Is Mutual Fund Systematic Investment Plans really the Best Mode of Investing

Let us settle this upfront. I think mutual fund systematic investment plan (SIP) is the one of best, if not the best, savings and investment options for average retail investors, particularly new investors. SIPs ensure that a portion of your monthly savings get invested towards your long term financial goals. Equity as an asset class has historically outperformed other asset classes in the long term. However, equity is also a very volatile asset class, more so in a market like India. SIPs in equity mutual funds enable investors to take advantage of the volatility through Rupee Cost Averaging, a concept that we have discussed many times in our blog. SIPs are convenient; when you start a monthly SIP, a fixed amount, determined by you, gets debited from your bank account every month and is used to buy units of the mutual fund scheme of your choice through the bank ECS mandate; it is all automatic, saving you time and effort. Systematic investing, automated through the SIP mandate, takes emotions out of investing. When emotions come in the way of investing, mostly we make poor decisions. Hopefully, most readers of our blog are familiar with the many virtues of investing through monthly SIPs and if you are not, I would encourage you to have a discussion with your financial advisor or read about SIPs. Financial advisors have pushed SIPs to their customers and this will in the long run, benefit the investors. The topic of our discussion in this blog post is slightly different. We will discuss if monthly systematic investment plans (SIP) give the best returns. Can an investor get higher returns by employing a different strategy?

There are lots of debates and discussions on a variety of topics in India, which is great. However, one problem that I see in most of these debates is that, there is a tendency of oversimplification and lack of intellectual sophistication. A few days back, I was watching a TV debate on a political topic with regards to what happened in a few universities in India. As I flipped through the channels, I saw all the channels had the same debate. What surprised me was that, in most cases, people on either side of the debate were taking extreme stands. It is fine if you take a stand on a particular issue, but what was surprising was there was no nuance in their views. Let me explain a little bit more. If there were 10 people on the panel, 5 were for the motion and 5 were against, the 5 who were for the motion all spoke in one voice; also 5 who were against the motion all spoke in one voice. I see this as a problem. Politicians are trained to speak in one voice to reflect the stand taken by their respective parties. But in this case, not all the 10 people on the panel were politicians; some were academics, some were journalists and some were authors. On a complex political debate, I expected people to have multiple nuanced views, even if they took sides in the debate. On any topic, political or financial, we should not be taken captive by sloganeering. What are slogans? From a business viewpoint, they are simply aggressive sales tactics. My knowledge and interest in politics is quite limited, so I will stick to investment and finance. Over the last 7 – 8 years there has been an aggressive push for Systematic Investment Plans by both financial advisors and mutual fund houses. In the first paragraph of this post, I have said that I am a big fan of SIPs, but unlike the panellists on TV channels I referred to earlier, I do not put my faith in slogans, but in logic and data. The topic of our blog today is whether SIPs give the best return.

Lump Sum versus SIP or Systematic Investment Planning

Do SIPs give better returns that lump sum investment? The rhetoric on SIPs seems to suggest it does, but let us examine it. To me, is SIP better than Lump sum, is an irrelevant question, because you are comparing apples and oranges, as discussed in our post Which is a better mutual fund investment option: Lump Sum or SIP, but nevertheless we should examine it for the sake of our readers. Let us assume you invested र 10 lacs in lump sum in a top performing large cap fund like Birla Sun Life Frontline Equity Fund 10 years back, the value of your investment today will be around र 38.5 lacs. If you invested र 8,330 in monthly SIP of Birla Sun Life Frontline Equity Fund over the last 10 years, your cumulative investment would be र 10 lacs and the value of your investment today will be little over र 20 lacs. If you compare the investment value of lump sum (र 38.5 lacs) with the investment value of SIP (र 20 lacs) then lump sum seems much better than SIP, but the fact is that, they simply cannot be compared. In the case of the lump sum investment, your entire money was invested for a period of 10 years, whereas in the case of SIP, your money was invested in equal monthly instalments over 10 years. Obviously, lump sum will give higher returns in absolute terms; how can you even compare? While it is obvious that lump sum investment can give higher absolute returns than SIPs, what about annualized returns in lump sum versus SIP? The annualized return of lump sum investment in Birla Sun Life Frontline Equity Fund over the last 10 years is 14.4%. What about the annualized returns of SIP in Birla Sun Life Frontline Equity Fund over the last 10 years? Since in SIPs, the money gets invested in equal monthly instalments, we have to look at Internal Rate of Return (or IRR). The SIP IRR of Birla Sun Life Frontline Equity Fund over the last 10 years is 13.5%. Lump sum again beats SIP. I brought this example out for people, who are convinced that SIP gives the best returns. Having said that, is it fair to compare lump sum returns to SIP returns, even on an annualized basis? The answer is again, no. Lump sum investment means that you have a large sum of money to invest at one go; SIP on the other hand is investment out of your monthly savings. They are two completely different investment concepts and it is simply not fair to compare.

Some of you may question, why look at large cap funds? Small and midcap funds are more volatile. Therefore SIPs have an advantage in small and midcap funds. We should examine lump sum versus SIPs in small and midcap funds. Let us assume you invested र 10 lacs in lump sum in a popular midcap fund like Franklin India Prima Fund 10 years back, the value of your investment today will be around र 38 lacs. If you invested र 8,330 in monthly SIP of Franklin India Prima Fund over the last 10 years, your cumulative investment would be र 10 lacs and the value of your investment today will be around र 25 lacs. SIP works better for small and midcap funds; no doubt about that. But lump sum absolute returns still beat SIP returns. However, on an annualized basis, SIP returns (17%) do beat lump sum returns (14%).

I come back to the point, which I raised earlier in this blog post. Let us not surrender logic to rhetoric. Giving in to rhetoric is the easiest thing to do, but not the wisest, as far as your investments are concerned. Your investment plans should be informed by your financial situation and investment objectives. One of the great thinkers of modern economic theories, Adam Smith, said that society progresses economically, when an individual does what is in his or her best interests. You should do what is in your best interest, not what the sales pitch asks you to do. Systematic Investment Plan is a fantastic investment option but you should understand the mechanics also. In SIPs you can buy units at a lower cost, but you also buy units at a higher cost. Rupee cost averaging does not mean that, you buy units at the lowest cost. It simply means that, you buy units at the average cost, which is lower than the highest cost.

Is there a better systematic investment strategy than monthly SIP

If you take the literal meaning of systematic investment plan, it means that you have a systematic approach to investing, unlike lump sum, which is seen as an ad-hoc investment approach. Systematic investing, in my opinion, does not only mean investing in equal monthly instalments. Let me clarify that, investing in equal monthly instalments is a form of systematic investing, but it is not the only systematic investment approach, even though it might be the most convenient one. Many financial advisors and investment experts say that, lump sum investing involves an element of risk with respect to timing the market. I agree with these financial advisors and market experts. But can you have a systematic approach to timing the market, in other words is there approach to capture lower valuations? If yes, is valuation based systematic investing better than investing fixed amounts every month through SIP? We will devote the rest of this article, examining this question.

We will compare two investment strategies, a monthly SIP of fixed amount and valuation based systematic investment strategy. In both the strategies the monthly investment amount will be the same, say र 5,000. Let us select a large cap equity mutual fund. In our earlier lump sum versus SIP example, we had used Birla Sun Life Frontline Equity Fund; let us continue with the same fund. However, you can run this analysis with any diversified equity fund. For our analysis let us choose the period January 1 2008 to January 1 2016. I had given some thought to the period chosen. The period in question had 3 bad years for equity market (2008, 2011 and 2015), 1 indifferent year (2013) and 4 good years (2009, 2010, 2012 and 2014). The point is that, during this period we experienced a variety of market conditions and this will help us test the robustness of our strategies. Let us now discuss each of the strategies and their results.

Monthly SIP or Systematic Investment Plan

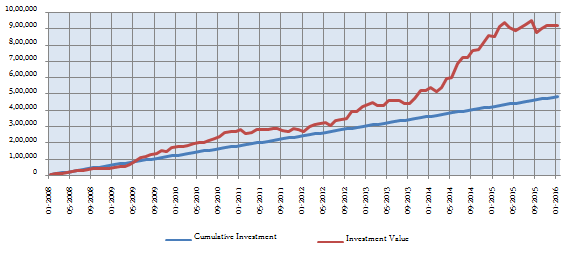

We are very familiar with this strategy. We invest a fixed amount every month in the selected fund. The chart below shows the returns of र 5,000 monthly SIP in Birla Sun Life Frontline Equity Fund from 1/1/2008 to 1/1/2016.

Source: Advisorkhoj SIP Calculator

You can see in the chart above that with a monthly investment of र 5,000 you could have accumulated a corpus of र 9.2 lacs, while your cumulative investment would have been only र 4.8 lacs. The annualized SIP return during this period was 15.7%. These returns are indeed very good, especially considering the fact that we had to face really tough market conditions during this period. However, the question is, could we have done better with our monthly investment of र 5,000?

Valuation Based Systematic Investing Plan

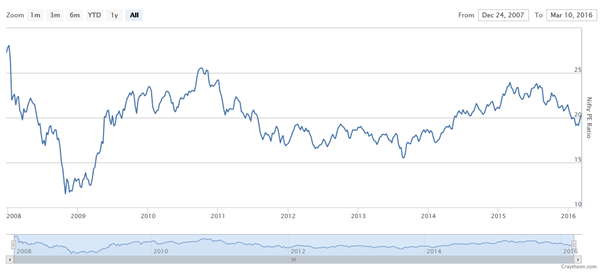

One fundamental fact about investing that we all understand is that, if we buy cheap we get good returns. How do we know whether our equity investment is cheap or not? We look at a popular valuation metric known as P/E ratio. If P/E ratio is high then the investment is expensive, if it is low then the investment is cheap. We do not have the time to look at the P/E ratios of all the stocks in a mutual fund’s portfolio. However, for a diversified mutual fund the market’s P/E ratio is a good indicator. The chart below shows the historical P/E ratios of Nifty.

Source: Craytheon

So at what P/E ratio are equities cheap or expensive? We will not get into a discussion on cheap or expensive P/E ratios. There are multiple views on this, each with their own merits and demerits. It is generally accepted that a P/E ratio of more than 20 is somewhat expensive and a P/E ratio of less than 15 is cheap. You are entitled to have a different view, but for our analysis, we will assume that P/E ratio of more than 20 is expensive and less than 20 is not expensive. So in our strategy we will do the following:-

- We will invest

र5,000 every month - Before investing every month, we will look at the P/E ratio of Nifty on the first business day of the month. If the P/E ratio of Nifty is less than 20, we will invest

र5,000 in Birla Sun Life Frontline Equity fund. - If the P/E ratio of Nifty is more than 20, we will invest

र5,000 in a liquid fund. - In any month when the P/E ratio of Nifty falls below 20, in addition to investing our

र5,000 savings, we will also switch the accumulated units of liquid fund to the equity fund.

For purpose of illustration, let us assume in month 1, P/E ratio of Nifty is 18; we invest र 5,000 in the equity fund. In month 2, Nifty P/E is 19; we again invest र 5,000 in the equity fund. In month 3, Nifty P/E is 20.5; we invest र 5,000 in the liquid fund. In month 4, Nifty P/E is 21; we invest र 5,000 in the liquid fund. In month 5; Nifty P/E is 20.2; we invest र 5,000 in the liquid fund. In month 6; Nifty P/E is 19; we invest र 5,000 in the equity fund. In addition, we switch the र 15,000 (plus accrued returns) accumulated in the liquid fund into the equity fund. I hope this is simple enough to understand. It takes a bit more effort than your usual monthly SIP, but making more money takes effort. For our example, though we are using a specific equity fund, we have assumed that the liquid fund will give an 8% annualized return. Top liquid funds have given around 8 – 8.5% annualized returns in the last 10 years; so it is not an unreasonable assumption.

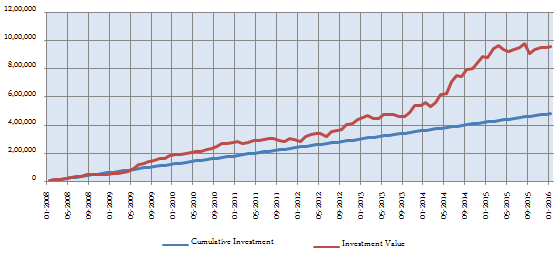

Let us now see using this strategy, how much money we would have made from 1/1/2008 to 1/1/2016.

With a monthly investment of र 5,000 you could have accumulated a corpus of र 9.5 lacs, while your cumulative investment would have been only र 4.8 lacs. The annualized SIP return during this period was 16.5%. Compare this return with the return of the monthly SIP. To recall, you could have accumulated a corpus of र 9.2 lacs with the same investment through (SIP return was 15.7%).

Why did this strategy give better results than SIP? The answer is obvious. In this strategy, you are investing only when valuation is less. In a monthly SIP, you are buying every month, irrespective of valuations. You can get as sophisticated as you can with valuation-based systematic investment strategy. For example, instead of using Nifty P/E ratios, you can use the actual P/E ratios of the benchmark index of the fund. Instead of using a benchmark P/E (20 in our example), you can define a range and use a variety of strategies. For example, above the upper end of the range, you invest in liquid funds; below the lower end of the range, you invest in equity funds; and within the range, you can invest in some pre-determined asset allocation ratio (in equity and liquid funds). Instead of liquid funds, you can also invest in arbitrage funds; this can give you tax benefits.

Conclusion

I shared the results of this analysis with a friend, who is a senior banker with a major multinational bank. He asked me, is this not too much effort for just र 30,000? I leave it up to readers to decide whether र 30,000 on an investment of र 4.85 lacs is material or not. If you think it is material then, I do not think this strategy requires too much effort. Implementing this strategy will take at most an hour or so every month. If you have a good financial advisor you need not even spend an hour because you can get your advisor to do most of the work involved. But all said and done, you can see in our analysis that monthly Systematic Investment Plan or SIP also gave quite good returns.

RECOMMENDED READS

LATEST ARTICLES

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

- Aditya Birla Sun Life Large Cap Fund: 23 years track record of outperformance and wealth creation

- Why is SIP Sabse Important Plan

- How can Multi Asset Allocation Funds provide stability in your portfolio

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY