar Bharat), infrastructure, digitalization, tax reforms etc will benefit companies across all three cap market cap segments. The changing global supply chain dynamics e.g. China + 1, will benefit companies across all three market cap segments.

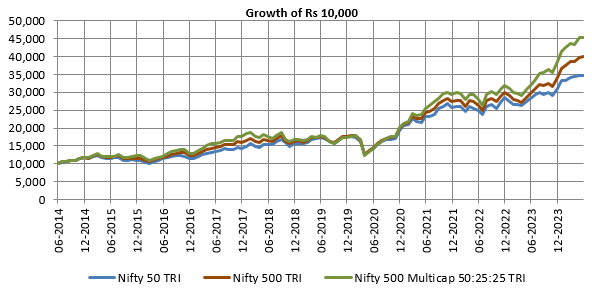

- Wealth creation: The chart below shows the growth of Rs 10,000 in Nifty 50 TRI, Nifty 500 TRI and Nifty 500 Multicap 50:25:25 TRI over the last 10 years. You can see the multicap index was able to create greater wealth for investors.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st May 2024.

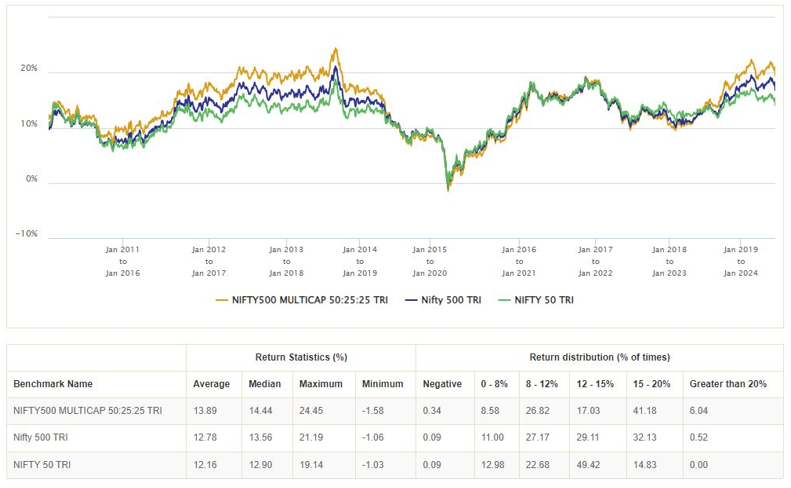

- Risk Return Trade-off: The chart below shows the 5 year rolling returns of Nifty 500 Multicap 50:25:25 TRI versus broad market indices like Nifty 50 TRI and Nifty 500 TRI over last 15 years or so (01.01.2010 to 31.05.2024). The average rolling returns of Nifty 500 Multicap 50:25:25 TRI across different market conditions is higher than Nifty 50 TRI and Nifty 500 TRI. Furthermore, observe that there is not much differences percentage of negative return instances of Nifty 500 Multicap 50:25:25 TRI, Nifty 50 TRI and Nifty 500 TRI over 5 year investment tenures (all are less 0.5%). However, the percentage of 15%+ CAGR returns instances of Nifty 500 Multicap 50:25:25 TRI is significantly higher than those of Nifty 50 TRI and Nifty 500 TRI. In other words, Multicap strategy offers superior risk return trade off over sufficiently long investment tenures.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st May 2024.

Motilal Oswal Multicap Fund

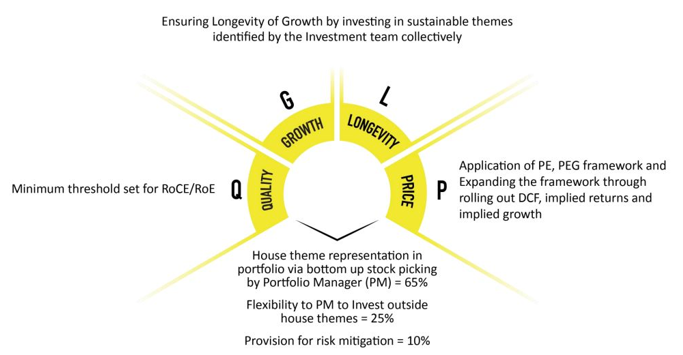

QLGP Framework

Motilal Oswal MF follows a disciplined investment approach based on Quality (Q), Growth (G), Longevity (L) and a Price (P) framework.

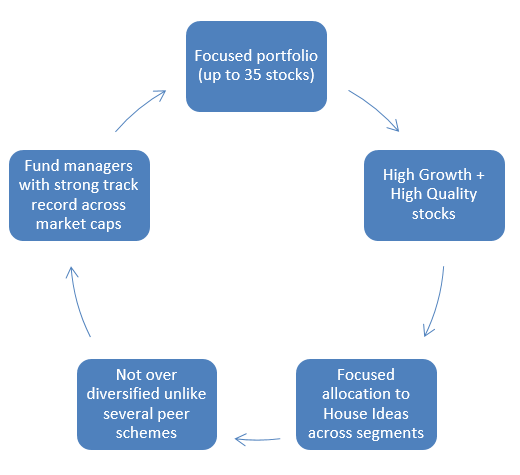

Why invest in Motilal Oswal Multicap Fund?

- Long and successful track record of Wealth Creation by investing in large, mid and small cap stocks

- The fund house has 20 years expertise in picking multibaggers. Select stocks picked by the AMC in the last 5 to 10 years have grown 6X to 24X (source: Motilal Oswal AMC)

- The fund will invest in House identified high growththemes which can evolve as leaders of current market cycle

- Uniquely positioned high conviction multi-cap fund – higher alpha creation potential based on track record of the fund managers and fund house

- Quality of business and management will be a key factor. Quality of business and management are important from the point of view of earnings growth sustainability and to ensure that the management takes care of the interests of minority shareholders.

- A fresh portfolio (NFO) with no baggage of legacy stocks can capture best opportunities for future growth

- The promoters of Motilal Oswal have their skin in the game with personal investments in the schemes of the AMC. There is commitment by the promoters for investment during NFO

Who should invest in Motilal Oswal Multicap Fund?

- Investors with investment horizon of 3-7 years for long term wealth creation

- Investors looking to capitalise on the potential of emerging businesses benefitting from India’s economic growth

- Investors seeking to participate in high growth themes Leading the markets

- Investors looking to invest in a unique high conviction focused multi cap portfolios

- Investors seeking a fund with disciplined allocation to all market cap segments at all points of time

- Investors with very high risk appetites

Investors should consult their financial advisors or mutual fund distributors if Motilal Oswal Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

LATEST ARTICLES

- Motilal Oswal Large and Midcap Fund: A clear winner in Large and Midcap Funds

- Motilal Oswal Small Cap Fund: Strong performance in difficult market conditions

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Special Opportunities Fund: Provides exposure to special opportunities

- Motilal Oswal curated funds basket: Aim to transcend growth effortlessly

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY