What is Behavioural finance and its impact on investment decisions

The stock market is at record high despite the dip seen on the election results day. Yet many investors are worried. When the market is at its high, some investors get concerned about valuations. Some investors are worried about Foreign Institutional Investors selling. Some investors may be worried about political stability and policy continuity. Some investors are worried about possibility of recession in the United States and its impact on global equities.

We worry about things that may or may not happen in the future. Stress is in outcome of anxiety and it impairs our ability to make right decisions. It is natural for humans to have psychological biases. Behavioural Finance is a study of psychological biases of investors and how it can affects their decision making. In this article, we will discuss some of these biases in the context of recent events and current market situation. If you are aware of these biases, you can avoid many errors in your investment decision making.

Availability Bias

Availability bias is a cognitive bias whereby investors give more importance to information that come readily to investors’ minds. Information which comes readily to investors’ mind is one which leaves a deeper impression on investors psyche. These investors tend to ignore other information. For example, if an investor was expecting a different result in Lok Sabha elections, the actual result and market crash on the day of counting may have come as shock. This investor may ignore other data points e.g. how the markets bounced back after the crash, India’s strong GDP growth in FY 2024 and forecasted growth in FY 2025, the interest rate scenario etc. Availability bias may result in you making wrong investment decisions. You need to consider different data points and make informed investment decisions, not rely on a single data point.

Recency Bias

Recency bias is a form of availability bias, where you give undue importance to recent events and ignore historical data or trends. For example, when India exited the 2007 World Cup held in Caribbean at the group stage, a pall of gloom descended on cricket fans in India. The players were written off and it seemed that there was no hope. The fans and media forgot that same team had reached the final of previous World Cup. It did not take much time for the wheel to turn. In less than 6 months since the World Cup exit in 2007, India won the inaugural T20 World Cup beating Pakistan in the final. Within a few months the mood went from despondency to euphoria. Recency bias is very common in investing and it can cause considerable damage to financial interests. Investors with recency bias will redeem when the market goes through deep correction. Mindset of these investors is very similar to the fans after 2007 world cup exit. When the market recovers, they will re-enter at much higher levels. Disciplined investing e.g. investing through systematic investment plan can help you avoid the pitfalls of recency bias.

Confirmation bias

Confirmation bias is based on pre-conceived notions or belief. Seeking information or opinions that supports their ideas or pre-conceived notions and ignoring information that is contrary to their pre-conceived notions is confirmation bias. Let us understand this with the help of an example. Many Indians consider a cat crossing the path as an ill omen. Suppose a cat crossed your path on your way to office. At work, you get a call from an upset customer or your manager reprimands you regarding some errors in your deliverable. If you have confirmation bias, you will blame the cat for the upset customer or the error in your deliverable. In reality, the issue may be with the product, service or your own work.

Confirmation bias is very common in investing. You may have heard from older generations that real estate and gold are the best investments, equity is very risky. If you have heard this repeatedly from your parents, grandparents or other relatives, this can become a pre-conceived notion at a sub-conscious level. Every fall in the market will serve to confirm this belief that equity is risky. You will ignore that the fact that market fell only fell in 3 or 4 months rose in the other 8 or 9 months. When a friend or colleague tells you that they sold their residential apartment at the double the price they bought, it will confirm your belief that real estate is the best investment. You will, for example, not ask your friend, when he bought the property. He may have bought it 7 years back. In 7 years, 100% returns means a CAGR return of just about 10%.

There are several pitfalls of this behavioural bias e.g. holding on underperforming funds, missing out attractive investment opportunities, ignoring asset allocation etc. Knowledge is your best friend in overcoming confirmation biases. An informed investor is usually a much more successful investor.

Negativity bias

There is a human tendency to give more attention to negative events than positive events, especially with regards to events that are relatively more recent. It is important here to make a distinction between a cognitive bias and your outlook in life. You may have a positive or optimistic outlook towards life, but you may still have a negativity bias in terms of how process news or information.

Let us go through a thought experiment. In the last 10 years, Nifty 50 rose from 7,500 levels to around 23,500 levels (more than 3X growth, source: National Stock Exchange, as on 14th June 2024). We will ask two questions. Do you remember in which month Nifty made the biggest gain / rose the most in the last 10 years? Do you remember in which month Nifty made the biggest loss in the last 10 years? Try to answer this question without the help of Google. Chances are that you need not Google to answer the 2nd question – in March 2020 Nifty had the biggest fall (outbreak of COVID-19). Let us ask two more questions.

The Nifty crashed by 1,400 points on the day Lok Sabha results were declared. If you were expecting a different result as exit polls was suggesting, the crash would have come as a shock for you. A person with negativity bias will ignore the fact that the market recovered all its losses and made a new record high. Negativity bias coupled with confirmation bias can lead you to making wrong assumptions and investment decisions. For example, if you are someone who believes that coalition Governments cannot be stable and unfavourable for equity markets then you may take every bit of negative news e.g. differences of opinion between coalition partners, market corrections etc, as confirmation of your belief. You will ignore history where Nifty 50 TRI gave 26% CAGR returns between May 2004 to May 2009 (in 2008 Nifty 50 fell by more than 50%), despite the biggest global financial crisis in the last 50 years, when a coalition Government was in power (source: Advisorkhoj Research, as on 31st May 2009).

Negativity bias can lead to skewed asset allocation, ignoring investment opportunities, inaction in decision making etc, all of which can be harmful for your investments.

Loss aversion bias

Loss aversion is a trait of investor behaviour wherein investors prefer to avoid a loss than to make an equivalent profit. Loss aversion is also known as regret aversion. When faced with a choice of avoiding a loss of Rs 1,000 or making a profit of Rs 1,000 investors with loss aversion bias will prefer not making a loss to making a profit.

Fear of making a loss can prevent an investor from investing when market is rising or when market is falling, resulting in high opportunity cost. Investors with loss aversion wait for some confirmation that market will move in a certain direction. Usually it is too late by the time these investors act and they lose out on attractive investment opportunities. Loss aversion can prevent you from reaching your financial goals.

How SIPs can help you avoid behavioural biases?

Through SIPs you can invest small amounts in mutual funds from your regular savings every month (or any other interval). Since you are investing systematically, short term market movements (upwards / downwards) do not have a large impact on your returns, since you are investing at both high and low prices (NAVs) – this is also known as Rupee Cost Averaging. SIP helps you overcome the behavioural biases and keep you disciplined, which according to legendary investor, is one of the most important factors in achieving success in your investment goals.

SIPs have become very popular in India. According to AMFI data every month more than Rs 20,000 crores is invested through SIP (source: AMFI, as 31st May 2024). In the last 2 years (FY 22 to FY 24) the number of SIP accounts grew by 59%. At the same time, the number SIP account closures (either discontinued or matured) grew by 102% (source: AMFI, as 31st March 2024). AMFI does not segregate SIP closures between SIP stop and SIP maturity. However, based on experiences shared by mutual fund distributors, many investors stop their SIPs when there is high volatility or deep correction. This defeats the purpose of SIPs as method of disciplined investing.

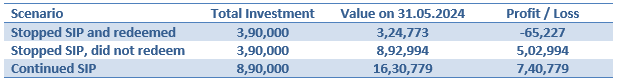

Let us assume you started investing in Nifty 50 through Rs 10,000 monthly SIP on 1st January 2017. You stopped on March 31st, when the market crashed due to COVID-19. Now there can be two scenarios (a) you redeemed your units fearing market will fall and (b) you did not redeem your units. Let us now have a third scenario (c), where you continued your SIP. Let us see the results of the 3 scenarios in the table below. You can see that simply continuing your SIP irrespective of market movements would have produced the best investment outcome.

Source: National Stock Exchange, as on 31st May 2024

Disclaimer: The example and calculations above are purely for illustration purpose and investor education only. Past performance may or may not be sustained in future. ABSL AMC /the Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments. The calculations are not based on any judgments of the future return of the debt and equity markets / sectors or of any individual security and should not be construed as promise on minimum returns and/or safeguard of capital. This calculation alone is not sufficient and shouldn’t be used for the development or implementation of an investment strategy. The illustration above should not be construed as investment recommendation. Mutual funds are subject to market risks. Investors should real all scheme related documents / consult with their financial advisors before investing.

Suggested reading: Ghar Ghar Mutual Fund: Har Ghar SIP

How to avoid behavioural biases in investing?

- Goal based investing and financial planning will keep you disciplined in your investment journey

- Asset allocation will balance risk and returns in your portfolio. It will prevent primal instincts like greed and fear affecting your investment decisions

- Try to avoid herd behaviour. Do not invest in a stock or fund because your friends are investing in it. Think rationally, do your research and make informed investment decisions.

- Do not act on the basis on rumours. Rumours usually turn out fake. Try to verify the information you have received with trusted sources e.g. newspapers, journals, news portals, AMC websites etc.

- Seek the help of a financial advisor if you need help in make in making investment decisions.

- Last but not the last, try to improve your investment awareness. Investor education is an ongoing process of gaining knowledge and wisdom.

Conclusion

In this article, we have discussed different behavioural biases in investing. Most of the times, you may not even know that you have these biases because they work at a sub-conscious level but they get reflected in the decisions you make. In the current market context, when the market is at record high, you should try to avoid these behavioural biases. Make yourself aware behavioural biases; awareness can help you avoid many pitfalls. Disciplined investing, financial planning, systematic investments and asset allocation can help you overcome these biases. Most importantly, knowledge is your biggest friend and can be your greatest strength. Aditya Birla Sun Life Mutual Fund has extensive online investor education resources, which can help you become a more informed investor. You can access Aditya Birla Sun Life Mutual Fund’s investor education resources by going to - https://mutualfund.adityabirlacapital.com/investor-education

Disclaimer: An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

- How can Multi Asset Allocation Funds provide stability in your portfolio

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY