Motilal Oswal Mid-cap Fund: A Long Term Pick

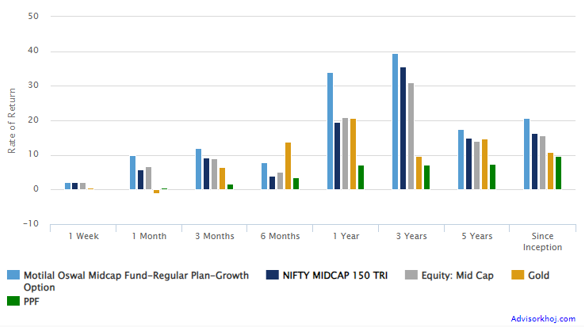

Motilal Oswal Midcap Fund was launched in Feb 2014. Since inception, the fund has given returns of 20%. To make it simpler, an investor who would have invested Rs 1 lakh when the fund was launched would be standing at Rs 5.65 lakh in their portfolio. This is phenomenal because if someone had invested in the Nifty 50 Index, their returns would be 3.4 lakh. During this period, an investment in FD @7% would have also resulted only in 1.9 lakh. A PPF, too, would have yielded only Rs 2 lakh.

Source: AdvisorKhoj; Data as on 7-June-2023

Rolling Returns

Investors don’t usually invest on the day of inception and remain invested in it. Instead, the common observation is that investors will come at different times. Therefore, a better way is to look at the fund’s rolling returns to accommodate this reality.

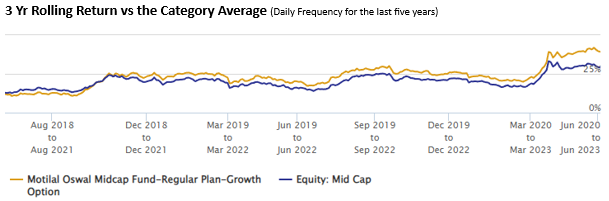

3 Yr Rolling Return vs the Category Average (Daily Frequency for the last five years)

Source: AdvisorKhoj; Data as of 7-June-2023 in last two years.

The graph above highlights how the fund has outperformed its peers consistently since Dec 2018. Any investor who would have invested after Dec 2018 would have seen their portfolio give returns of above 15% and outperform the category average.

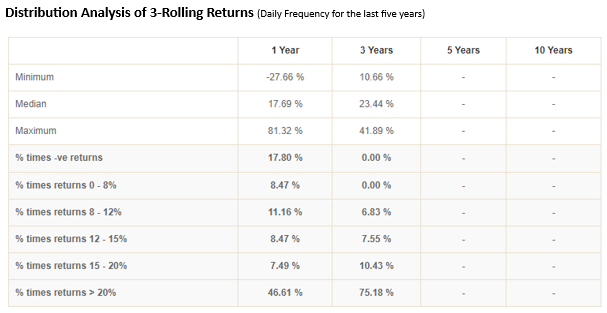

Distribution Analysis of 3-Rolling Returns (Daily Frequency for the last five years)

Source: AdvisorKhoj; Data as of 7-June-2023. 3-Yr Rolling Return with Daily Frequency for the last two years.

A close analysis of the rolling returns table shows that any investor who remained invested for three years would have made more than 8% returns. It also shows that more than 85% of the time, an investor would have got more than 15% returns.

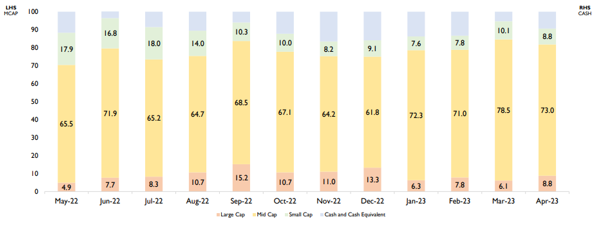

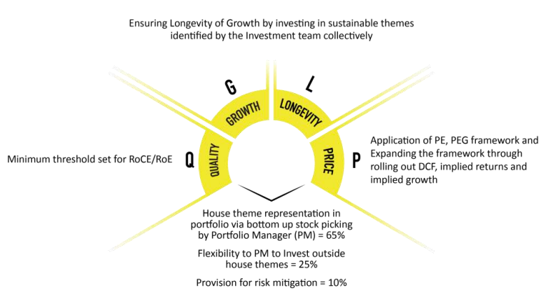

Investment Style

The fund must invest 65% or more of its portfolio in stocks of midcap companies as per SEBI mandate for the category. Fund Manager decides on the exposure of large and small cap depending on the opportunity in the market. Market cap exposure at any given time aligns with the fund manager’s objective of delivering risk-adjusted long-term growth with lower volatility.

Source: Motilal Oswal Midcap Fund Presentation

The fund house investment philosophy is of QGLP – which stands for Quality, Growth, Longevity and Price. Quality can be assessed using quantitative factors such as RoE and RoCE. Similarly, for measuring price, a combination of PE, PEG, DCF, implied returns and implied growth might be used to determine part of the valuation. Assessing a company’s longevity and growth prospect requires a deep understanding of the company, sector, local policy, and global & local demand-supply, making it a qualitative aspect of the research. Therefore, it is evident that Motilal Oswal AMC puts much effort into fund management.

The AMC has a robust risk management framework. Elaborating on this, the AMC stated, “There are set limits of minimum and maximum exposure, limits on sector deviation related to benchmark, proprietary framework for profit-taking/stop loss management, among other risk mitigation mechanisms”.

In the portfolio, the fund manager sometimes takes exposure to derivatives. We were informed, by the AMC, that this exposure is mostly done for hedging purposes.

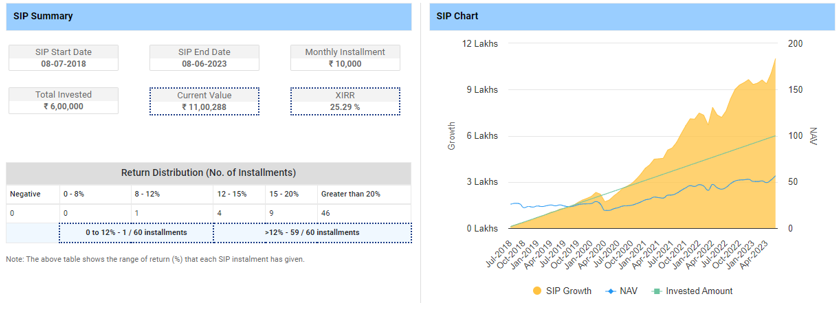

SIP Returns Analysis

Source: MutualFundTools.com; data as on 8-Jun-2023

The above simulation is over 5 years of SIP from 2018 to 2023. As can be seen from the graph, the investor’s market value of the investment would have gone below its cost factor between Jan 2020 to Jul 2020; this includes the period of pandemic-induced lockdown. But if an investor continued with their SIP, then over the five years, they would have earned a net return of 25.29% (XIRR).

Fund Management

Niket Shah has been managing the fund since July 2020. He has more than 10 years of experience. Before joining Motilal Oswal AMC, he was associated with Motilal Oswal Securities Limited as Head of Midcaps Research (Feb 2013 to Mar 2018). He has worked with Edelweiss Securities and Religare Capital Market as Research Analyst – Midcaps (Mar 2010 to Jan 2013).

Fund Manager Shah has his Master’s in Business Administration (MBA) in Finance from Welingkar Institute of Management Studies.

He manages the Motilal Oswal Midcap Fund and Motilal Oswal Flexi Cap Fund, a cumulative AUM of Rs 12,943 cr. In Flexi Cap, he is a co-fund manager.

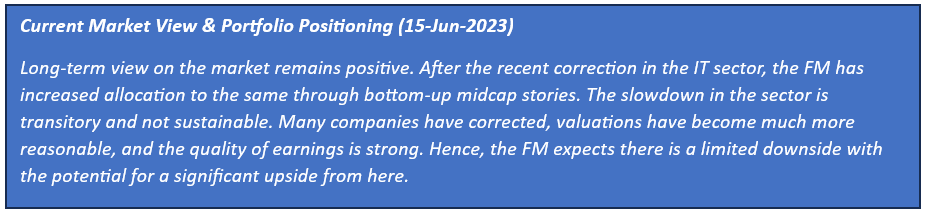

Outlook

The fund’s current size is 4,508 cr (as of 31-May-2023), giving it a long runway to grow through performance and adding fresh AUM from investors. As a market segment, Midcap funds require more active stock picking as companies may move into large-cap or small-cap or vice-versa. Also, this segment is filled with niche companies and challengers to market dominance. Therefore, companies in the segment are likely to witness more volatility.

Motilal Oswal Midcap Fund, with a track record of the last five years combining the portfolio management skills of Niket Shah and processes, gives confidence that the fund may likely do well in the future.

For more details, please refer to the following link.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

- Motilal Oswal Large and Midcap Fund: One of the best performing large and midcap funds

LATEST ARTICLES

- Motilal Oswal Multicap Fund: Outperforming the benchmark

- Motilal Oswal Large Cap Fund: One of the best performing large cap funds for current market conditions

- Motilal Oswal Innovation Opportunities Fund: Leveraging the innovative investment opportunities for long term growth

- Motilal Oswal ELSS Tax Saver Fund: One of the best performing ELSS

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY